The OECD Secretariat Unified Approach: above the Arm’s Length Principle or BEPS Erase & Replace?

Article written by Elfie Ossard Quintaine & Guillaume Madelpuech, Economists, and Laurence Mazevet, Tax Partner, KPMG Avocats (1).

Article written by Elfie Ossard Quintaine, Guillaume Madelpuech, & Laurence Mazevet.

Elfie Ossard Quintaine

Economist

Guillaume Madelpuech

Economist

Laurence Mazevet

Tax Partner, KPMG Avocats

Is that truly the biggest overhaul of global tax rules in 90 years?

In the context of Pillar One of BEPS 2.0 initiative, the OECD Secretariat has released on October 9, 2019 a consultation document (the “Secretariat Draft2”) outlining a so-called “Unified Approach” (the “Proposal”).

The Secretariat Draft does not represent the consensus views of the Inclusive Framework, the Committee on Fiscal Affairs (CFA) or their subsidiary bodies. Indeed, the Proposal can be seen as seeking to build on the commonalities of the three previously competing proposals included in the March 2019 Public Consultation Document related to the tax challenges of the digitalization of the economy.

Yet, the Proposal could have far-reaching consequences on profit attribution rules for MNEs well beyond highly digitalized businesses. Mr. Saint Amans calling it "a badly needed update of the rules we currently play with dating back to 19283". The Proposal would in particular entail going above the arm’s length principle in a wide range of circumstances.

It is worth noting that while the Secretariat Draft outlines some principles, it does not discuss many critical parameters, which would be crucial to fully grasp the impact of the Proposal.

The Secretariat Draft’s intend, from a public policy standpoint, is pretty clear: taxing the large Internet companies. However, some of the technical provisions of the document seem not fully in line with this noble-minded goal and the statement of purpose as regards the dispute prevention and resolution mechanisms slightly theoretical.

The Approach

The Proposal outlines a formulaic / supposedly simplified approach to allocate a – possibly significant – share of the consolidated “Business to Consumer” (“B2C”) profit of Multi-National Enterprises (“MNEs”):

— To the jurisdictions where consumers are located, irrespectively of whether such MNEs have a physical presence under current applicable concepts (companies or permanent establishment);

— To the jurisdictions where marketing and distribution activities are located.

The new Pillar One would rely upon three new founding stones, each described thereafter:

— Scope;

— Nexus;

— Profit Allocation.

1. Scope

Even though the intent of the Proposal is to tax “highly profitable” and/or “highly digitalized business models”4, the Proposal has a much wider reach. The Proposal:

"should be focused on large consumer-facing businesses, broadly defined, e.g.:

· businesses that generate revenue from supplying consumer products or

· providing digital services that have a consumer- facing element5."

In terms of definition of consumer, the Secretariat Draft mentions that:

"The term “consumer” generally refers to individuals who acquire or use goods or services for personal purposes (i.e. outside the scope of a professional or business activity), while the term “customer” generally includes all recipients of a good or service (including business customers that are not end-users)6."

It is worth mentioning that the concept of “user” is not separately defined. We will further refer to as the MNEs or businesses covered by the Proposal as “B2C” (vs “B2B”) in the remainder of this document.

It is thus possible that the scope of the Unified Approach may be narrowed to certain B2C Business Lines of MNEs, but the Secretariat Draft is still vague on this point and it cannot be excluded that all groups even with a limited B2C activity may fall within the scope of the Proposal.

In practice, some exclusions may apply:

– Industries: most likely the extractive and commodities sectors, and possibly financial services will be excluded from the Scope;

– Size: the Secretariat Draft refers to a threshold of 750M€ of consolidated turnover by analogy with the Country-by-Country Report.

For step 4 of the Profit allocation (see below), a new "Nexus" rule, or "Link" rule that would be applicable "in all cases when a business has a sustained and significant involvement in the economy of a market jurisdiction, such as through consumer interaction and engagement, irrespective of its level of physical presence in that jurisdiction".

2. Nexus

Once an MNE falls into the (broad) Scope defined above, the jurisdictions in which this group are selling products or services will be entitled to tax a portion of their profits. This is the “new Nexus rights” detailed in the Proposal as:

– "The new nexus rule would [be] applicable in all cases where a business has a sustained and significant involvement in the economy of a market jurisdiction, such as through consumer interaction and engagement, irrespective of its level of physical presence in that jurisdiction.

