The businesses started by Chinese Australian entrepreneurs span many different industries, with a large proportion in the services industry. These businesses regularly engage in cross-border activities, with operations simultaneously in China and Australia. In contrast to what we see with many Australian-born founders with Australian companies, they don’t expect to hand down the business to other family members, or even employ family members. Many of the companies they have started fall into the high growth sector, but still face many of the same growing pains that all SMEs do.

Key findings:

|

Bridge between Australia and China

Over half of Chinese Australian businesses engage in regular cross-border business activities with China and are operating simultaneously in both countries. Of the responding companies, 45 percent have offices in China and 11 percent in other countries in Europe and North America.

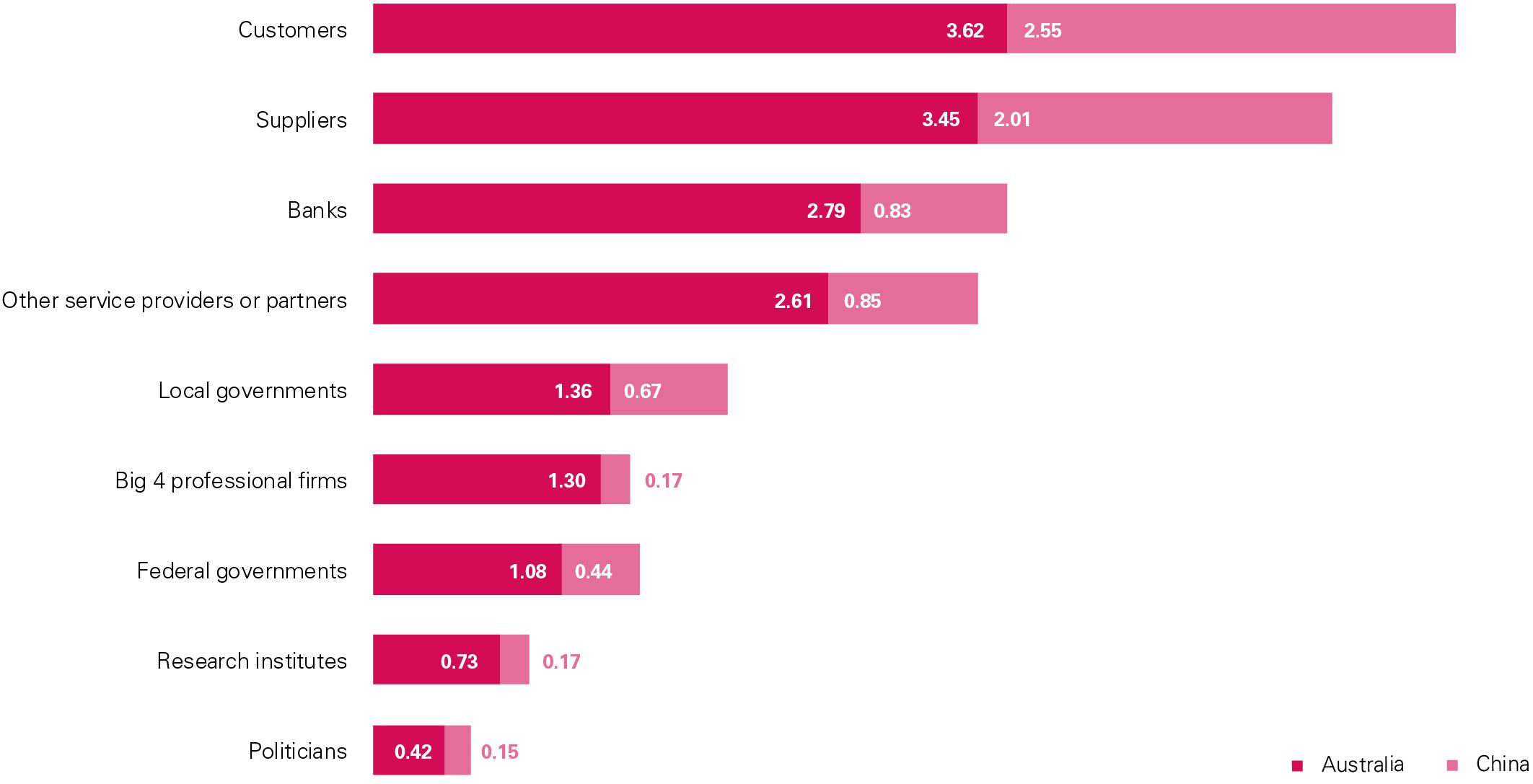

Our Chinese Australian entrepreneurs reported that they interact with, and use resources from, both Australia and China but are more active in Australia. They consider regular cross-border cooperation with commercial partners and an economic presence in both Australia and China as their competitive advantage. On average, these businesses communicate with their Australian customers and suppliers a few times per month, in comparison to a few times per year with their Chinese customers and suppliers (Figure 1).

