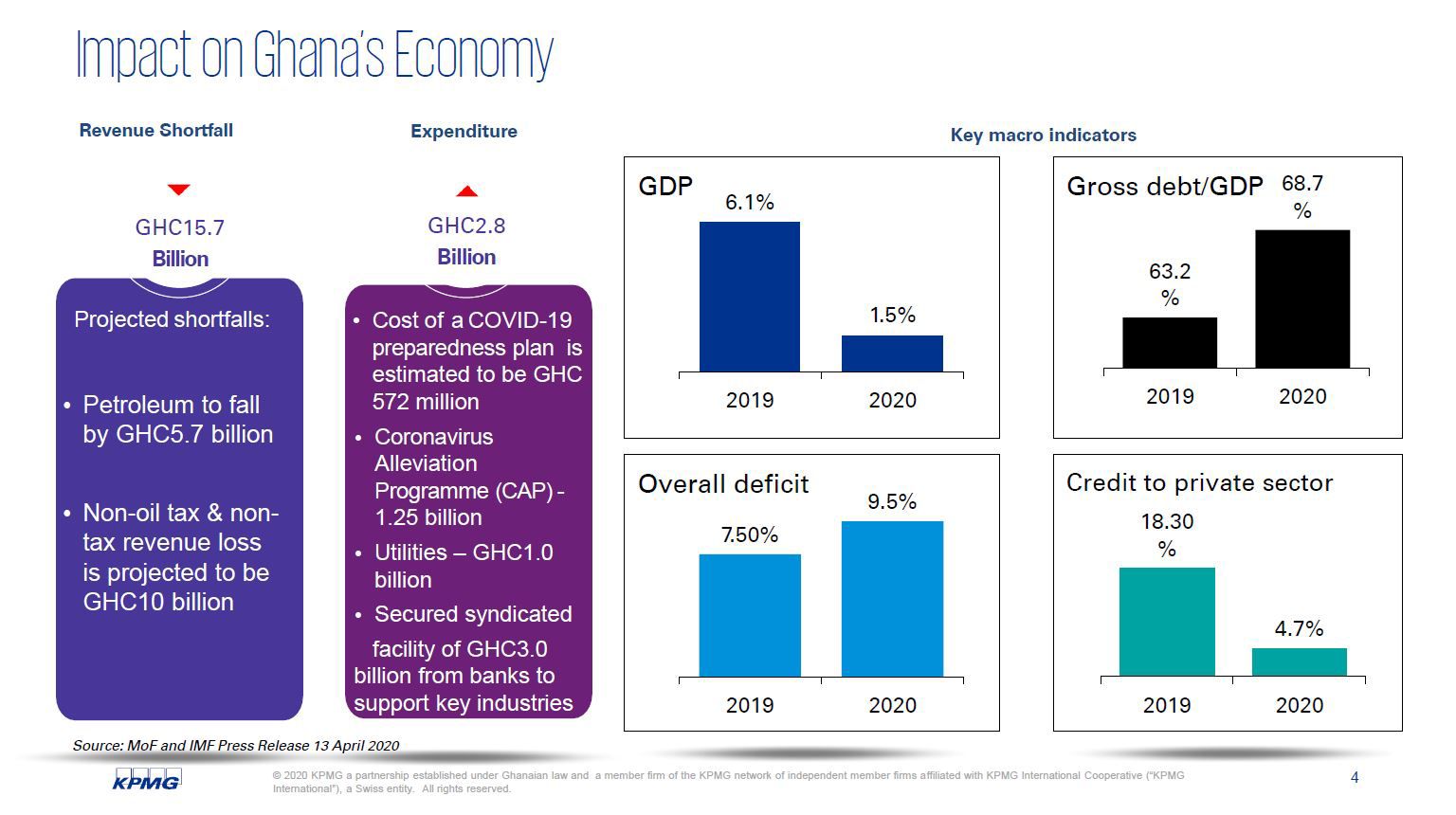

The outbreak of COVID-19 and the impact on the wider economy has placed unprecedented pressure on businesses. The pandemic continues to put severe strain on people and businesses across the globe.

• The banking industry in particular is being hit hard by daily pivoting market conditions and deteriorating credit among others.

• The speed and size of the economic impact that COVID-19 has on bank’s bottom line has brought into stark reality the importance of robust stressing testing, beyond what many banks were undertaking in the past.

• These are unprecedented times for CEOs, CROs, risk functions and business. “Stress Testing Banking Operations under COVID-19 Scenario” seeks to discuss the need to stress test banking operations to identify risk and opportunities, and ultimately to understand the capacity of the bank to be compliant and generate value in the era of COVID-19.

