KPMG's Property Lending Barometer 2016

KPMG's Property Lending Barometer 2016

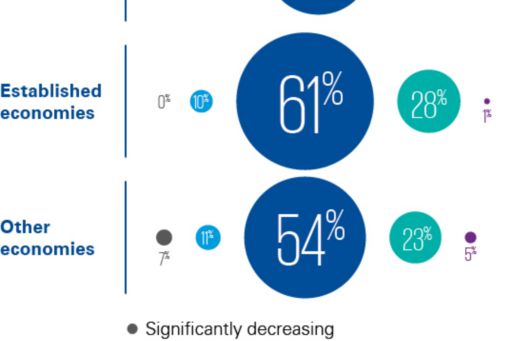

The latest edition of KPMG's comprehensive survey of Europe's property lending markets reveals that conditions for financing real estate are favorable, and 75% of those surveyed want to maintain or grow lending for property investments — but the uncertainties around such sentiments are accumulating.

This 7th edition of KPMG's publication surveys representatives from nearly 100 banks in 21 countries throughout Europe, offering readers a comprehensive assessment of financing prospects for those looking to invest in European real estate markets.

Still, despite favorable conditions, some banks are still a bit leery of lending for property investments in markets which have seen many non-performing loans, and investment markets are even seeing a slight downturn, according to KPMG's Andrea Sartori, Partner and Head of Real Estate in Central & Eastern Europe, who coordinated the survey.

He comments: “We have yet to see the conditions of bank financing that existed before the global financial crisis, and it's not likely we will see them according to what we're observing from our analysis.”

Banks were also asked to identify the key drivers affecting their real estate portfolios.

“Both local and European macroeconomic conditions are thefactors exerting the most influence regarding this positive sentiment,”explains KPMG's Sartori, “but in some countries there are few prime propertiesthat need to be financed, coupled with a lack of active investors.”

Property Lending Barometer

© 2024 KPMG Central and Eastern Europe Ltd., a limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.