Global Venture Capital investment holds strong in Q4’20

2020 was a year of tremendous change. While the global pandemic severely impacted countless industries — from travel and sports to hospitality and live entertainment — it also acted as a catalyst for technology transformation and innovation as startups capitalized on accelerating digital trends and corporates worked to rapidly advance their digital strategies in order to survive and effectively meet the shifting needs of their customers.

The VC market globally showed incredible resilience in 2020, defying early expectations of a potential dip due to COVID-19. While the total number of VC deals globally dropped sharply in 2020, total global VC investment grew year-over year as VC investors focused primarily on late-stage deals and on supporting companies within their existing portfolios. VC investment in the earliest deal stages dropped off in most jurisdictions, a multi-quarter trend that could affect the pipeline for deals over the longer term.

Looking ahead to Q1’21, global VC investment is expected to remain quite high given the low interest rate environment in many regions of the world and the vast amount of dry powder in the market. IPO activity is also expected to remain strong given the pipeline of unicorns and other mature technology companies looking to exit.

We could continuously talk about COVID-19 and the enormous challenges it has created, but the reality is that some sectors, like tech sector, specifically in Saas, AI, and digital health, are more resilient then ever due to pandemic. People and businesses across the world have embraced technology and that’s why there’s so much money going into the space right now. That momentum is only going to continue in Q1’21.

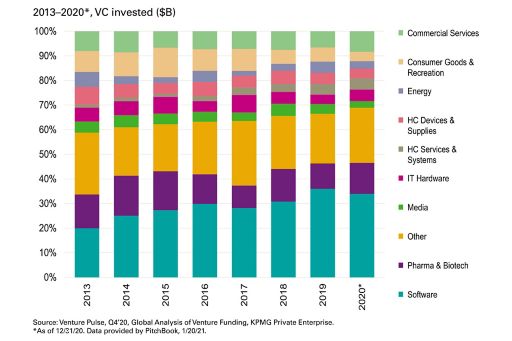

European venture financings by sector

Annual VC investment in Europe shatters previous high

Numerous European jurisdictions see record levels of VC investment in 2020. The surge to a record level of VC investment in Europe during 2020 was driven by record-breaking levels of annual VC investment in numerous jurisdictions, including the Nordic region.

In 2020, the amount of funding dedicated to first-time financings in Europe was weak as investors focused on their existing portfolio companies and proven bets. VC investors were likely also hesitant about making completely new investments without the opportunity to meet founders face to face. While there continued to be fierce competition for the best deals, it was very difficult for most companies looking to raise Seed and Series A funding rounds to attract investments without making major compromises.

In recent months, a number of startups pulled back on funding rounds given concerns over valuations and access to potential funds — instead looking to shorter-term interim funding to keep them afloat and push their need for larger raises down the road.

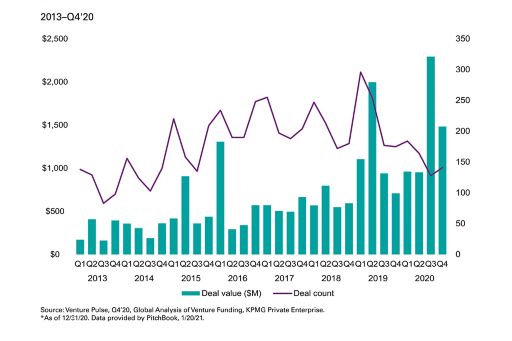

Nordics region continues to see large deals as ecosystem matures

A handful of the top 10 financings globally helped propel the Nordic region’s aggregate deal value to a new record in Q3 2020. Although that performance was not repeated in Q4 2020, volume evened out, in a tentatively promising sign for future funding levels.

Corporate investment was also high, particularly in the fintech space. Many of the region’s biggest banks have been actively investing in open banking applications — applications they are now bringing to market. SaaS and healthtech also continued to attract interest from VC investors in the region.

VC investment in Europe is expected to remain strong heading into Q1’21, particularly in areas like fintech, healthech, edtech, and SaaS solutions. Cybersecurity is also expected to be a hot area of investment given the rapid acceleration of digital strategies and changing consumer behaviors. One area expected to grow on the radar of VC investors is foodtech given the increasing emphasis being put on the sustainability of the food supply and food sources across the region.

Venture financing in the Nordics

There was a lot of promise around open banking after the regulations changed (PSD2) — a lot of talk. We’re now starting to see the actual applications come to market — primarily from the big banks who have been quite active in terms of investing in and working with open banking startups. This activity is expected to continue well into 2021.

Contact us

Jan Hove Sørensen

Partner, Head of Corporate Finance

KPMG in Denmark

Stig Meulengracht

Partner, Transaction Services

KPMG in Denmark

Dale Treloggen

Partner, Head of Transaction Services

KPMG in Denmark

Jakob Lumholtz

Manager

KPMG in Denmark