DAC6 – The EU Mandatory Disclosure Rules have now entered into force across the EU

DAC6 - EU Mandatory Disclosure Rules

DAC6 & Brexit

Following the Free Trade Agreement negotiations between the UK and the EU ahead of the 31 December 2020 deadline, a significant reduction in the scope of DAC6 reporting in the UK has been announced. In particular:

- DAC6 reporting in the UK will still be required for a limited time, but only for arrangements meeting Hallmarks D (arrangements undermining Automatic Exchange Of Information and disguising beneficial ownership). This will apply retroactively to 25 June 2018.

- The UK will consult on draft legislation and implement the OECD’s MDR recommendations under BEPS Action 12. This means that DAC6 will likely be replaced by new “UK MDR” rules in the near future.

Despite this reduction in scope of the UK implementation, it is important to be cognisant of the following:

- Businesses will no longer be able to rely on a report in the UK to discharge a reporting obligation in another territory – e.g. where a reportable arrangement involving the UK and an EU territory may previously only need to have been reported in the UK, it would now need to be reported in the other country.

- UK-led businesses with operations in the EU will still need to continue preparing for compliance in the remaining 27 EU Member States as before. For example, businesses will still need to establish processes and procedures to identify and assess potentially reportable arrangements and make relevant disclosures.

Download our DAC6 Mandatory Disclosure Rules flyer

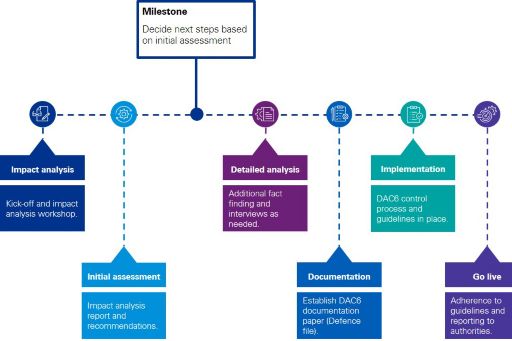

With most employees still advised to work from home, we have adapted our project approach to these constraints. Our implementation project model is leaner, scaled-down, and focused on the essentials for delivering a compliance DAC6 process, without relying on in-person workshops.

Do you have any questions?

If you have any questions to the new rules or the process do not hesitate to contact:

Birgitte Tandrup, Partner, KPMG Acor Tax

Mads Nørgaard Sørensen, Partner, KPMG Acor Tax

Simon Tornø Olesen, Manager, KPMG Acor Tax

Francois Marlier, Senior Consultant, KPMG Acor Tax