Impacts of COVID-19 on the Hungarian banking sector

Impacts of COVID-19 on the Hungarian banking sector

The MNB's report on the impacts of COVID-19 on the Hungarian banking sector.

The coronavirus significantly affects almost every sector of the economy, including the financial intermediation system. The economic effects of COVID-19 and the stimulus measures designed to offset it are forcing credit institutions to make a number of changes, with high uncertainty about the trend of the virus and the trajectory of the economy, and limited data available, such as a payment moratorium. For this reason, it is worth reviewing the MNB's recently issued Financial Stability Report (the source of the table and graph), in which it is useful to pay attention to several data.

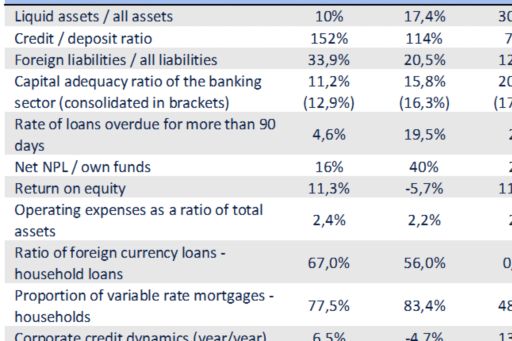

Fortunately, according to MNB, the domestic banking system is in a much better shape at the beginning of the economic crisis caused by COVID-19 than at the beginning of the recent crisis situations. Based on the data published by MNB, the capital and liquidity positions of institutions are significantly more favorable at the end of 2019, and the ratio of non-performing loans in both the household and corporate segments is below the 2008 levels.

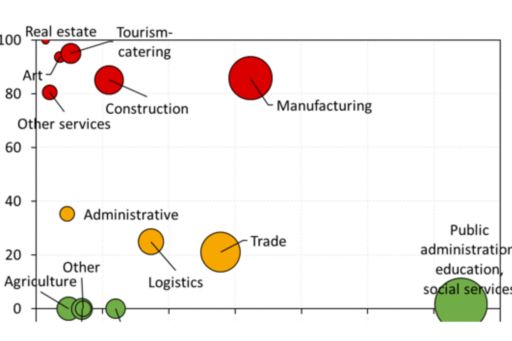

In retail lending, the introduction of the PTI, the quasi-disappearance of foreign currency lending and the recent significant increase in the share of fixed-rate loans have all had a positive effect on retail lending risks, but the coronavirus epidemic may have a significant negative impact on this segment. In connection with retail lending, one of the most important risk factors is the development of unemployment and reduced wages due to reduced working hours due to falling demand. According to MNB surveys, the share of loans to households working in vulnerable jobs (typically in the manufacturing, tourism and hospitality, real estate and construction sectors) is about 31% of the total household loan portfolio, as shown in the following figure, where the size of the circle is proportional to the number of people employed in the sector.

Risk indicators for corporate lending also improved fundamentally by the end of 2019, the share of project loans in the sector-level portfolio decreased compared to the previous crisis, but companies are also experiencing significant difficulties with the coronavirus epidemic and negative supply and demand shocks. Debt service can be a problem for companies that lose a significant portion of their revenue. In the figure above, vulnerable loans are the loans taken out by debtors with vulnerable activities (Hungarian NACE Rev. 2), the size of the circle bubble is proportional to the value added of the sector as a whole. In addition to the above, based on the MNB's data, it can be seen that 16% of the current bank corporate loan portfolios have a medium or worse liquidity situation and at the same time, a medium or high level of indebtedness.

