Online purchase behavior

Online purchase behavior

The digital age and rise of ecommerce is driving unprecedented business model shifts for manufacturers and retailers.

Highlights

- Key insights: a look at online trends

- Product categories: online products poised for growth

- Borderless shopping: the rise of international ecommerce and e-retailers

- Device preferences: device trends and the use of smartphones

Many traditional consumer businesses and new start-ups alike are moving away from models that are shop-centric or geographically-focused, to ones that are customer-centric and virtually borderless.

To help inform companies tackling this transformation, KPMG International’s recent survey of 18,430 consumers provides a unique, comprehensive index of consumer online shopping behaviors and sentiments across countries, products and generations.

Key insights

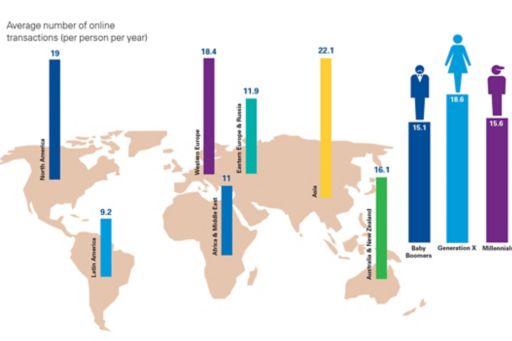

- Ecommerce is a rising trend: Online purchase frequency varies considerably by geography. Consumers in Asia, North America and Western Europe are most likely to shop online, while per capita online purchases in Eastern Europe and Russia, Latin America, and the Middle East and Africa are less frequent.

- Generation X consumers are the most active online shoppers: Among the different age groups, Generation X consumers (born between 1966 and 1981) made more online purchases last year than any other age group, averaging nearly 19 transactions per online shopper per year.

- Don’t underestimate the Baby Boomers: Compared to the digital-first Millennial generation, it is reasonable to presume that Baby Boomers (born between 1965 and 1946) are less inclined to shop online. However, the Baby Boomers surveyed in fact shopped online just as frequently as the Millennials.

- Men spend more online than women: While men and women shopped with about equal frequencies, on average, the men spent more per transaction – men spent US$220 vs. US$151 for women on their most recent purchase.

Product categories

The online shopping landscape is gradually changing in terms of the types of products that are being bought online. Generally, consumers’ planned online purchases indicated a year over year increase for most product categories. These results signal a higher willingness to buy new product categories online, particularly those more traditionally sold in shops.

Greater options for shipping and delivery have made it easier and more common to buy bulkier products online – including furniture, appliances and even vehicles. Meanwhile, although ‘easier to ship’ products such as books, music, electronics, accessories and apparel remain the most popular online categories, relative growth in these segments is expected to be minimal.

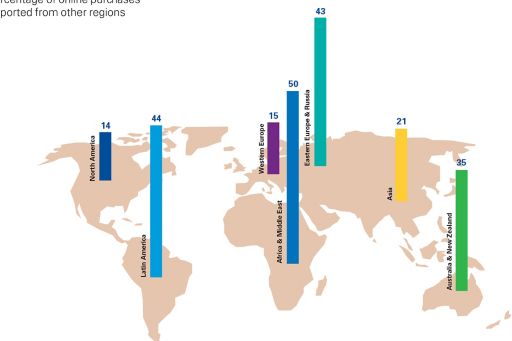

Borderless shopping

Cross-border shopping is on the rise globally, driving international retail trade.

In many countries, the tendency to buy internationally is highest among Millennials. This could indicate potential growth for cross-border online shopping as consumers increasingly seek unique or specialized products from other countries. In the US, for example, 15 percent of Millennials’ recent purchases were imported, compared to 9 percent for Generation X and just 3 percent for Baby Boomers. It will be interesting to see how the new US administration’s proposed focus on domestic protectionism might affect the trend for younger US consumers to shop outside the country.

The rising power of e-tailers is also apparent around the world and contributing to global ecommerce. Their dominance is particularly evident in China and India – where over 80 percent of online purchases were from e-tailers – as well as in Japan (69 percent), Italy (68 percent) and South Africa (65 percent). The share for e-tailers in these countries is far above the global average of 50 percent.

A trend of younger consumers being less likely than Baby Boomers to buy from e-tailers could indicate a future slowdown in this platform’s growth. Fifty-four percent of Baby Boomers, who are less prone to shop around for price and who prefer to buy from familiar websites, made their most recent purchase from an e-tailer, compared to Millennials with e-tailer purchases at 48 percent. Conversely, Millennials were 30 percent more likely than the Baby Boomers to buy directly from a retail shop’s website.

Device preferences

Cross-border shopping is on the rise globally, driving international retail trade.

In many countries, the tendency to buy internationally is highest among Millennials. This could indicate potential

Despite the global proliferation of mobile smart phones and tablets, the majority of consumers still prefer traditional desktop PCs or laptops when shopping online. More than half (57 percent) of online purchasers globally said they prefer to use desktop PCs or laptops, while 17 percent said they preferred to use a mobile device and 27 percent had no preference.

While mobile may not be the most preferred online sales channel, over two-thirds of the consumers said they had used a smartphone for product research while in a physical shop.