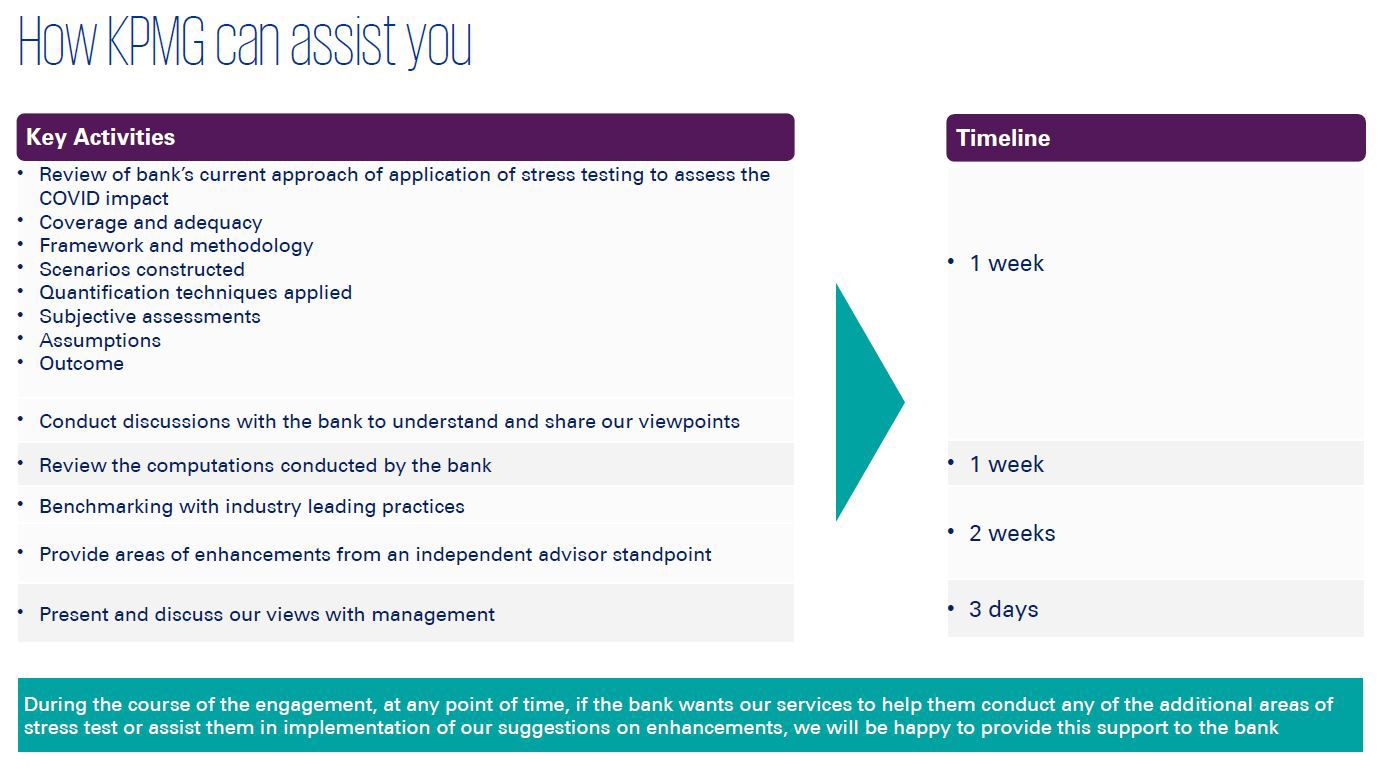

• KPMG shares its 4-step approach to stress testing and offers advice based on deep expertise and experience in Financial Risk Management within the banking sector.

• The learnings from the webinar will help banks re-align their products and investment strategies to the changes in the local and global market dynamics.

Latest CJEU, EFTA and ECHR

CJEU decisions on progressive tax on turnover and fines related to advertising tax

On March 3, 2020, the Court of Justice of the European Union (CJEU) rendered its decisions in three cases, (C-482/18), (C-323/18) and (C-75/18), each of which concerned aspects of Hungarian law. The CJEU decided that the EU freedom of establishment does not preclude Member States from levying a progressive tax on turnover, the actual burden of which is mainly borne by companies controlled from another Member State. The Court also ruled that Hungarian advertisement tax penalty regime disproportionately affected companies located in another EU Member State and was therefore contrary to the EU principle of freedom to provide services.

For more information, please refer to Euro Tax Flash Issue 426.