The unprecedented COVID-19 crisis has brought about many challenges for the financial sector, and regulators and supervisors continue in their efforts to ensure banks can focus on core operations and effective crisis management and preparedness. A key element hereto are recovery plans, which aim at restoring banks’ financial and economic viability under stress. Following the ECB’s announcement on 12 March of temporary capital and operational relief in response to the pandemic, the EBA published a series of expectations on 22 April, which clearly indicate to banks that alongside monitoring all their recovery indicators, they must enhance their focus on understanding which recovery options are necessary and available under the current stressed conditions. The message is clear: information on recovery planning can quickly become outdated and time is of the essence for prompt reporting to competent authorities. It is also the banks’ intrinsic interest in having up-to-date KPIs and KRIs for effective bank management.

Regulators and supervisors have recently published expectations for recovery planning. This includes monitoring and reporting obligations in times of stress. In this article we discuss what this means for banks and how best to respond.

1. Regulatory and supervisory expectations

Regulators and supervisors have been quick to outline for banks their views on recovery planning over the last weeks, the main points being:

- Banks are reminded to continue monitoring their full set of recovery indicators, increasing this frequency as required (e.g. on a weekly basis) and report on a timely basis any breach of indicator thresholds to their competent authorities, even if it does not result in the implementation of recovery actions. To this end, the ECB reinforced its expectation that JSTs should be informed regarding any breach within 24 hours and any subsequent decisions taken in response, including implemented recovery options.

- Banks should regularly review and update their list of credible and feasible recovery options that are in their recovery plans, taking into account the current COVID-19 system-wide stress. Furthermore, any preparatory measures deemed feasible and necessary to ensure the ability to quickly implement the recovery options should be taken. The ECB has further stated that it maintains its right to require banks to provide an updated list and details of the available recovery options.

- Banks are further required to estimate their overall recovery capacity for liquidity and capital (e.g. on a quarterly basis), as well as how the COVID-19 stress may evolve for them in particular. The ECB has further specified that JSTs should be informed in case an institution’s overall recovery capacity (ORC) decreases by more than 25% compared to their last recovery plan submission (particularly for the highly feasible and swiftly implementable options).

These immediate and ongoing expectations are further complemented by the ECB and EBA indicating requirements for the usual recovery plan update for 2020, taking into account the current crisis. These include the following:

- Banks will have the possibility to submit only the key elements needed to withstand a crisis to their competent authorities, while other parts (such as business as usual governance, description of the institutions/entities, communication plan) may be submitted during the following assessment cycle (2021) unless there are material changes (compared to the last submission) or unless the last assessment cycle has shown key deficiencies for these areas. Doing so will not lead to a ‘material deficiency assessment’ by the ECB. Furthermore, the number of scenarios can be reduced to one COVID-19 pandemic system-wide scenario, which is currently the most relevant for banks.

- The ECB still expects the standardised reporting template to be updated and submitted to the ECB in addition to the recovery plan itself.

- While the EBA states that dry-run exercises may be postponed to 2021 and institutions’ reports should instead focus on real-life experiences, some banks have been requested by the ECB to perform their dry-runs as planned.

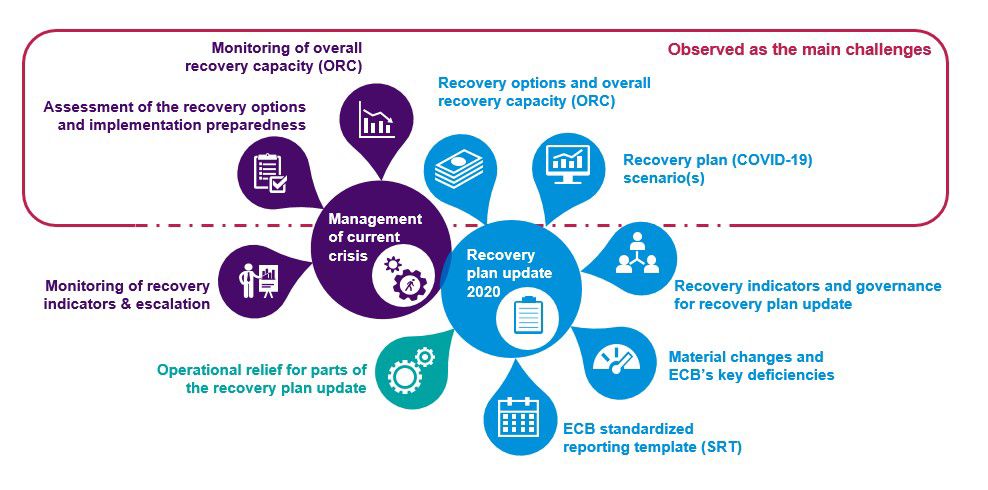

The main challenges for banks: recovery options and recovery plan scenarios

Given all the above statements, we have observed the following main challenges for banks in the figure below.

