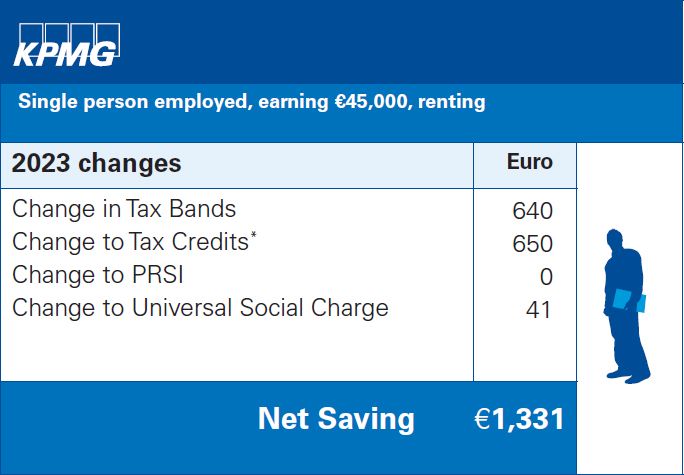

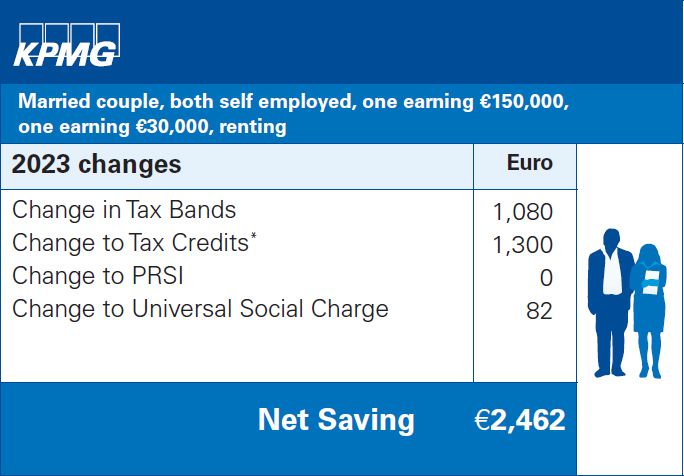

*The new annual rental tax credit of €500 can also be claimed for 2022 from early 2023

*The new annual rental tax credit of €500 can also be claimed for 2022 from early 2023

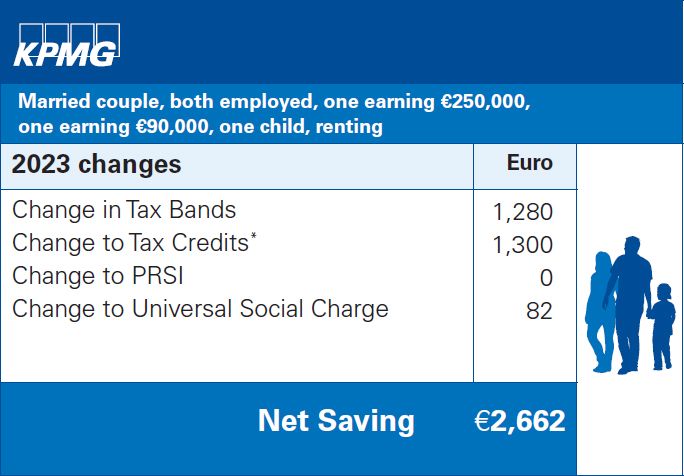

*The new annual rental tax credit of €500 can also be claimed for 2022 from early 2023

*The new annual rental tax credit of €500 can also be claimed for 2022 from early 2023