– The simplest way of operating the new rule would be to define a revenue threshold in the market (the amount of which could be adapted to the size of the market [to ensure that jurisdictions with smaller economies can also benefit]) as the primary indicator of a sustained and significant involvement in that jurisdiction.

– The revenue threshold would also take into account certain activities, such as online advertising services, which are directed at non-paying users in locations that are different from those in which the relevant revenues are booked7."

3. Profit Allocation

In order to determine the taxable profit in a specific market jurisdiction (in accordance with existing rules as well as the New Nexus rule), the Proposal consists in a three tier-allocation mechanism.

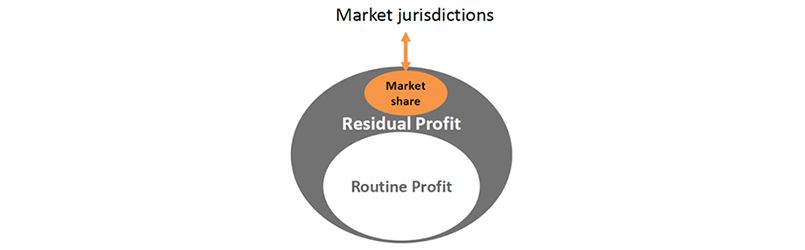

During the October 9th 2019 webcast, the OECD Secretariat used the following simplistic diagram:

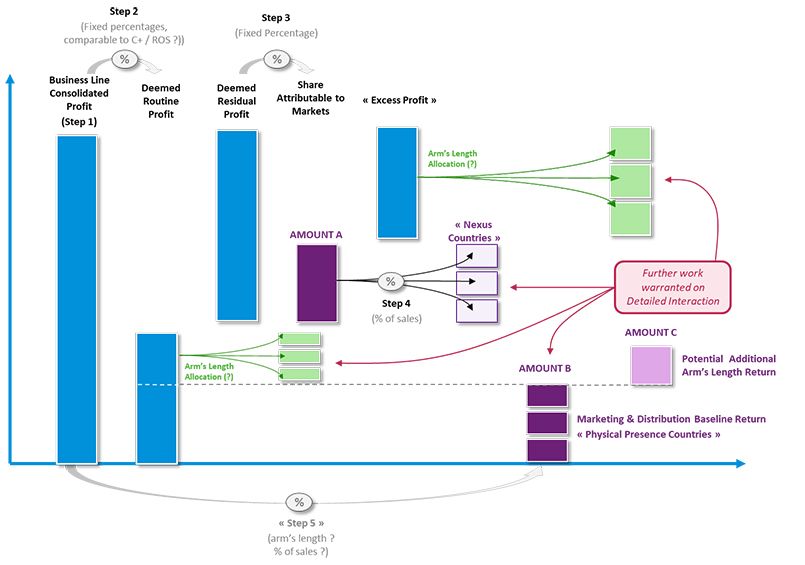

The Proposal indeed discusses a slightly more complex mechanism as per the chart below:

Each Step is further described below:

Step 1 – Determination of Profit to be considered

"The relevant measure of profits could be derived from the consolidated financial statements (…) [but] may need to be determined on a business line and/or regional/ market basis8."

Step 2 – Determination of the deemed routine and deemed residual profits

The Secretariat Draft mentions:

"[This Step] would seek to approximate the remuneration of the routine activities based on an agreed level of profitability. (…) The level of profitability deemed to represent such “routine” profits could be determined using a variety of approaches, but a simplified approach would be to agree a fixed percentage(s), possibly with variances by industry9."

Step 3 – Determination of the profit attributable to Markets (“Amount A”)

The Secretariat Draft mentions:

– "a share of the deemed non-routine profit attributable to the market jurisdiction would be determined in accordance with a simplifying convention, such as non-routine profit multiplied by an internationally- agreed fixed percentage, though it is possible that different percentages might be applied to different industries or business lines10 ;

– specific rules would need to be considered for the treatment of losses under Amount A (e.g. claw-back or “earn out” mechanism)11."

