As the insurance industry continues to evolve at an unprecedented pace, where regulatory, environmental and technological advances introduce new challenges to the Company growth strategies and business objectives, insurance leaders acknowledge the important role of Actuaries in shaping the future of the industry. In the realm of financial risks tied to insurance products and the need for optimal operational processes to meet regulatory risks our Actuarial and Insurance Services stand out as not just a choice, but the right choice. Led by Qualified Actuarial and Insurance professionals we are committed to crafting tailored solutions with precision, ensuring that your unique challenges find the right answers. Our local experience as being the leader consultants in the Cyprus insurance market as well as our international exposure in the Arab world and Europe are our ingredients that support our optimal solution propositions.

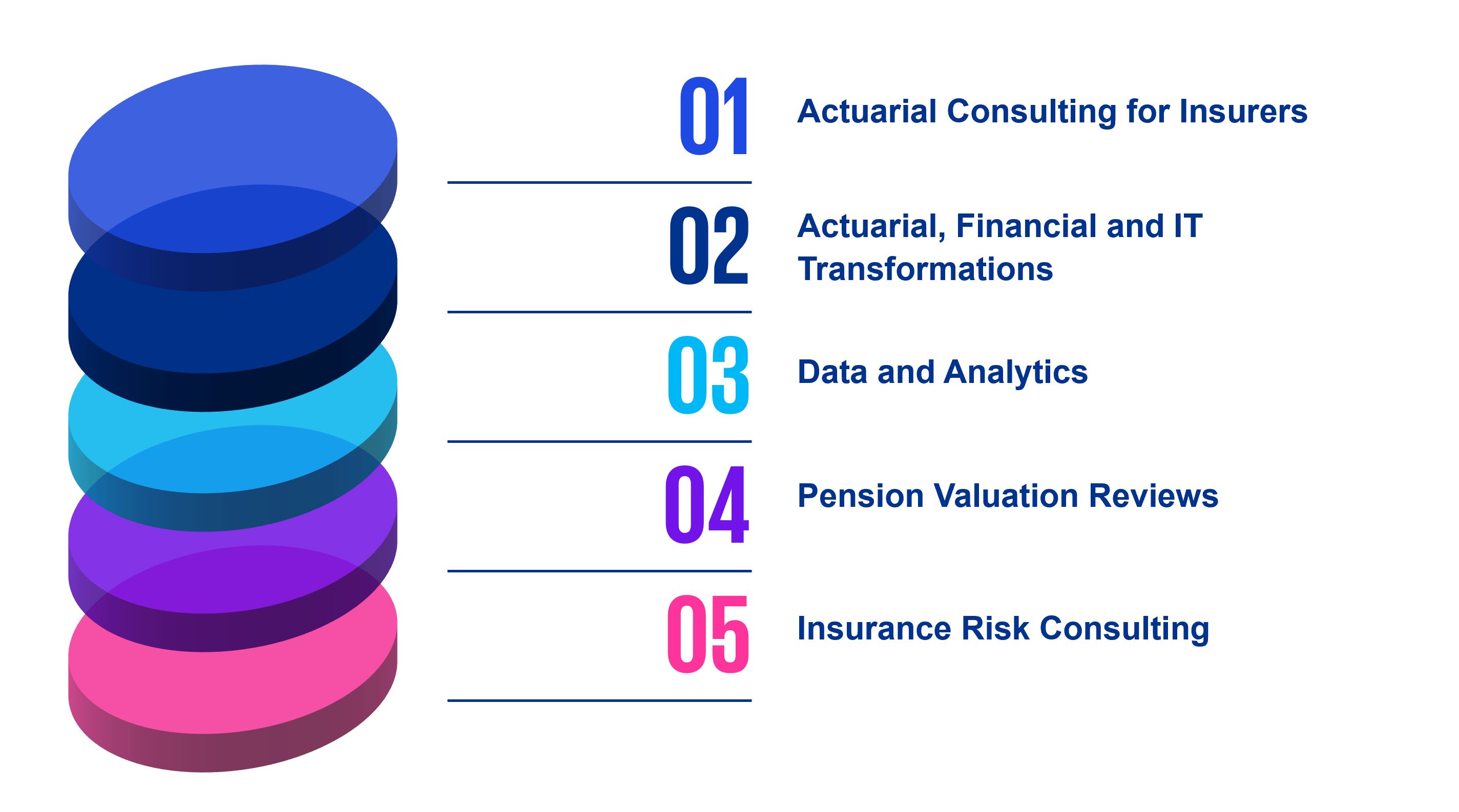

A glance at our services

Addressing the needs of the modern insurer that is challenged from the technological and regulatory advances we have tailor made specific services.

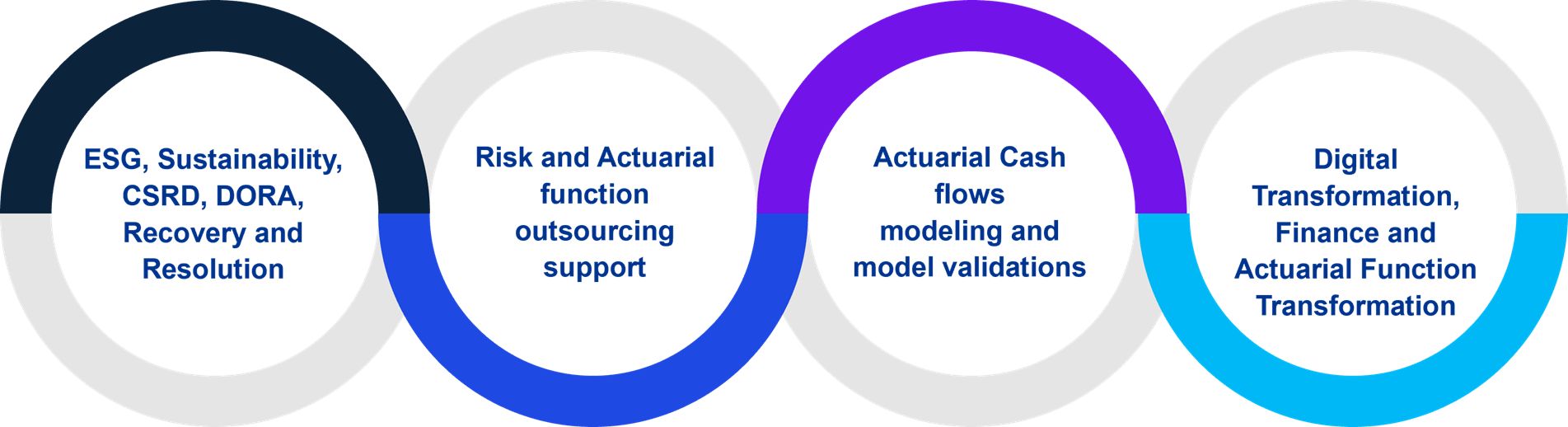

In a bit more detail we can support you on:

- Actuarial Reserves Valuation to optimize reserves, ensuring financial resilience and regulatory compliance.

- Outsourcing of Functions – Actuarial and / or Risk Management Function

- Complete end to end transformations within your organization Financial and IT landscape to accommodate mandatory changes (IFRS17, DORA, ESGs) as well as internal Governance requirements

- Automation and Digitalization of processes to achieve operational efficiency, cost optimization, timelessness, credibility of output and auditability of the process

- Actuarial software support on cashflow modeling on both off the shelf actuarial software as well as custom made model to support specific modelling Company needs

- Insurance and Actuarial Data Analytics and Data Science including Machine Learning and Data Analytics

- Pricing, Repricing and Price optimization to set competitive yet sustainable prices for insurance products

- ALM and Capital Modeling utilizing expert modeling to align assets and liabilities, optimizing capital allocation and reinforcing financial performance

- Strategy design and implementations, profitability studies, Underwriting performance, Reinsurance structure optimization, Business planning and budgeting