Figure 1. Frequency of communications with stakeholders in Australia and China, N=100

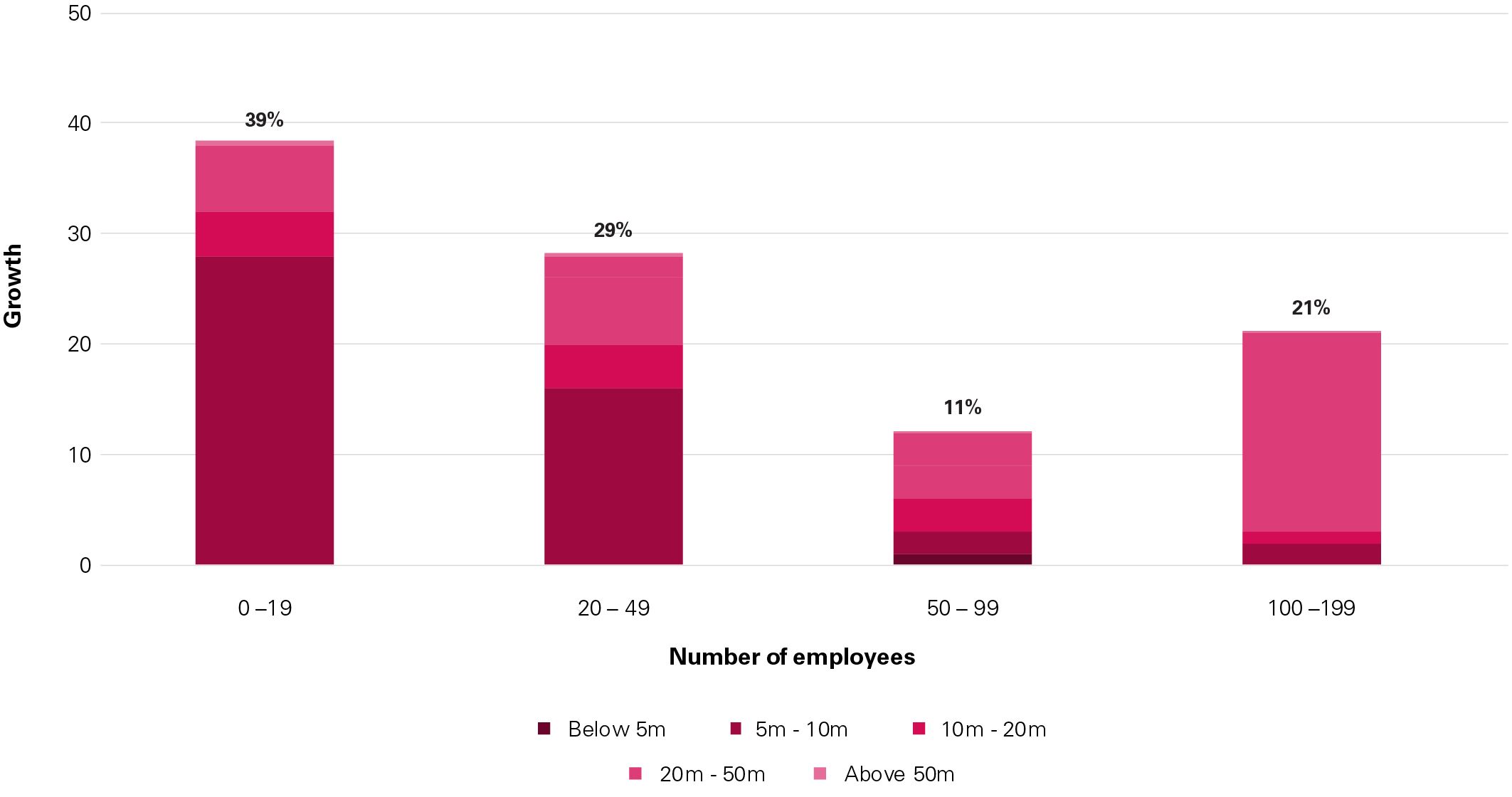

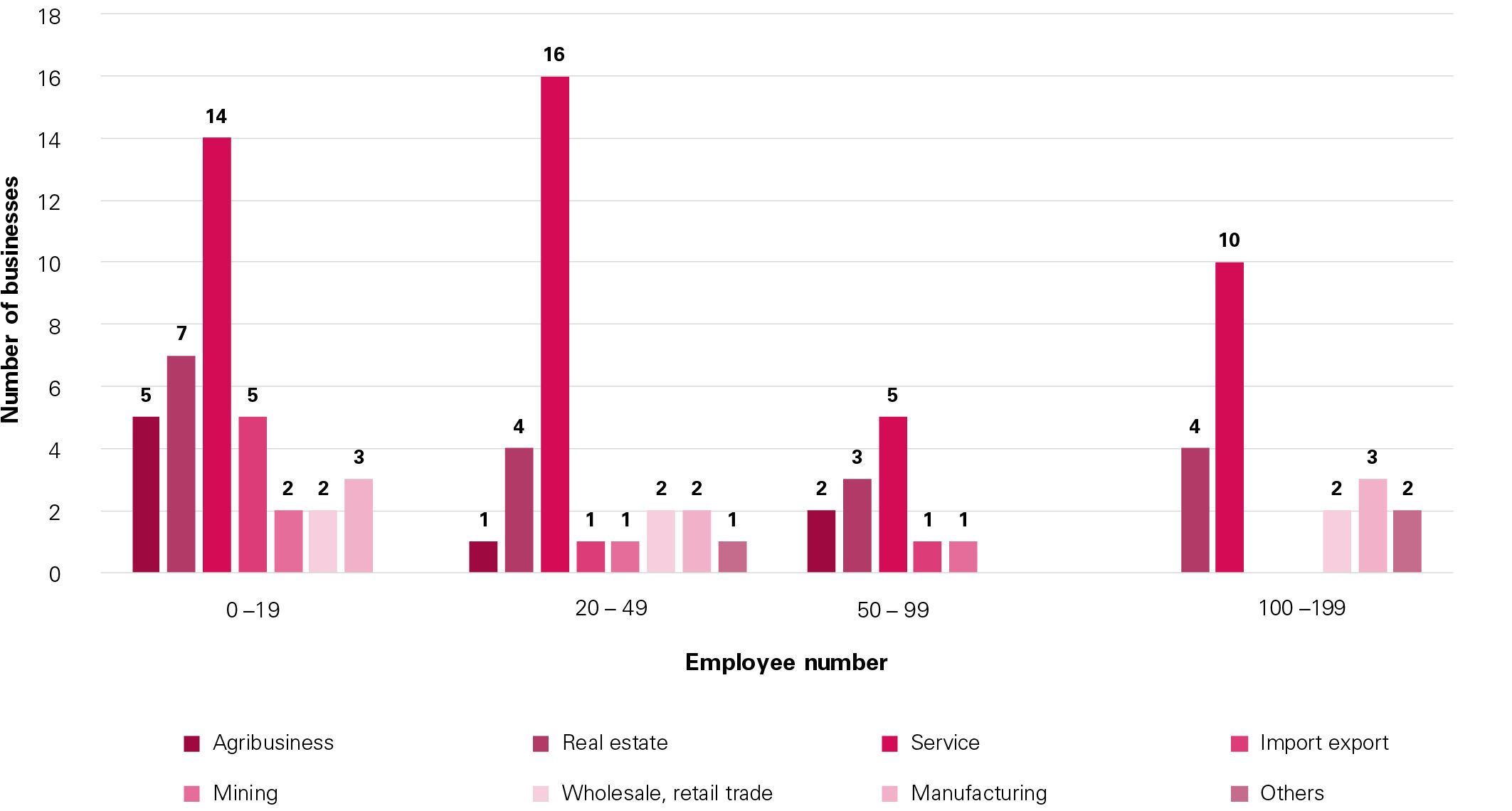

Business size

Among the businesses we interviewed, 61 percent are medium-sized, employing between 20 and 199 staff and 21 percent employ between 100 and 199 staff (Figure 2). Half of the businesses (51 per cent) reported turnover above AU$10 million and 19 percent had a turnover above AU$50 million, 19 percent between AU$20-50 million and 13 percent between AU$10-20 million (Figure 2).

