Digital Transformation in the Shipping Industry is here

Article by Michael Papageorgiou, Senior Manager, Advisory Department, KPMG for NAFS magazine

Article by Michael Papageorgiou, Senior Manager, Advisory Department, for NAFS magazine

Nikos Dimakos

Partner, Head of Consulting

KPMG in Greece

Article by Michael Papageorgiou, Senior Manager, Advisory Department, KPMG for NAFS magazine

Shipping Companies are exploring ways to leverage new technologies to improve the efficiency and productivity of their investments. Other industries have been affected by digitizing their operations much earlier than the shipping industry, which is due to the inherent complexity of the maritime industry. But things are changing and, unusually for the maritime sector, very quickly. According to a survey conducted by Wärtsilä Marine Business, two-thirds of shipping companies have started on their digital journey, with this being just the beginning, as 69% of them are currently exploring digital solutions.

The new business environment demands the shipping industry to shift from the traditional business model of selling capacity, to one that offers value to customers. With the increasing need of global supply chains for seamless flow of goods and services, Digital Business is a key enabler for shipping companies today.

Technologies such as the Internet of Things (IoT), Big-Data, Artificial Intelligence (AI), Application Programmable Interfaces (APIs) and sensors, together with the vast amount of data that are now available, are being utilized to optimize operations, enhance efficiency, drive down costs and increase the uptime of vessels. Implementation of these innovations will require changes in the operating models, use of produced data, cyber security as well as the role of vessels to create value.

Maritime 4.0: Disruption by digital innovation

Digital technologies and tools will transform the role of vessels from being a central mechanism to an enabler of value creation. These tools will create smarter, more connected distributed networks and will provide performance monitoring as well as real-time visibility of the vessels. This will massively reduce the lack in communication between the people on the vessel and those on-shore and will set up the foundation for more centralized know-how where data from one vessel can be used to drive improvements in other vessels as well.

The Industry 4.0 becomes Maritime 4.0 to reinforce the research focus to specific blue challenges, to develop innovative digitally connected vessels, to improve the market competitiveness, to plan the development of the appropriate skills and last, but not least, to include the environmental sustainability of vessels and shipbuilding.

