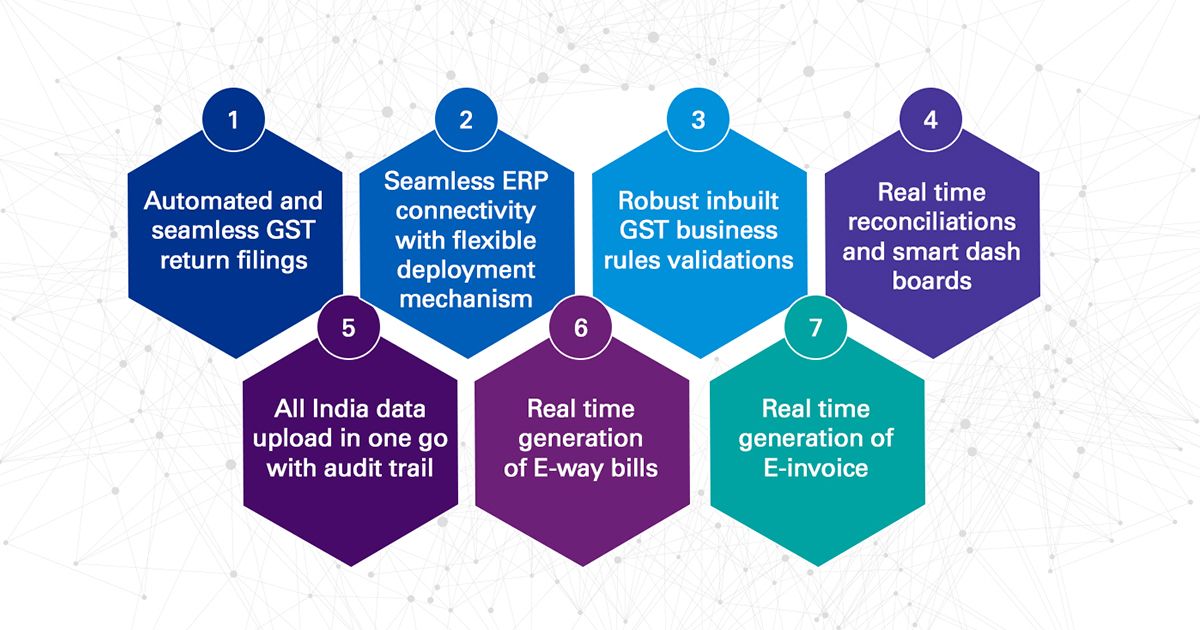

As an approved GST Suvidha Provider (GSP), and Application Service Provider (ASP) our KPMG GST Compliance Pilot provides an integrated end to end solution for seamless filing of GST returns along with generation of e-invoicing and e-waybills.

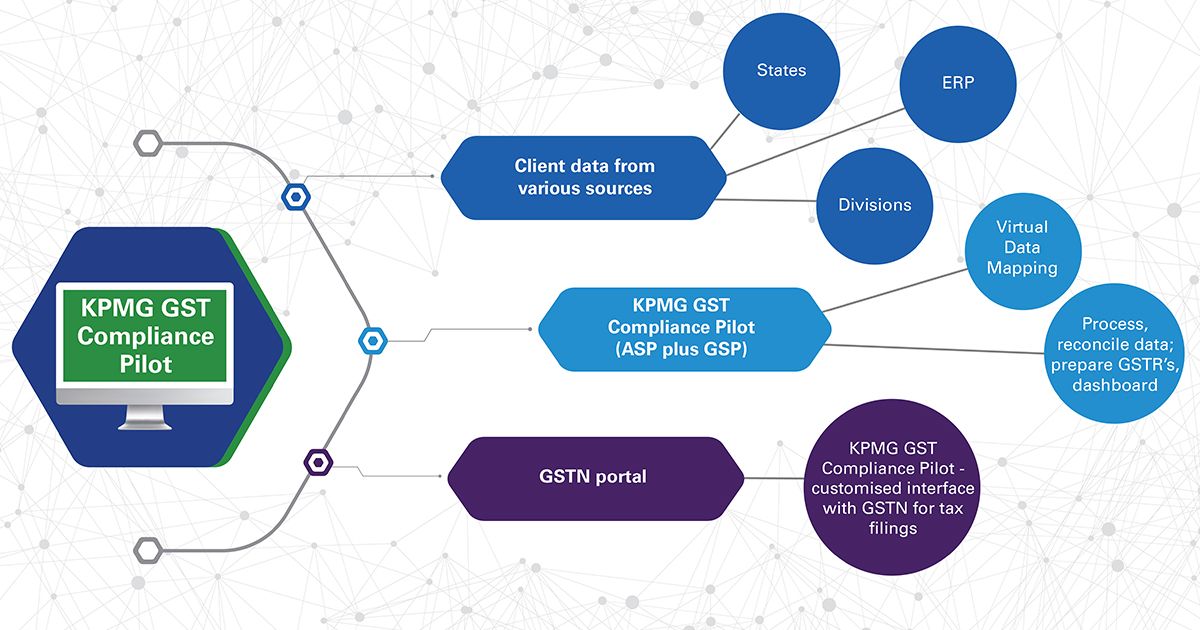

KPMG GST Compliance Pilot, (our GST compliance technology) can be aligned to our clients’ ERP and GSTIN. It gathers data from various sources from our clients and processes the data in the KPMG GST Compliance Pilot tool (data mapping, reconciling, prepare GSTRs and dashboard). KPMG GST Compliance Pilot also has a customised interface with the GSTN portal for tax filings.

KPMG GST Compliance Pilot also provides a scalable and integrated platform for generation of e-invoice and e-waybills. It also supports multiple file formats (JSON, Excel etc.) and integration methods (API, SFTP) and is seamlessly configurable as per business requirements.

Key aspects of GST compliance – the new normal

- Transaction reporting of purchase and sales data, at invoice and Harmonised System of Nomenclature (HSN) level

- Multiple filings every month, every state

- Credits available, based on matching of purchase data with sales data filed by vendors on the GSTN portal.