Figure 2. Australian Chinese owned businesses – by revenue and employee numbers, N=100

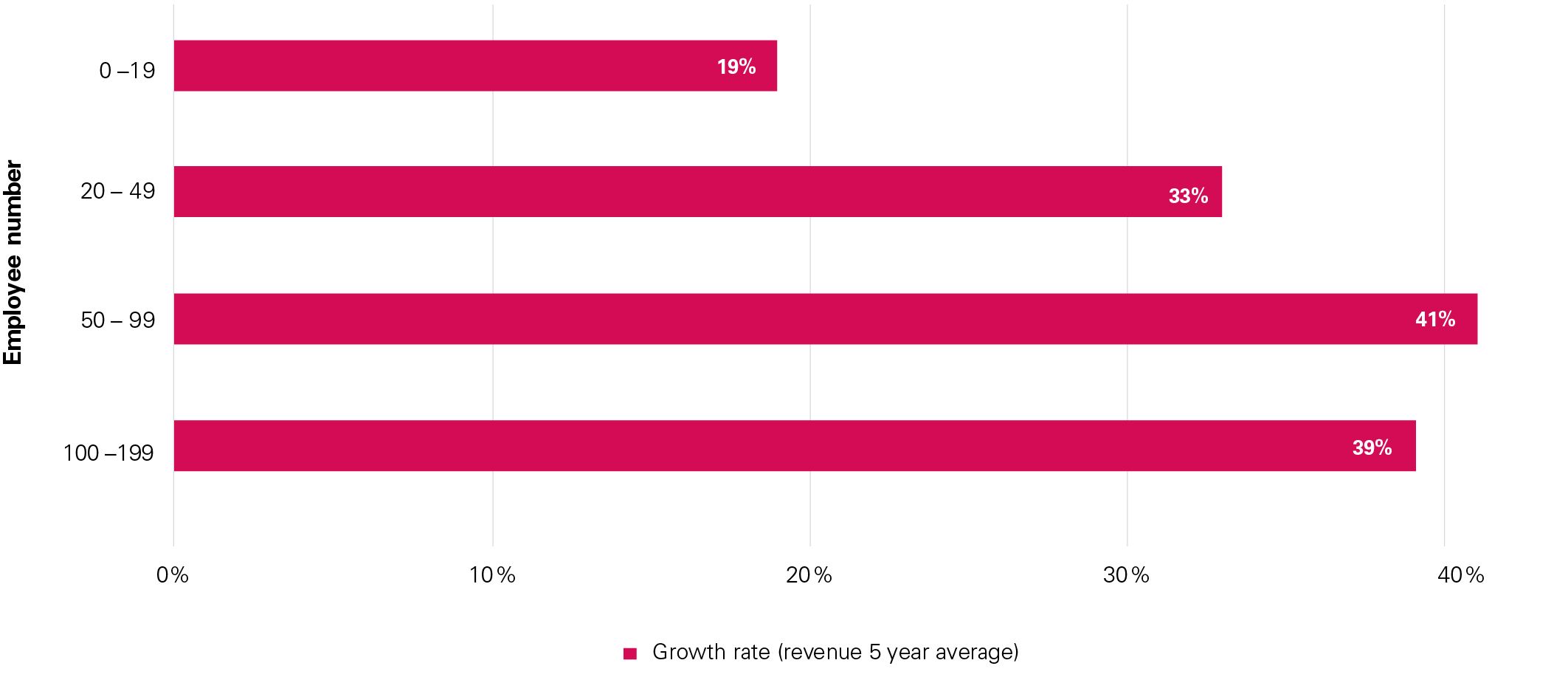

Firms with between 50 and 100 employees recorded the highest growth rate (41 per cent), and firms with less than 20 employees recorded the lowest rate (19 percent) among all participants (Figure 3).

From our research, we found that high revenue growth resulted from these businesses (I) being able to clearly identify the needs and wants of their customers (whether in Australia or in China), and (II) developing a business strategy that enables them to effectively address these needs and wants by providing high-quality goods and services at competitive prices.

Figure 3. Revenue growth by number of employees, N=100

More than a family business

In contrast to the Chinese diaspora tradition, our group of Chinese Australian entrepreneurs do not see themselves as running family enterprises, and few of them are considering long-term plans for their businesses beyond retirement. Two thirds (68 percent) of the entrepreneurs reported that no family members work in their business. One quarter stated that one or two family members work in their companies, mainly their spouses or siblings.

