2 min read

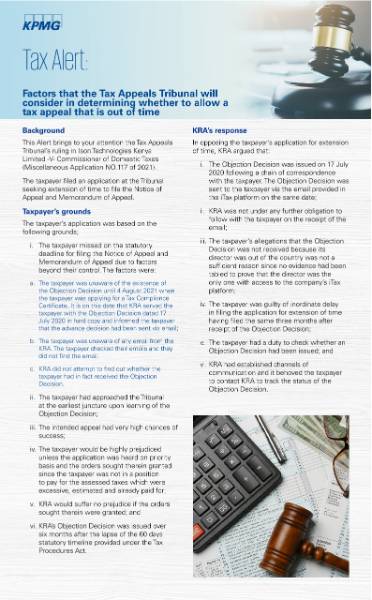

Background

This Alert brings to your attention the Tax Appeals Tribunal’s ruling in Ison Technologies Kenya Limited -V- Commissioner of Domestic Taxes (Miscellaneous Application NO.117 of 2021). The taxpayer filed an application at the Tribunal seeking extension of time to file the Notice of Appeal and Memorandum of Appeal.

Taxpayer’s grounds

The taxpayer’s application was based on the following grounds;

- The taxpayer missed on the statutory deadline for filing the Notice of Appeal and Memorandum of Appeal due to factors beyond their control. The factors were:

- The taxpayer was unaware of the existence of the Objection Decision until 4 August 2021 when the taxpayer was applying for a Tax Compliance Certificate. It is on this date that KRA served the taxpayer with the Objection Decision dated 17 July 2020 in hard copy and informed the taxpayer that the advance decision had been sent via email;

- The taxpayer was unaware of any email from the KRA. The taxpayer checked their emails and they did not find the email.

- KRA did not attempt to find out whether the taxpayer had in fact received the Objection Decision

- The taxpayer had approached the Tribunal at the earliest juncture upon learning of the Objection Decision;

- The intended appeal had very high chances of success;

- The taxpayer would be highly prejudiced unless the application was heard on priority basis and the orders sought therein granted since the taxpayer was not in a position to pay for the assessed taxes which were excessive, estimated and already paid for;

- KRA would suffer no prejudice if the orders sought therein were granted; and

- KRA’s Objection Decision was issued over six months after the lapse of the 60 days statutory timeline provided under the Tax Procedures Act.

KRA’s response

In opposing the taxpayer’s application for extension of time, KRA argued that:

- The Objection Decision was issued on 17 July 2020 following a chain of correspondence with the taxpayer. The Objection Decision was sent to the taxpayer via the email provided in the iTax platform on the same date;

- KRA was not under any further obligation to follow with the taxpayer on the receipt of the email;

- The taxpayer’s allegations that the Objection Decision was not received because its director was out of the country was not a sufficient reason since no evidence had been tabled to prove that the director was the only one with access to the company’s iTax platform;

- The taxpayer was guilty of inordinate delay in filing the application for extension of time having filed the same three months after receipt of the Objection Decision;

- The taxpayer had a duty to check whether an Objection Decision had been issued; and

- KRA had established channels of communication and it behoved the taxpayer to contact KRA to track the status of the Objection Decision.

Clikc the link below to read more.

Submit a request for proposal

Find out how KPMG's Expertise can help you and your company

Request Opens in a new window