Summary

The Court of First Instance recently held in a case that the upfront one-off lump sum and annual royalties derived by a company in the Hong Kong SAR (Hong Kong) under a licensing and sub-licensing arrangement of trademarks are taxable as they are revenue in nature and with a Hong Kong source.

In this tax alert, we summarise the court’s analysis and discuss our observations on the case.

Background

The Court of First Instance (CFI) handed down its judgment in Patrick Cox Asia Limited v Commissioner of Inland Revenue1 on 19 October 2023.

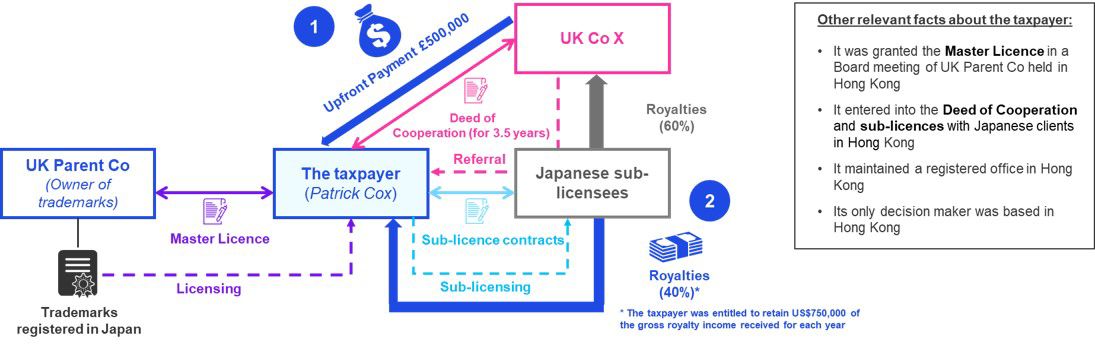

The diagram below gives an overview of the taxpayer’s business model and income streams involved.

In brief, the taxpayer is a Hong Kong incorporated company engaged in licensing and sub-licensing of trademarks. It licensed the trademarks from its parent and sub-licensed them to the Japanese companies introduced by another UK company (UK Co X). Under the Deed of Cooperation between the taxpayer and UK Co X, UK Co X made an upfront payment to the taxpayer for (1) obtaining the right to participate in the business of selling certain products under the trademarks in Japan and (2) sharing the profits (i.e. 60% of the royalties after the minimum amount retained by the taxpayer) derived from such business.

The issues in dispute

The key question in the case is whether the upfront payment and the 40% royalties derived by the taxpayer are taxable. In answering this question, the key issues in dispute are:

(1) whether the taxpayer carried on its business in Hong Kong;

(2) whether the upfront payment and the 40% royalties were sourced from Hong Kong; and

(3) whether the upfront payment was capital or revenue in nature.

The CFI’s judgment and analysis

Below is a summary of the CFI’s judgment and analyses on the above three issues:

Issue 1: Whether the taxpayer carried on its business in Hong Kong

- It is not open for the taxpayer to argue before the CFI that the Board of Review erred in failing to find that (1) the taxpayer conducted multiple separate businesses and (2) the specific business of sub-licensing the trademarks to Japanese companies was not conducted in Hong Kong since it did not put forward such argument before the board or obtain leave to appeal on this ground.

- Based on the board’s findings, the taxpayer only carried on one single business (i.e. business of licensing the trademarks, whether in Japan or other locations) and there was no dispute that some parts of its business operations (i.e. licensing operations regarding trademarks registered outside Japan) were conducted in Hong Kong.

- It followed that the taxpayer must have carried on the business of licensing of trademarks in Hong Kong.

- As an obiter dictum, the CFI judge also expressed the view that Newfair Holdings Limited v CIR2 did not lay down any principle that having a registered address in Hong Kong as a formality of corporate law is by itself insufficient to constitute the conduct of a trade or business in Hong Kong. In her view, the decision in the Newfair case was based on the specific facts of the case. As such, it is up to the board in this case to take into account the taxpayer’s directors’ report (which showed its principal place of business as the registered address in Hong Kong) as a piece of evidence to support its finding that the taxpayer carried on a business in Hong Kong.

Issue 2: What is the source of the upfront payment and 40% royalties?

- The profit-producing activities were (1) the acquisition of the master licence and (2) the entering of the deed of cooperation and sub-licensing contracts in Hong Kong.

- Regarding the upfront payment, what the taxpayer did to earn the sum was to enter into the Deed of Cooperation. As this was done in Hong Kong, the upfront payment was sourced in Hong Kong.