Figure 1 – Key challenges for operational relief and additional ad-hoc requests on recovery planning

Source: KPMG International

From our recent discussions with banks, it seems that the requirements concerning recovery options and recovery plan scenarios are the two main areas which will be challenging for banks in the short to mid-term. This may partly be due to the fact that some key stakeholders will be faced with a multitude of tasks, given the pandemic, that require their immediate focus, as well as the complexity of the changes in many banks’ recovery planning that these requests will trigger. Prioritisation will continue to be a major challenge for banks.

While we have seen that some banks have made their first steps towards (or even achieved) a fully flexible recovery planning framework capable of responding to any ad-hoc requests at any time, for most banks the current crisis and related regulatory expectations on the topic of recovery planning will continue to present a larger challenge.

2. Recovery options:

Banks have been asked to focus on the availability, credibility and feasibility of recovery options in the current crisis and update their own assessment on a quarterly basis. Institutions should estimate their overall recovery capacities for liquidity and capital and identify primary recovery options that can be quickly implemented.

However, the current crisis is likely to have significant impact on the breadth and depth of recovery options. Several banks have had their ability and capacity to implement a number of loan book actions curtailed as central banks and governments have urged them to continue to lend and provide appropriate credit facilities to their customers. In addition, securitisations and other market-based actions have also been impacted creating further difficulty for banks to generate capital and/or liquidity.

It is clear that banks can take a series of actions now, in order to put them in the best position to meet these requirements:

- Assess any new or updated recovery options that have been established by central banks and/or governments. Central banks and governments have provided additional support and options to banks via new or amended facilities and guarantees.

- Obtain up-to-date data or an approximation for the assessment of the recovery options’ valuation and the assumptions taken for the impact assessment under COVID-19 stress and ensure regular updating of the recovery options as the crisis continues to unfold.

- Assess central bank or government directives which may curtail the impact of the recovery options.

- Analyse the potential operational impediments due to the pandemic and identify measures to overcome these impediments.

- Focus on a generally valid update of the recovery options and build sustainable updating capabilities for the recovery options beyond a one-time crisis-specific update.

3. Recovery plan scenario(s):

In addition to the above, banks have also been asked to establish a specific COVID-19 system-wide scenario which could be capital, liquidity or combined (whichever is most relevant for the institution) which complies with regulatory requirements, especially in terms of severity, i.e. reaching the institution’s near-default point.

It should be noted that where several scenarios are deemed relevant, banks are encouraged to use more than one scenario, and on this note banks could take the following actions:

- Base the scenario(s) on the current pandemic, but at the same time comply with the ‘near-default’ requirement.

- Consider an appropriate mix of macro-economic risk, bank-specific risk caused by the systemic crisis and operational risk.

- Define an adequate starting point for the scenario(s) as well as the way and timeline in which the scenario is deployed including reliable forecasts.

- Assess different types of macro-economic scenarios (e.g. V-shape versus U-shape recovery) to determine the most relevant type for the recovery plan scenario(s).

- Produce a best estimate for the valuation of recovery options in the scenario(s).

- Determine whether any of the recovery options are no longer available or viable.

- Data availability and quality may not be given, and workarounds may be needed.

- Determine the bank’s overall recovery capacity through assessing all the bank’s available options under the stress and its ability to remain solvent and liquid throughout the crisis.

4. Summary

Since the financial crisis of 2007-08, there has been momentum for banks to amend and enhance their crisis management frameworks via the introduction of playbooks and dry-runs as appropriate tools. The COVID-19 pandemic now allows banks to turn these documents and tools into living and usable frameworks, according to lessons learnt. As mentioned in our recent blog, banks have an opportunity to take key first steps to setting a secure foundation for post-crisis transformation, and any enhancement to their recovery planning processes now should mean a stronger-than ever flexible approach to meet the needs of internal and external stakeholders in any future crisis scenarios.

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia