Mixed signals before Corona impact

Nordic Private Equity Data Snapshot, March 2020

Nordic Private Equity Data Snapshot, March 2020

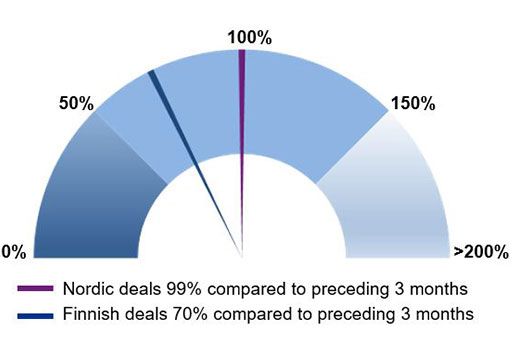

Last 3 months Nordic and Finnish Buyout and VC deal activity compared to preceding 3 months

Deal activity

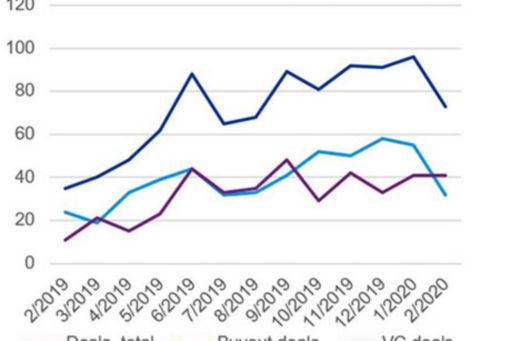

Late entry of several deals relating to an accelerator program in Sweden and Denmark and few other deals raised the Nordic aggregate January deal volume to a peak figure for the past twelve months. In February the Nordic deal volumes, especially the buyout deals, dropped significantly.

In Finland the decrease in deal volumes was visible already in January, even though the Nordic deals kept the pace. Two consecutive slow months in terms of the Finnish deals lowered the 3-month rolling speedometer to 70%. The Nordic rolling deal count remained at par compared to the review period.

No doubt the effects of the coronavirus on the deal volumes as well as fundraising will be visible in the upcoming months.

Monthly Nordic Buyout and VC deal volume

Fundraisings

Finnish Sparkmind.vc announced the first closing of its education technology specialist venture fund at €40 million. The fund will focus on supporting EdTech founders, with entry points ranging from the Seed stage to Series B rounds.

Innovestor announced the first close of its new B2B Industrial Technology Fund at €30 million. The fund, which will be capped at €100 million, is the first in the Nordics and Baltics to focus exclusively on early-stage B2B industrial technology companies and offers pre-series A to series A investments.

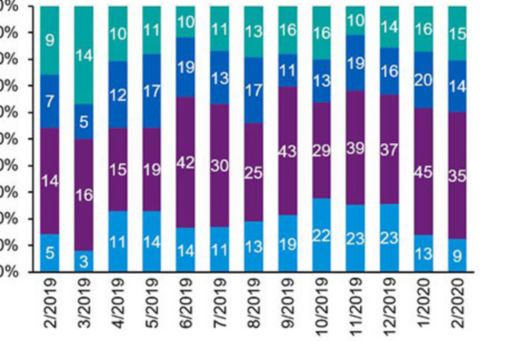

Monthly Nordic Buyout and VC deal volume

Deal picks of the month

Aiven, a startup combining the best open source technologies with cloud infrastructure, announced that it has raised $40 million in Series B funding. The round was led by Silicon Valley-based IVP. Existing investors Earlybird VC and Lifeline Ventures, also participated in the round.

Korona Invest announced on Feburary 28 that it has acquired the majority of Epic Autokoulu Oy. Epic Autokoulu is a modern driving school chain with a net sales of €8.8 million.

Sensible 4 raised $7 million of Series A venture funding in a deal led by Itochu and NordicNinja VC. The funds will be used to software development. Sensible 4 is a developer of self-directed robot minibus designed to facilitate all public or shared transport vehicles to safely become self-driving in all weather conditions and environments.

Private Equity Data Snapshot compiles monthly deal volume data from Finland and the Nordics. Read our older Private Equity Data Snapshots.

How can we help?

Kenneth Blomquist

Partner, Advisory

KPMG in Finland

Jussi Paski

Head of Startup & Venture Services

KPMG in Finland