Step 4 – Allocation of a share of Amount A to each eligible jurisdiction under the new Nexus Rule

The Secretariat Draft mentions:

– "This allocation should be based on a previously agreed allocation key, using variables such as sales. The selected variables would seek to approximate the appropriate profit due to the new taxing right12;

– [This step is applicable] irrespective of whether they have an in-country marketing or distribution presence (permanent establishment or separate subsidiary) or sell via unrelated distributors13."

Step 5 – Attribution of a “Baseline” profit and potentially more for activities in countries where there is a taxable presence under existing PE rules (“Amount B” and “Amount C”)

The Secretariat Draft mentions:

– "[This step] would seek to establish a fixed return (or fixed returns, varying by industry or region) for certain “baseline” or routine marketing and distribution activities taking place in a market jurisdiction14;

– The quantum of the fixed return could be determined in a variety of ways: it could be (1) a single fixed percentage; (2) a fixed percentage that varied by industry and/or region; or (3) some other agreed method15."

This return is referenced to in the Secretariat Draft as “Amount B”.

The Secretariat Draft provides for the possibility for “market” jurisdictions to claim for a higher profit, for these activities, under applicable profit attribution rules, subject to the existence of robust dispute resolution mechanism16 (Amount C):

– "Taxpayers and tax administrations would retain the ability to argue that the marketing and distribution activities taking place in the market jurisdiction go beyond the baseline level of functionality and therefore warrant a profit in excess of the fixed return contemplated under Amount B17."

Next Steps

The ongoing work will be presented in a new OECD Secretary-General Tax Report during the next meeting of G20 Finance Ministers and Central Bank Governors in Washington DC, on 17-18 October.

Interest parties are invited to send their comments no later than November 12, 2019. A public consultation on the Unified Approach will be held November 21–22 in Paris.

The Secretariat Draft mentions that "[one should recognize] that certain aspects still require further work. A number of implementation and administration questions also need to be addressed18."

The OECD hopes that a unified approach to pillar one can be agreed by January 2020.

Analysis & Discussion

Impact

The Proposal could have massive impacts on the current international taxation principles, in terms of:

– Industries.

Amongst many, the following industries could be in the scope of the Approach19:

automotive, electrical, electronics & computer, pharmaceutical, food industry, fashion & textile, telecommunication, transport, Utilities, Constructions, Oil & Gas Downstream, Media, Entertainment, Publishing, Retail, Luxury, Cosmetics, Wholesale, Personal Services, etc.

The Proposal does not discuss at all about how a specific MNE will fall within one or the other of these (not yet defined) industries. Indeed, in most cases, MNEs are involved in several industries at once and new “highly digitalized business models” consist in intermediation amongst various industries.

– Interaction with domestic taxation law.

For instance one might consider that, for a subsidiary performing routine marketing and distribution services only, the Corporate Income Tax of this company would be based on Amount A + Amount B (potentially both calculated following a formulaic approach) and would therefore not anymore depend on standard statutory accounting principles. Moreover, the question of how in practice market jurisdictions will be able to tax the Amount A when an MNE does not have a physical presence is yet to be articulated. The Secretariat Draft mentions a potential withholding tax but does not discuss the practicalities of implementing it at a consumer sales level.

Undefined concepts, mechanisms and parameters in the Proposal

The Proposal relies upon many critical definitions and parameters, which will likely be extremely difficult to agree on for technical and/or political reasons. These concepts notably include:

– The definition of the B2C businesses considering that the scope encompasses business models relying on intermediaries and delineation of B2B vs B2C business lines within a single MNE;

– The delineation of the industries carved out from the Approach;

– The market level of the “sales” factor for the purposes of the application of Step 4 (allocation of Amount A to eligible jurisdictions)20;

– The rules to address transactions between B2B and B2C business lines, within an MNE;

– The interaction between the various aggregates in the method, to avoid double taxation and double non-taxation21;

– The interaction between the countries where the Proposal would be implemented vs the ones where it would not be implemented;

– The differences in accounting standards even for intermediary revenues definition between US GAAP and IFRS GAAP;

– The parameters (and underlying definitions) for each of the calculation steps including of course the percentage of the Deemed Residual Profit attributable to the markets22 with their possible regional / industrial variants.

Applicability and Viability

Changes advocated by the Proposal would have to be enacted on a country-by-country basis, in the context of domestic tax law and tax treaties, irrespective of an adoption by the OECD Committee on Fiscal Affairs.