- Regarding the 40% royalties, it is important to note that:

- under the Deed of Cooperation, both the taxpayer and UK Co X had to perform their respective obligations to earn their share of royalties;

- the obligation to be performed by the taxpayer to earn the 40% royalties was to grant sub-licences to the Japanese companies introduced by UK Co X, whereas the obligations to be performed by UK Co X to earn its share of 60% of royalties was to identify and introduce sub-licensees to the taxpayer and arrange for negotiations, etc;

- the taxpayer’s accounts recorded 40% of the royalties as its income, rather than 100% less UK Co X’s share of the royalties as expenses;

- the fact that UK Co X was designated as the taxpayer’s agent in the deed of cooperation is irrelevant as UK Co X’s business activities in Japan did not produce the taxpayer’s profits;

- the fact that the trademarks were registered in Japan and only exploitable in Japan is also irrelevant as it is not the taxpayer’s profit-producing activities; and

- the board found that the taxpayer concluded the sub-licence contracts in Hong Kong and the taxpayer did not seek or obtain leave to challenge this finding.

Based on the above, the CFI held that the 40% royalties was sourced in Hong Kong.

Issue 3: Whether the upfront payment was capital in nature

- Whether an item is a capital expenditure in the hands of the payer is irrelevant to determining whether the item is a capital or revenue receipt in the hands of the payee.

- The taxpayer did not transfer (1) any of its economic and contractual rights regarding the trademarks or (2) 60% of the economic benefit it would otherwise have derived under the master licence to UK Co X in return for the upfront payment.

- The taxpayer did not give up any asset or transfer any risk for earning the upfront payment.

- The upfront payment was earned by exploiting the taxpayer’s right under the master licence and arose in the ordinary course of the taxpayer’s business (rather than before the commencement of its business).

Based on the above, the CFI held that the upfront payment was revenue in nature.

Accordingly, the CFI dismissed the taxpayer’s appeal and upheld the board’s decision that both the upfront payment and the 40% royalties are chargeable to Hong Kong profits tax.

KPMG Observations

The source rules for royalty income

Subject to any further appeal by the taxpayer to a higher court, this judgment adds to the existing case authorities in Hong Kong on the source of royalty income, namely the CIR v HK-TVB International Ltd and Lam Soon Trademark Ltd v CIR cases. Consistent with these two precedents and the Inland Revenue Department’s position in Departmental Interpretation and Practice Notes No. 22 on taxation of royalties, the CFI in this case held that the source of royalty income from licensing and sub-licensing of an intellectual property (IP) is the place(s) where the licensing and sub-licensing agreements are effected rather than the place of use of the IP. This is different from the international norm under tax treaties where the place of residence of the royalty payer (which generally is also the place of use of the IP) is regarded as the source state of the royalties.

Apportionment between onshore and offshore royalty income

In the present case, it appears that the taxpayer only pursued an offshore claim on the 40% royalties (but not the minimum royalty retained under the same sub-licensing arrangement). It is not clear from what was disclosed in the court judgement whether the minimum royalty was treated as onshore and taxable and if yes, the taxpayer’s basis of adopting differential tax treatments for the two amounts which were both derived under the same sub-licensing arrangement.

DIPN 22 is silent on whether there could be an apportionment of royalty income between onshore and offshore sourced. Also, there have not been any precedent cases specifically dealing with this issue so far. In cases where the activities for producing the royalty income are performed both in and outside Hong Kong, apportionment of the royalty income should be considered.

Capital vs revenue nature of income receipts

While there are relatively more precedent cases in Hong Kong dealing with the issue of whether an expense item is capital or revenue in nature, this case discussed the principles for determining the nature of an income item. In particular, the court pointed out that an item that is a revenue expenditure in the hands of the payer does not necessarily mean the same item is a revenue receipt from the payee’s perspective. In fact, the upfront payment in this case is more akin to a capital expenditure in the hands of UK Co X as it was a one-off payment giving rise to a right that generated a long-term benefit.

Impact of the FSIE regime on foreign-sourced IP-related income

Whatever the final outcome of this case, under the existing foreign-sourced income exemption (FSIE) in Hong Kong, a similar non-taxable claim on offshore royalty income received in Hong Kong by a Hong Kong entity within a multinational group will be available for royalties derived from a patent, or an IP similar to patent only, and subject to the fulfilment of the newly introduced nexus requirement. In addition, under the expanded FSIE regime (i.e. expanded to cover foreign-sourced gains from disposal of all types of assets), effective from 1 January 2024, an upfront payment received under a licensing or sub-licensing arrangement, even if being foreign-sourced and capital in nature, may nevertheless be taxable if it represents an income from sale of a covered asset (which is widely defined to include any movable property and immovable property, and effectively means all assets in the laws of Hong Kong).

1 The CFI judgment can be accessed via this link to the Judiciary website.

2 In the Newfair case, the CFI held that the taxpayer did not carry on any trade or business in Hong Kong although it had a registered office in Hong Kong. For more details of the case, please refer to our Hong Kong (SAR) Tax Alert – Issue 5, April 2022.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia