Businesses today are grappling to understand how to deal with a wide range of ESG issues, from reducing emissions, supply chain issues, increasing regulatory demands, access to green finance, understanding market demand, and attracting and retaining talent.

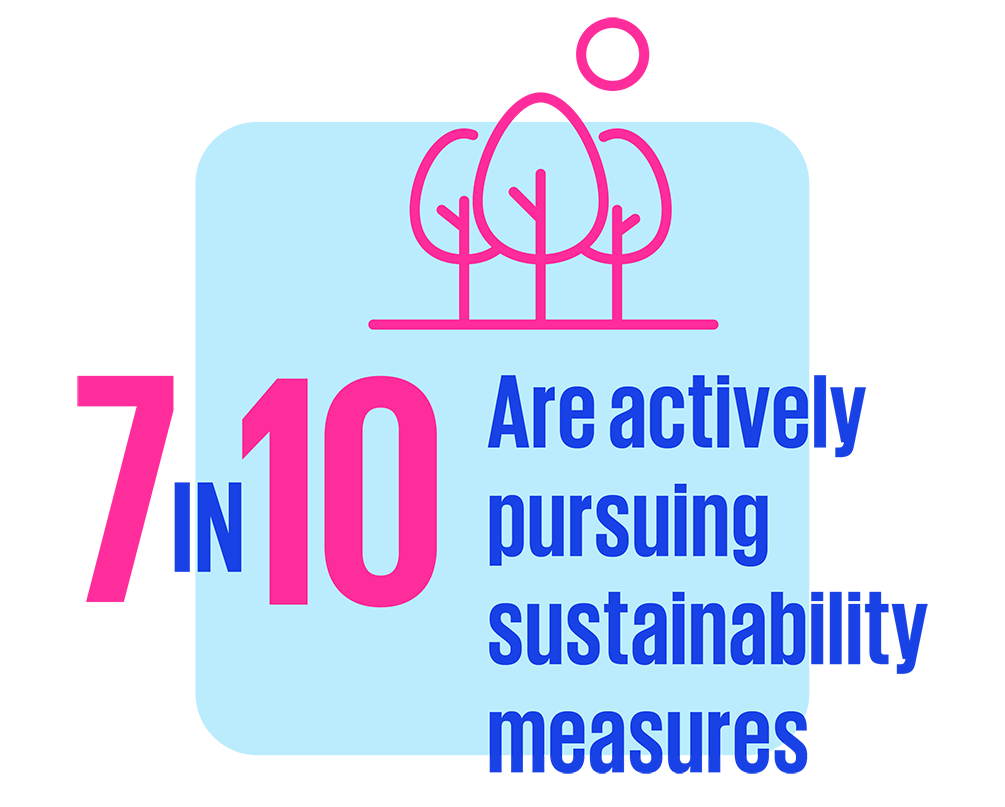

Despite these many challenges, a significant majority (83 percent) support the need for more action on climate change. With 7 in 10 saying they are actively pursuing sustainable measures, it is clear sustainability is no longer a “nice-to-have”, and businesses are moving from incremental improvements to systemic changes in business models, operations, and financial practices.

Prioritising sustainability

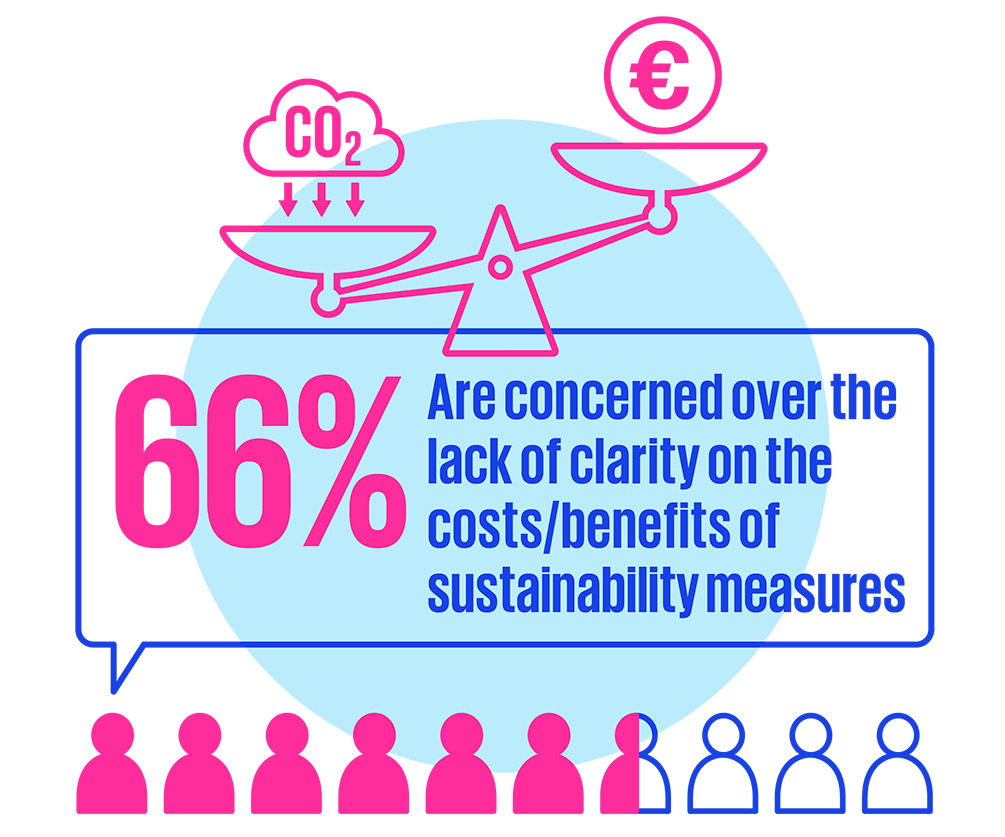

However, despite the acknowledgement of the importance of embedding sustainability, two-thirds express concern over the lack of clarity on the costs and benefits of these measures, while over half (53 percent) are concerned that an increase in green initiatives will lead to a rise in costs for their business. This highlights the challenges in prioritising sustainability, especially against a backdrop of high interest rates and rising costs, and a need for businesses to fully understand the positive and negative financial implications and to develop the business case for action.