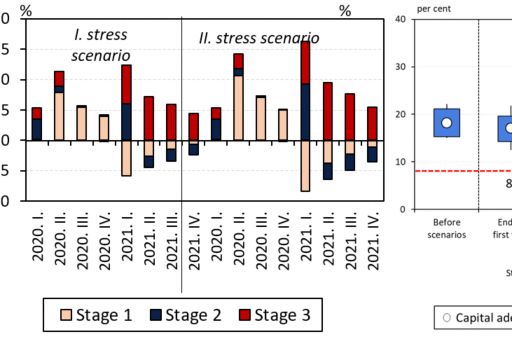

Unfortunately, no public, sector-level data are available on loan loss provisions for the first quarter of 2020, but the MNB's scenario analysis can provide a good basis for analyzing these. On stress scenario I, a change of GDP of -3.8% was expected for this year, while for next year -0.1%, and on stress scenario II, -7.1% and -2.9%, respectively. In addition to the two stress scenarios MNB examined, among other things, the loan loss provisions and the distribution of the number of capital adequacy ratios. The chart on the left shows net generated loan loss provisions, grouped by end-of-quarter stages, in proportion to the gross book value of the household portfolio. It is clear that significant increases in Stage 2 and Stage 3 loan loss provisions are expected after the end of the payment moratorium. For the corporate portfolio, only annual data is available, which shows that net generated loan loss provisions, cumulated from the start of the stress test in proportion to the gross book value of the corporate portfolio is 2.22% in Scenario I and 2.99% in Scenario II by the end of 2021.

The other figure shows what the impact would be on capital adequacy for a given stress situation. Based on the MNB's results calculated on the basis of current information, it can be seen that although the epidemic will have a significant impact on the profitability of the banking system, most domestic banks do not need capital replenishment even in the event of a more severe stress trajectory.

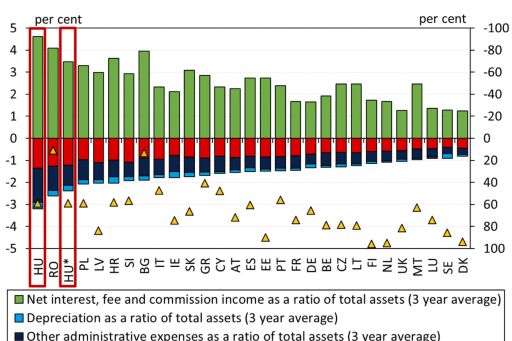

The MNB's Stability Report also analyzes the profitability of the banking sector in detail, one of which I would highlight in this blog post. In an EU comparison, institutions operate in Hungary at a high cost-to-asset cost level (data on bank levy, transaction tax and foreign subsidiaries are filtered out from the column marked with an asterisk). One of the reasons for this may be the relatively lower proportion of electronic service channels, the lower economy of scale efficiency, and the proportion of automation and digitization solutions used to a lesser extent. In our previous blog post, we wrote in detail about this topic.

A well-functioning and healthy banking system is essential for the stability of the national economy, as the behavior of the banking system can amplify but also mitigate the problems in the real economy. Some institutions have tightened lending conditions significantly, which in some respects is totaly reasonable, but in other respects it could have a negative impact on the bank's profitability and the national economy, if the bank does not support otherwise viable and profitable credit needs. In order to strengthen the real economy and the financial intermediation system, several measures have been taken, ranging from a payment moratorium to a temporary easing of prudential requirements to the introduction of new / wider forms of financing. An institution can make effective use of these opportunities, if its risk management processes and solutions are flexible enough to ensure that credit risks are kept under control in the face of significantly changing circumstances. This means effective credit monitoring, robust credit assessment that supports lending dynamics, and the provision of accurate and up-to-date information to management.

© 2024 KPMG Hungária Kft./ KPMG Tanácsadó Kft. / KPMG Legal Tóásó Ügyvédi Iroda / KPMG Global Services Hungary Kft., a magyar jog alapján bejegyzett korlátolt felelősségű társaság, és egyben a KPMG International Limited („KPMG International”) angol „private company limited by guarantee” társasághoz kapcsolódó független tagtársaságokból álló KPMG globális szervezet tagtársasága. Minden jog fenntartva.

A KPMG globális szervezeti struktúrával kapcsolatos további részletekért kérjük látogassa meg a https://kpmg.com/governance oldalt.