Only 14 entrepreneurs out of 100 said they would hope to have their children take over the business in the future. Six of those 14 entrepreneurs still anticipated hiring a CEO to run the organisation alongside their children after their retirement. Many of the entrepreneurs felt their success was due to their strong work ethic, but also thought their business needed to be managed with more formal corporate governance in the future. They indicated that they thought their Australian-born children lacked the Chinese business culture awareness and networks, and that they don’t have the experience to manage a medium-sized business. Hiring a manager is an option they actively consider, hoping to find one with some level of appreciation for Chinese culture.

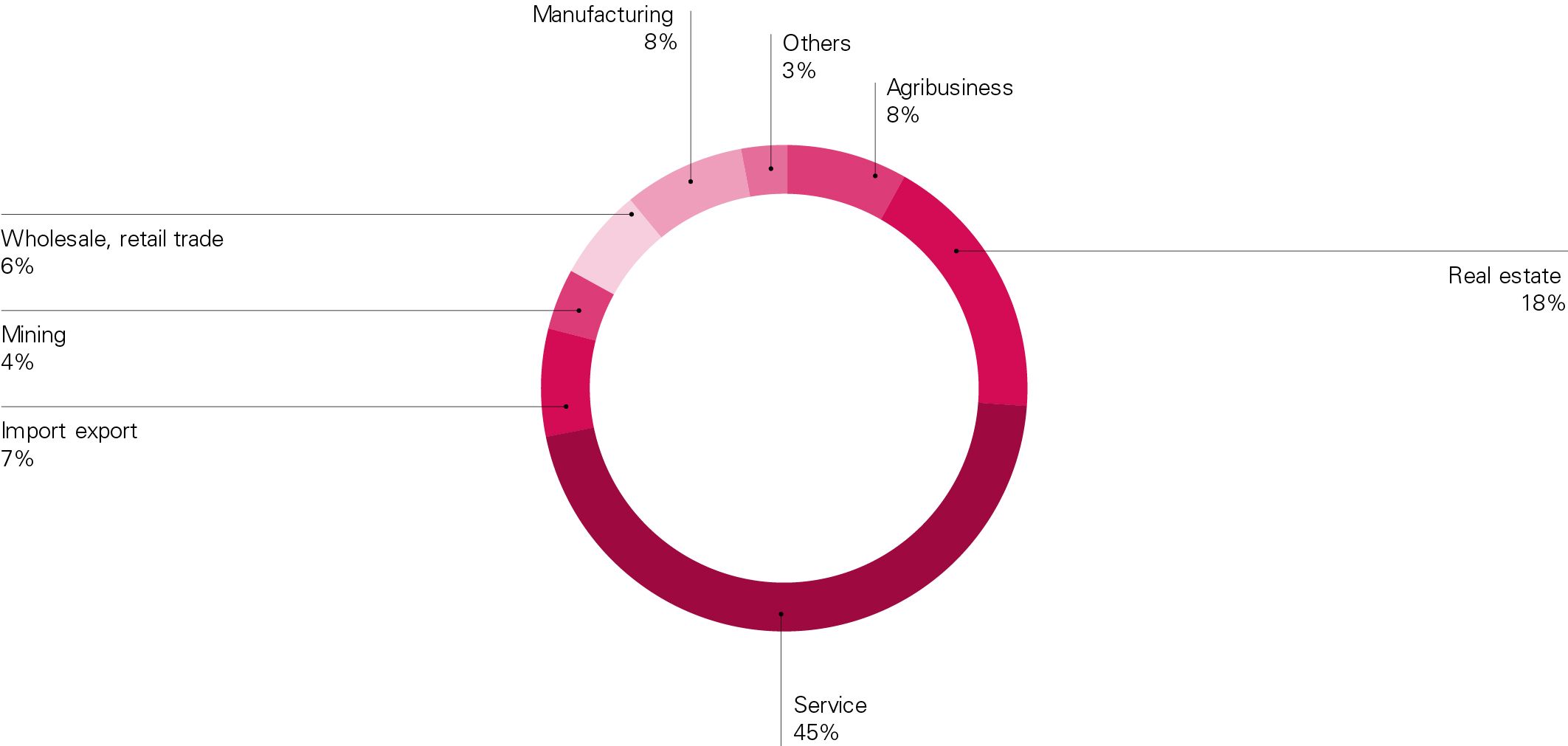

Diversity of industry

Of our Chinese Australian entrepreneurs, 45 percent are in the services industry with businesses in areas such as tourism, property agents, immigration agents and some new professional services like asset and wealth management, legal, accounting, high tech, healthcare and media (Figure 4).

