CEO Outlook 2017: Leading in 21st Century ASEAN

CEO Outlook 2017: Leading in 21st Century ASEAN

According to KPMG’s 2017 global study of CEOs, 3 out of 4 Singapore CEOs are confident about growth amidst an uncertain global economy. Most CEOs in Singapore and ASEAN are viewing disruption as an opportunity rather than a threat to their business.

Singapore companies set to disrupt and grow

The 2017 CEO Outlook: An ASEAN perspective is based on in-depth interviews with nearly 1,300 CEOs, leading some of the world’s largest companies. These CEO interviews provide unique insights into their strategic issues, their expectations for business growth and the challenges they expect to face over the next 3 years.

"Comparing our results across ASEAN with the rest of the world, we see a greater confidence among ASEAN business leaders that should translate into an economically positive year for the region. For CEOs in ASEAN and SG, greater digital investments will offer more opportunities to find competitive advantage in an uncertain global geopolitical environment. It’s clear from the CEO Outlook this year, that speed to market and innovation are high strategic priorities for companies in Southeast Asia. Both are the outcomes of a clearly-articulated digitisation strategy whose benefits go beyond cost savings to greater efficiency in supporting faster decision-making and strengthening customer relationships. It may be impossible to fully prepare for unknown cyber threats, but strengthening cyber security will remain an ongoing journey for CEOs wanting to protect their brand reputation. Ultimately, building public trust remains consistent with pursuing business objectives and being good corporate citizens for CEOs in this region. Companies which focus on developing a values-based culture, such as treating both internal and external stakeholders fairly, are also more likely to earn the trust of their customers." Ong Pang Thye |

The 2017 CEO outlook finds that globally, 65 percent of CEOs see disruptive forces as an opportunity rather than a threat to their business. Among Singapore and ASEAN CEOs, this figure was even higher at 96 and 98 percent respectively.

CEOs are broadly confident about global economic prospects. However, this optimism has dipped from 80 percent last year to 65 percent this year, internationally. While this optimism was similarly shared among ASEAN CEOs (65 percent), Singapore CEOs were slightly more confident (73 percent).

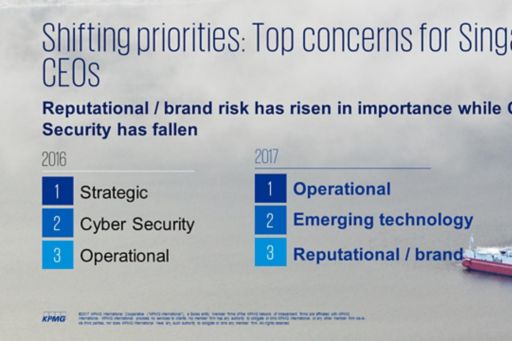

A striking change this year is the rise in the number of CEOs who cite reputational and brand risk as one of the a top 5 concerns. Not featuring in the top 10 concerns in 2016, it is now the 3rd most important risk (out of 16 in total) this year.

Cyber security, which ranked as a top risk in 2016, has this year fallen to 5th position. This may reflect CEO views of progress made in cyber risk management. Half of Singapore CEOs say that they feel adequately prepared for a cyber event – up from 25 percent last year.

Singapore CEOs are looking at disruption from the inside out - not just in terms of transforming their organization but also in terms of disrupting their own positions. A large proportion of leaders are focusing on their own skills and the roles they perform. For many, disruption is as much a personal challenge as an organizational one.

For example, Singapore CEOs are also considering different ways of working. The majority say they are more open to new influences and collaborations than at any previous point in their career. And most are evolving their skills and personal qualities to better lead the business. More than 8 in 10 have taken training or a new qualification in the last 12 months.

Key findings

- CEOs are viewing disruption as an opportunity rather than a threat, increasingly thinking of technological disruption as the key trigger to transform their business model, develop new products and services, and reshape their business.

- However, they are less certain about how to make this happen most effectively.

- CEOs are acutely aware of the new strategic/operational challenges they may face in the years ahead, following the political events of last year. This, in turn, has both tempered their growth expectations and reinforced their belief in the need to disrupt themselves in order to grow.

- For many leaders, disruption is as much a personal challenge as an organisational one. In Singapore, a higher percentage of CEOs is more open to acknowledging new personal challenges and working towards disrupting their own roles than among Global or ASEAN CEOs.

- More CEOs say they feel better prepared for a cyber attack than they did last year. They also see cyber as an opportunity rather than a threat – a confident approach that was challenged by the recent ransomware crisis.

- Building public trust has become a high strategic priority for CEOs. The concern over risk to reputation and brand underscores an important theme that emerged from our CEO responses. The importance on building – or regaining – customer trust in an era of disruption.

Risks and Priorities

- Singapore CEOs rank their top 5 concerns in 2017 as operational, emerging technology, reputation / brand, strategic and cyber security.

- Strategic priorities for SG CEOs in 2017 are greater speed-to-market, limiting brand risk, and responding effectively to regulatory changes.

- Technology priorities - Singapore and ASEAN CEOs are significantly more concerned than their international counterparts about keeping pace with the rate of technological advancement in their industries. They share the same number 1 challenge: transforming into a digital organisation.

- Investment priorities – Businesses are increasing investment in recruiting key specialists – for example, geopolitics or cognitive technologies – to disrupt and prepare for the future. Getting closer to the customer remains a preoccupation for most CEOs. Four categories garnered most attention from ASEAN and Singapore CEOs:

- Improving bottom-line growth

- Improving customer engagement

- Strengthening organizational resilience

- Increasing productivity

More CEO Outlook

- View the Global Report (PDF 2.57MB)