Social, regulatory and investor pressures mean Irish companies will need to review business practices to stay relevant and drive long-term shareholder value. Our study found that two-thirds (66 percent) reviewed their overall business operations in light of sustainability.

However, this number decreased when participants were asked about separate sustainability issues. For example, 62 percent of businesses reviewed their sources of energy, 47 percent reviewed their supply chain and 46 percent reviewed the use of sustainable materials.

Practical decarbonisation

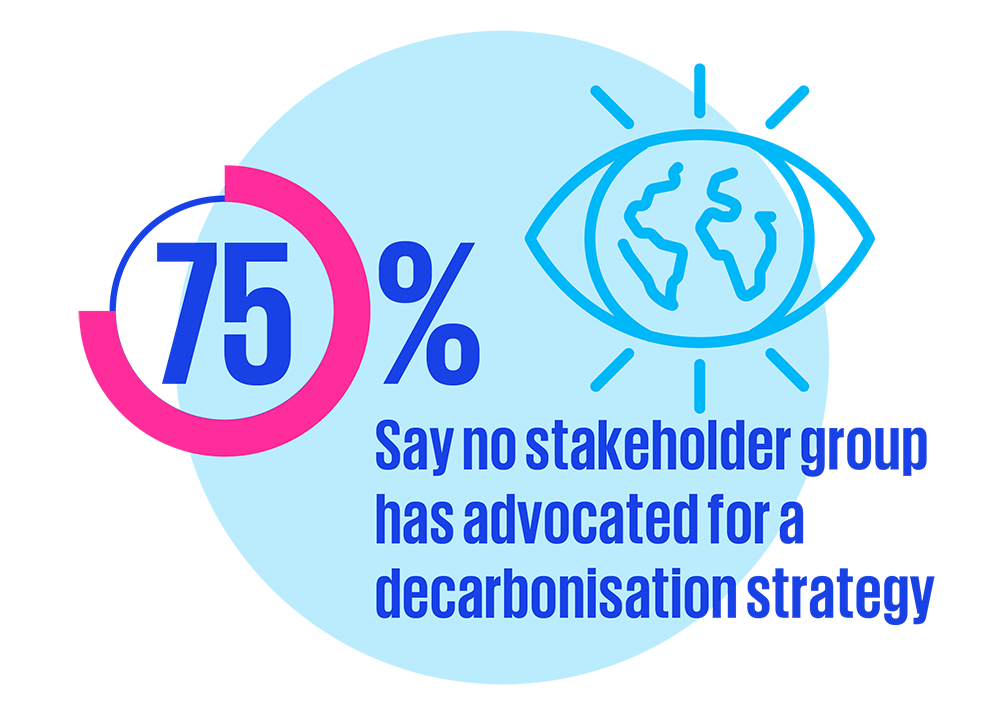

Interestingly, our research also suggests that despite most businesses supporting climate action and actively pursuing sustainability measures, only a small proportion face significant pressure from stakeholder groups to develop a decarbonisation strategy. Specifically, 75 percent say that no stakeholder groups are exerting pressure on them.

Furthermore, only 9 percent of customers and 6 percent of regulators actively request enterprises to develop a decarbonisation strategy. These findings indicate that while companies are taking voluntary steps towards sustainability, there is currently less external pressure from stakeholders to enforce stricter environmental policies, albeit we expect this to change in the future.

According to Russell Smyth, Head of Sustainable Futures at KPMG, “While to date much activity has been voluntary, from 2026, many businesses will have to comply with mandatory EU regulations for the first time. Proactive companies that lay the groundwork now and prepare for these regulations will be at an advantage and avoid unnecessary pressure down the line.”

All businesses large and small will be forced by regulatory measures or market forces to decarbonise their businesses to one extent or another

Our view

While the most common ESG lens applied by businesses is to focus on reducing their impact on the environment (e.g., CO2 emissions), perhaps the more immediate business-critical issue is to actually consider the impact the environment is going to have on the business.

As physical climate impacts evolve (high temperatures, flooding) and transition risks emerge (mandatory climate regulations, rising carbon pricing), businesses which are not prepared to address the ESG agenda will increasingly feel external pressure and costs whilst also missing new market opportunities.

For example, implementing decarbonisation measures can provide businesses with a competitive edge, insulating them from fluctuations in carbon and energy prices and attracting new customers.

Decarbonising business

In addition, a strong ESG strategy helps companies venture into new markets and expand into existing ones, while ESG will increasingly become a scoring metric in business tenders. ESG is also vital for recruiting and retaining talent, as Millennials and Gen Z employees prioritise sustainability and seek employers whose values align with theirs.

According to Paul O’Brien, Tax Partner at KPMG, “All businesses large and small will be forced by regulatory measures or market forces to decarbonise their businesses to one extent or another, and we would welcome the introduction of new tax measures to further incentivise and accelerate this decarbonisation."

By actively participating in the transition to a low-carbon economy, businesses will have the opportunity to create longterm value, differentiate themselves in the market, and contribute to shaping a sustainable future.