Figure 4. Companies by industry sector, N=100

The remaining 55 percent are distributed across real estate, agribusiness, manufacturing, import and export, wholesale retail trade and mining industries (Figure 5). Five percent are in high-tech industries, such as game development, block chain applications and FinTech.

Figure 5. Business size by industry sector, N=100

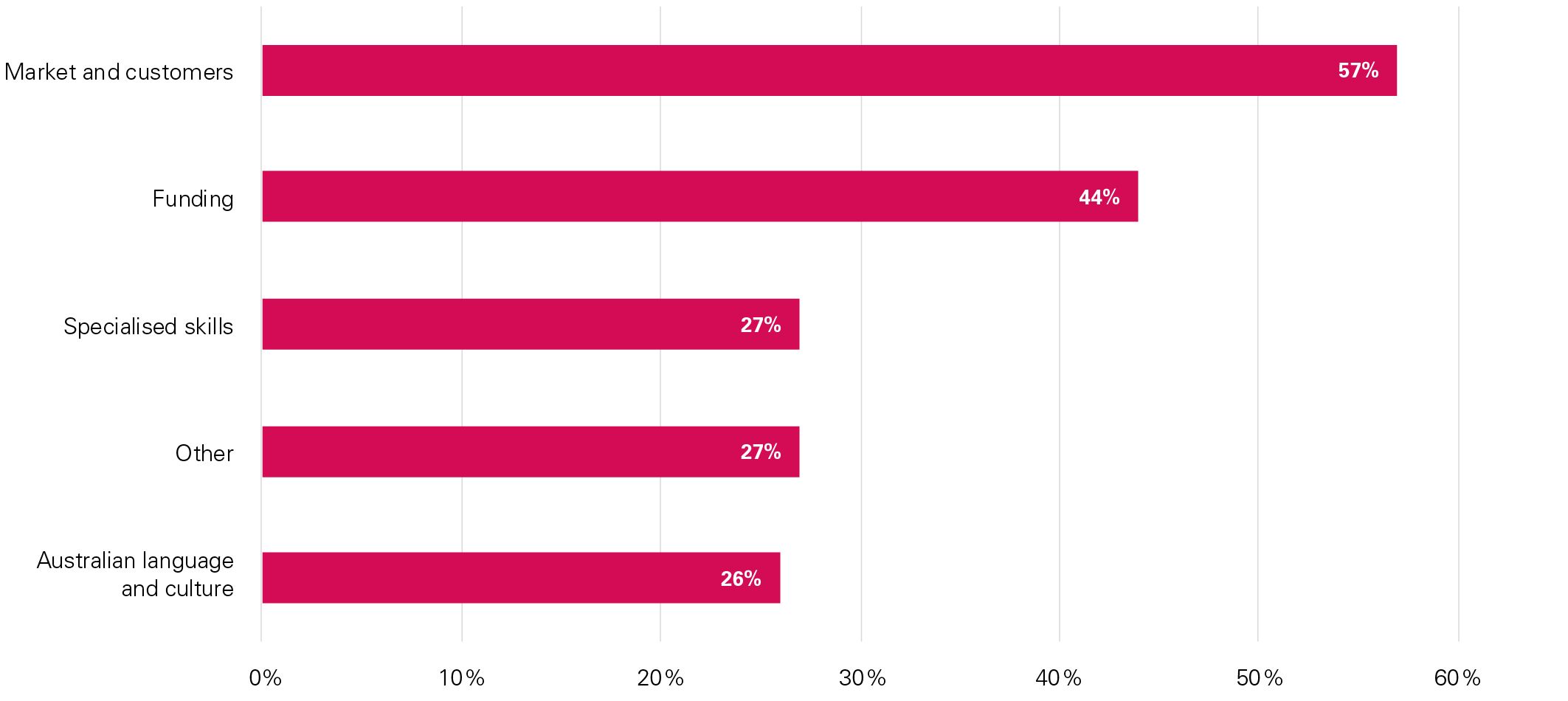

Start-up challenges

Like other migrant entrepreneurs, our group of Chinese Australian entrepreneurs faced numerous challenges when starting up in Australia (Figure 6). More than half (57 percent) noted identifying and capturing markets and customers as the biggest challenge when first starting their businesses, followed by access to funding (44 percent) and acquiring specialised skills (27 percent). In terms of starting capital, 28 percent of the entrepreneurs reported they started with less than AU$50,000, while 11 per cent reported they had more than AU$500,000 capital to draw on.

