Article Posted date

10 May 2023

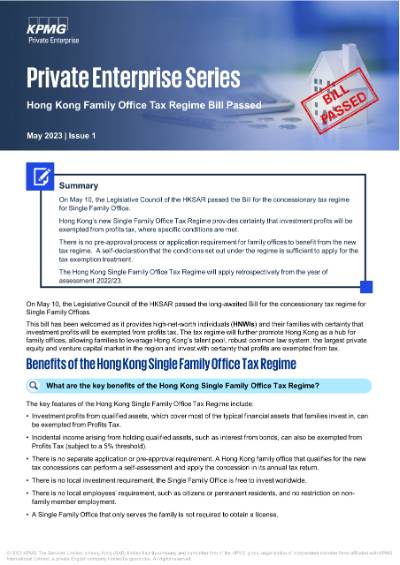

Summary

On May 10, the Legislative Council of the HKSAR passed the Bill for the concessionary tax regime for Single Family Office.

Hong Kong’s new Single Family Office Tax Regime provides certainty that investment profits will be exempted from profits tax, where specific conditions are met.

There is no pre-approval process or application requirement for family offices to benefit from the new tax regime. A self-declaration that the conditions set out under the regime is sufficient to apply for the tax exemption treatment.

The Hong Kong Single Family Office Tax Regime will apply retrospectively from the year of assessment 2022/23.