Finnish deals holding up, despite deteriorated market environment

Nordic Private Equity Data Snapshot, April 2020

Nordic Private Equity Data Snapshot, April 2020

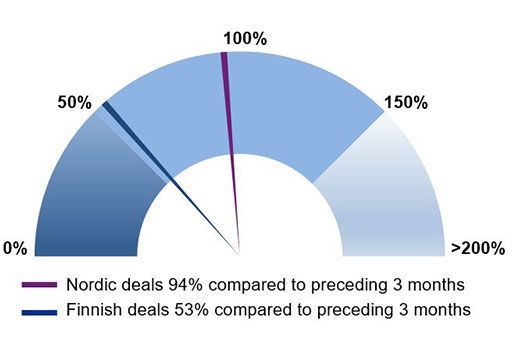

Last 3 months Nordic and Finnish Buyout and VC deal activity compared to preceding 3 months

Deal activity

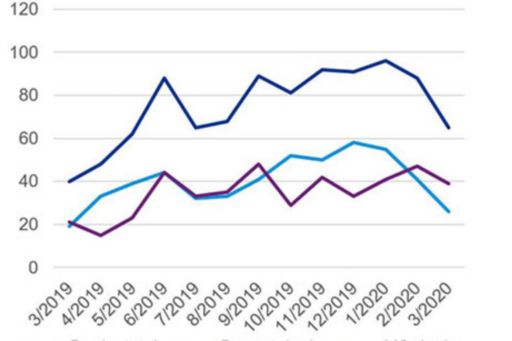

On the Nordic level the private equity deal volume declined significantly in March, in line with the expectations. The drop in buyout deals has continued since the beginning of the year. Notably, the VC deal count declined for the first time during 2020. Aggregate three-month rolling deal count held up as a result of the solid performance earlier this year.

In Finland, the deal activity picked up a bit after a two-month breather. However, compared to the strong deal environment in the end of 2019, the 3-month rolling speedometer plummeted to 53% compared to the preceding 3 months.

Monthly Nordic Buyout and VC deal volume

Deal picks of the month

Norvestor signed an agreement to acquire the majority of the shares in PHM Holding Oy. Together with the current owners, Intera Partners and management of PHM, the plan is to back the company’s continued growth and consolidation of the Nordic residential property maintenance sector. The deal is expected to be completed during spring 2020 after approval from competition authorities.

CapMan Buyout’s fund has entered into an agreement to invest in leading industrial software solutions provider PDSVISION. CapMan acquires a majority equity share in the company, with key members of the PDSVISION organization retaining a significant share. The investment is the first of the CapMan Buyout XI fund, which was established in 2019.

Smart ring startup Oura raised $28 m of Series B venture funding from Gradient Ventures, The Yard Ventures, Square and Forerunner Ventures. The company intends to use the funds to bring on new key hires and product updates.

Finnish IoT and product development company, Haltian, raised EUR 9m of venture funding from Ilmarinen Mutual Pension Insurance, Nordic Option, Inventure and a group of private investors through investment service SijoittajaPRO, including Head Invest. The funds will be used to develop existing products, create new products and strengthen its presence in international markets.

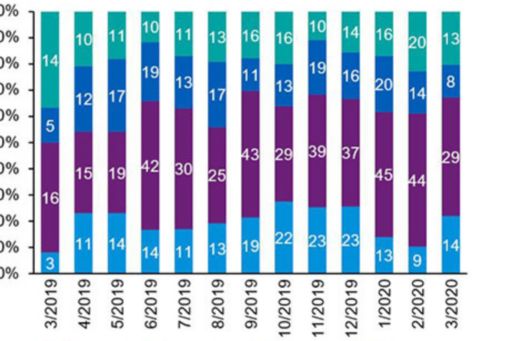

Monthly Nordic Buyout and VC deal volume

Private Equity Data Snapshot compiles monthly deal volume data from Finland and the Nordics. Read our older Private Equity Data Snapshots.

How can we help?

Kenneth Blomquist

Partner, Advisory

KPMG in Finland

Jussi Paski

Head of Startup & Venture Services

KPMG in Finland