Figure 6. Main challenges when starting the business (multiple choice), N=100

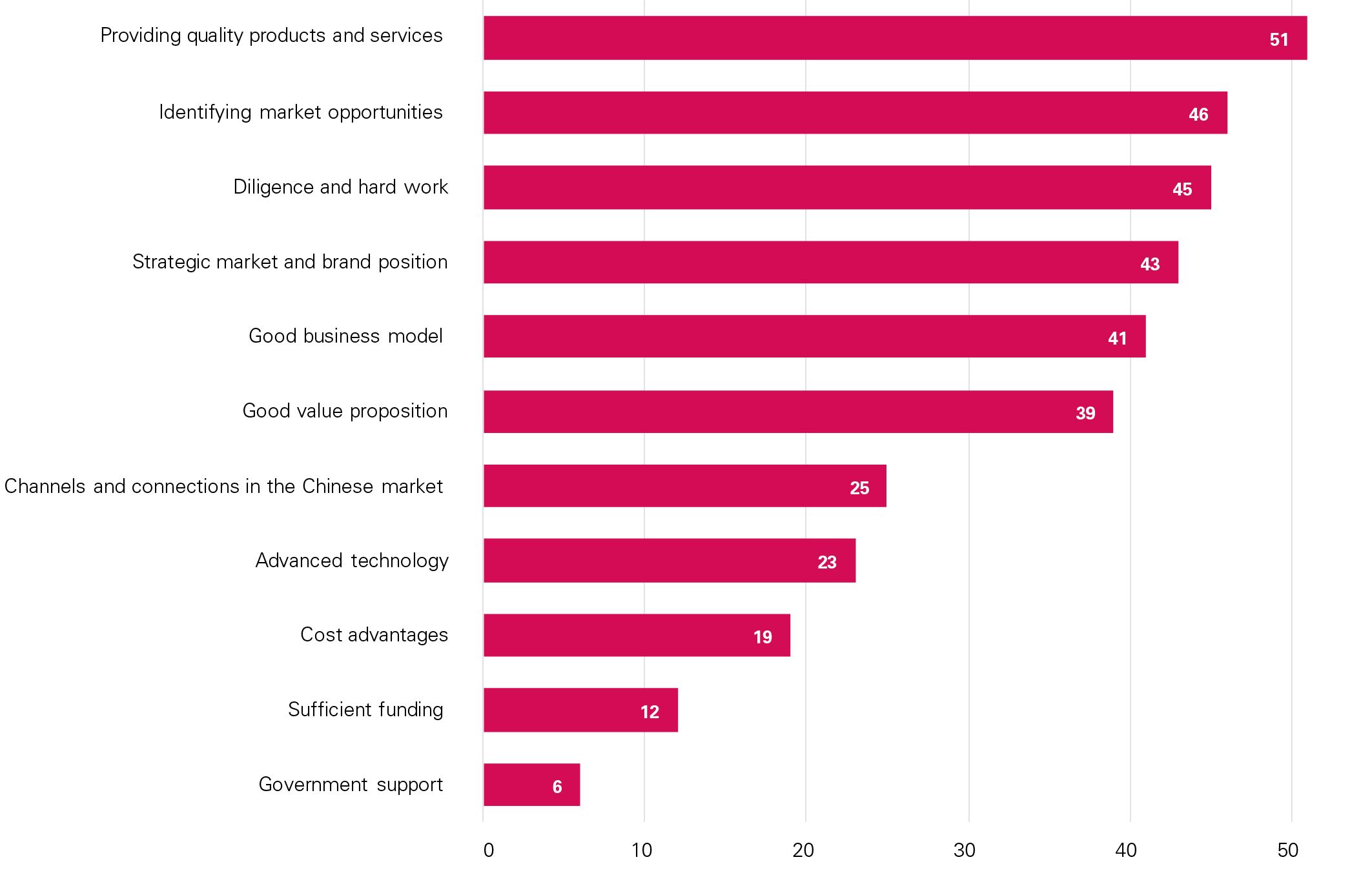

What makes a successful business?

Differentiation and quality are seen as more important than cost advantage for these businesses to be successful. Over half (51 percent) of the Chinese Australian entrepreneurs identified the ability to provide quality products and services as a key reason for their success, this is followed by identifying the market opportunities and diligence and hard work. Only 19 percent identify cost advantages as a reason for success (Figure 7).

Their business success is more about having the right strategy in place – market opportunities, strategic marketing and brand positioning, good business model, and good value proposition.