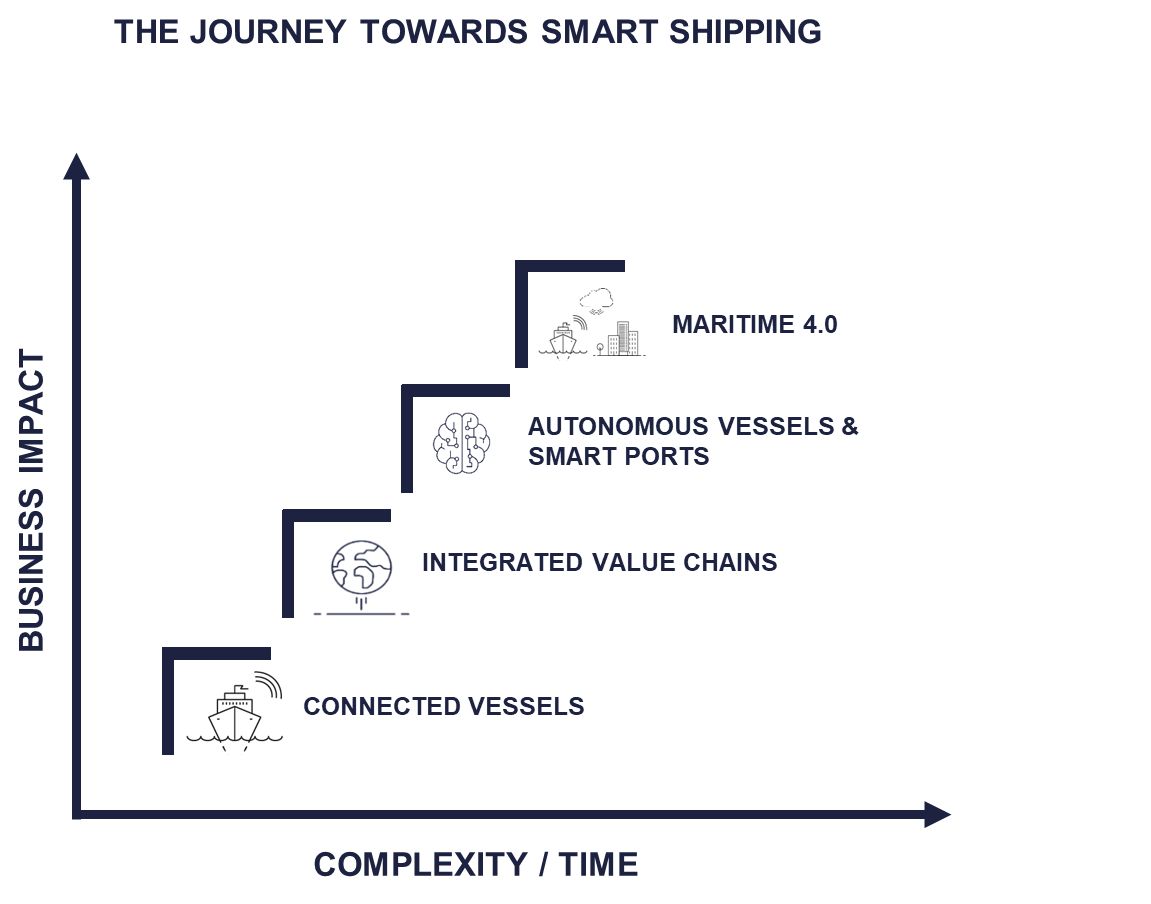

The digital disruption which Maritime 4.0 will bring, is depicted in the following figure:

Figure 1: The journey to smart shipping

To continue playing a vital role in international trade, shipping will need to integrate these technologies into the infrastructure and operations of both the vessels and the world’s maritime cities that service them. To minimize the future impact of external influences on the shipping industry, advances in automation and connectivity will play a key role. Although many maritime companies were already quite technology-driven, most were still taken aback by the scale of disruption seen last year.

Digital Transformation encloses significant cost savings

Although innovation in shipping is driven by compliance, we see that industry’s main focus will remain Operational Expenses (OPEX) reductions and efficiencies in operations.

Digital transformation is reinvigorating the shipping industry through new applications to streamline operations, customer experience, and efficiency. In shipping, digital platforms, real-time tracking data, big data, IoT, blockchain, and online third-party logistics (3PL) integrations are leading the way to disruption and redefining of this legacy industry.

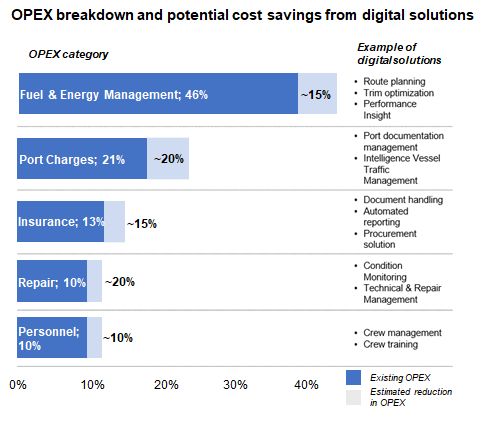

In the following figure the contribution of the basic cost elements in the OPEX of a shipping company is presented along with a potential cost savings due to digital disruption, based on a recent study by BCG.

Figure 2: OPEX breakdown & potential savings

Overall, with a potential of more than 15% OPEX reduction due to digital disruption, a rapid growth in the number of connected ships is expected over the next 5 years.

Conclusion

The Global Marine Technology Trends 2030 (GMTT2030) Report presents the outlook towards the future of technology. Technology trends are not isolated, but are intimately intertwined with societal trends, sustainable-resource exploitation, jobs, wealth, peace and war.

In GMTT2030, three important messages are apparent.

Firstly, strong opportunities for growth in the commercial shipping, ocean space, and naval sectors could be found in the future, if businesses could harness the scientific and industrial capabilities required to take advantage of the technologies and innovation.

Secondly, the commercial shipping, ocean space, and naval sectors will undergo a rapid transformation as competition intensifies and technologies mature in other sectors.

Thirdly, a stable, coherent framework of regulation and support is still essential to boost confidence to the private sector, in order to invest.

The shipping industry will continue to innovate, with the potential of autonomous shipping, digitization and a clear commitment to decarbonization by 2050. The complexity is increasing, whilst shipping continues to provide prosperity to all stakeholders according to International Chamber of Shipping (ICS). Digital transformation doesn’t happen in a vacuum, it is at the heart of a nation’s and company’s competitiveness, driving business performance, and enriching people’s lives like never before. Market forces and technology are pushing shipping companies to rethink the way they operate.

Sources

- The connected experience by Forrester Consulting, a study contacted on behalf of KPMG, January 2019.

- Global Marine Technology Trends 2030, Lloyd’s Register, QinetiQ and University of Southampton.

- Shipping Benchmark Initiative, Boston Consulting Group

- International Chamber of Shipping (www.ics-shipping.org)