KPMG Risk Hub brings organisations a world leading GRC system, managed and maintained by KPMG - bringing people, culture and technology together as an innovative Risk as a Service.

Evolving complexity in regulation, market dynamics, competitive forces and rapidly advancing technology are just some of the challenges forcing organisations to consider how to best improve governance, risk and compliance (GRC).

The impact of increasing risk and regulatory burden to organisational resources is not sustainable, unless technology is leveraged to deliver a cost effective risk management solution.

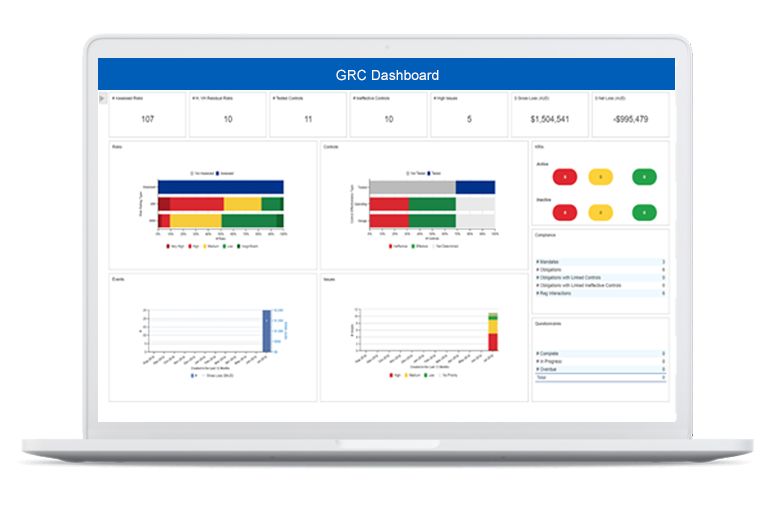

Risk Hub brings a holistic view of risks, integrating information and data across all levels of the business through an interactive, cloud based technology solution enabling real time risk management.

KPMG, in a global alliance with IBM, brings this complete managed risk service to the market at a price point equivalent to the cost of one risk professional.

With its integrated data and advanced analytics, Risk Hub helps leaders make insightful risk-based decisions to enhance business performance.

Aligned and integrated governance, risk and compliance processes across your whole business

Greater ownership

at the front line – helping your people make the right decisions

Greater risk oversight

by executives and the board resulting from an integrated and complete view of risk

Best practice

processes, templates, risk / control libraries and interactive dashboard reporting

Data quality

for improved reporting and decision making

Specialist support

partnering with you to achieve your business objectives

Cost effective

as all for the cost of one risk professional - no capital cost, but monthly fee

Innovative technology - IBM® OpenPages®

Advanced business intelligence

Integrated AI with IBM Watson

Market leading according to Gartner's Magic Quadrant Report

Get in touch

Interested in finding out more? We will call you to discuss Risk Hub.

FAQs

Implementation

How long would implementation take?

The timeline for implementation is approximately 8 to 12 weeks, depending on volume of data, number of users, and number of modules.

What is required from me during implementation? What support do we need to provide?

Support from your team would be required initially to identify the data, data sources, and mapping of your risk management processes to the solution, and then following with testing and signoff.

What will I need to do for ongoing system maintenance?

Risk Hub once implemented means you only need to use the solution to help you manage risk, with no need to spend time and effort on management of the solution. It is fully inclusive of the following

Benefits

What are the benefits of Risk Hub as a managed service?

Risk Hub brings a holistic view of risks, integrating information and data across all levels of the business through an interactive, cloud based technology solution enabling real time risk management. With its integrated data and advanced analytics, Risk Hub helps leaders make insightful risk-based decisions to enhance business performance.

Is it cost effective?

There is no Capital Expenditure (CAPEX) required for your organisation. This allows you the benefits of a fully capable GRC tool without the need to develop infrastructure, perform maintenance, or hire and maintain additional staff.

Is it easy to use?

Risk Hub is simple to use and navigate for the end user by way of a highly simplified task-focused user interface.

Licencing & Pricing

How much does it cost?

We would really like to provide a cost estimate upfront however the cost is dependent on the size of your organisation and the number of users. Risk Hub is structured in a way that offers a flexible modular pricing system. We believe it offers the best value as a managed service to fit your risk needs.

How does the access and pricing work across a global solution for a managed service? For example, can Full Access users see data from both the Australian and Singapore locations?

Yes, a client has access to all their data. It is for the client to decide who can see which data and access will be applied at the relevant location in the organisational structure accordingly.

Technical

Where is the data stored and processed?

The technical solution and the managed service is operated in Australia, and the data is stored wholly within Australia.

What technical measures are in place to protect data?

The system operates on secure infrastructure within KPMGs global cloud platform One Platform, hosted on Microsoft Azure. OpenPages application security determines what data a user can view, or read and update. All users of the technical solution must have an authorised user licence. The technical solution does not hold any personal data of users other than their user ID and password.