Yet, the Secretariat points out that:

[Even though] the technical work of the Secretariat, as well as consultations with the membership, indicate that this is a viable option23 (…) the re-allocation of taxing rights raises important political considerations. A crucial one is that these changes would need to be implemented simultaneously by all jurisdictions, to ensure a level playing field24.

At this stage, the likelihood of implementation of the Approach in a foreseeable future is unknown.

Controversial Discussion or Constructive Debate?

Concluding on whether the Secretariat Draft is a more-than-welcomed evolution, a mini-revolution or an illusion is a difficult exercise.

Whereas the political intent is clear, the technical provisions in the document raise so many questions that it is uncertain that the Proposal has a chance to be implemented in practice. The setting of the parameters in the Proposal will potentially have important macro-economic consequences for governments’ public finances. It is therefore possible that the Inclusive Framework, even after an initial governments’ positive reaction, would fail to reach an agreement on the most critical parameters in the Proposal.

From a technical perspective, it is surprising that the Proposal offers to overcome the arm’s length principle without waiting for the full consequences of Action 8-10 and Action 13 of the BEPS project works to materialise.

More fundamentally, one may be unsure that the Unified Approach will achieve its goals. The issue of fair profit allocation of MNEs amongst jurisdiction is intrinsically complex and economic by nature.

We would be inclined to think that an attempt to tame this issue through formulaic concepts would be doomed to fail. In particular abusive tax strategies would be likely to exploit loopholes created by prescriptive rules.

Last but not least, we are doubtful about the Draft Proposal to achieve two of its main goals as notably mentioned during the OECD Webcast. While the Unified Approach aims at preventing unilateral actions from governments and praises robust dispute resolution mechanisms, we, on the contrary, foresee a potentially increasing number of areas of disagreement and related tax uncertainty for taxpayers.

One disputable interpretation would be to consider that the OECD Secretariat issued the best formulaic alternative to the arm’s length principle, only to prove that such approach is unworkable, both for technical and political reasons.

Take Aways

Key Take Aways includes:

– The OECD Secretariat issued a Proposal on profit allocation, initially aiming at compensating “market jurisdictions” with far reaching consequences for all Groups in a B2C business;

– The Proposal would also help calibrate the compensation of routine distribution activities;

– Key concepts, mechanisms and parameters in the Proposal are not defined in the Secretariat Draft;

– Consequently it is difficult to assess the likelihood of eventual enforcement, in practice, of regulations derived from the Draft.

Authors

Elfie Ossard Quintaine

Economist

Guillaume Madelpuech

Economist

Laurence Mazevet

Tax Partner, KPMG Avocats

---

1 Please note that this document reflects the views of the authors from a Transfer Pricing standpoint and not necessarily those of the KPMG Network. This post aims to share the team’s first reactions. Further analysis would be performed in the coming weeks in light of the ongoing Public Consultation and in order to envisage other direct and indirect tax implications.

2 Secretariat Proposal for a “Unified Approach” under Pillar One, Public consultation document, October 9, 2019, https://www.oecd.org/tax/oecd-leading-multilateral-efforts-to-address-tax-challenges-from-digitalisation-of-the-economy.htm

3 France24 TV Interview by Stephen Carroll, October 10, 2019

4 §15

5 §20

6 Footnote 7

7 §22

8 §53

9 §54

10 §57

11 §37

12 §60

13 §15

14 §62

15 §63

16 "It would be essential to consider existing and possible new approaches to dispute prevention and resolution, including mandatory and effective dispute prevention and resolution mechanisms to ensure the elimination of protracted disputes and double taxation” (§64)

17 §64

18 §15

19 Industries such as Oil & Gas Upstream, Agriculture, Financial Services, Aerospace, and Business Services might be considered out of scope.

20 Without even discussing the fact that the information may not be known by taxpayers when there is an intermediary.

21 These aggregates being (I) The Deemed Routine Profit, (II) Amount A, (III) the Excess Profit, (IV) Amount B and (V) Amount C.

Only as regard the interaction between Amount A and Amount C, the OECD points out that “in relation to Amount C, it would also be important to ensure that the profit under Amount A could not (whether in whole or part) be duplicated in the market jurisdiction (§65)”

22 The other parameters include (I) the Deemed Routine Returns in Step 2 (II) the baseline return for marketing & distribution activities in Step 5.

23 §15

24 §40