Figure 7. Success factors, N=100

Corporate social responsibility

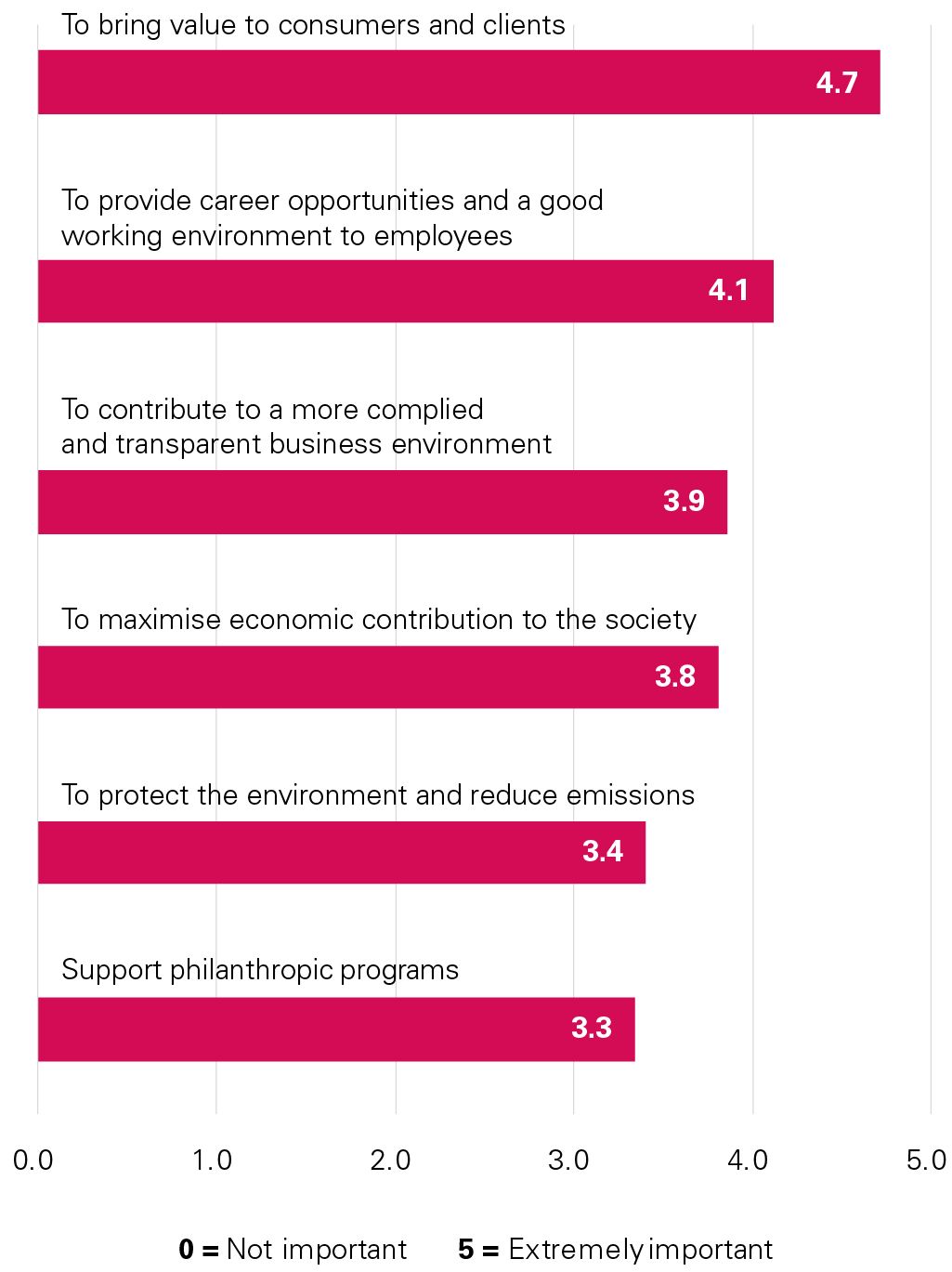

Chinese Australian entrepreneurs have a broad understanding of corporate social responsibility. They feel they have obligations towards their customers, employees, business stakeholders as well as the local environment and community support (Figure 8).

Figure 8. Company's social responsibilities, N=100

This is chapter one of our five chapter report in the new generation of Chinese Australian owned businesses in Australia.

Download the full report (PDF, 2.6MB)

(PDF, 2.6 MB)

(PDF, 3.2 MB)

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia