Summary

The District Court recently held in a case that a foreign limited liability company (LLC) and a UK limited liability partnership (LLP) were “associated” body corporates within the meaning of section 45 of the Stamp Duty Ordinance (SDO) although the latter did not have any “issued share capital” similar to that of a company limited by shares. Accordingly, the Court held that the intra-group transfer of the shares in a Hong Kong company from the UK LLP to the foreign LLC was entitled to the stamp duty relief under section 45 of the SDO.

In this news alert, we discuss the District Court’s judgment and analysis as well as some of our interesting observations from the case.

The facts of the case

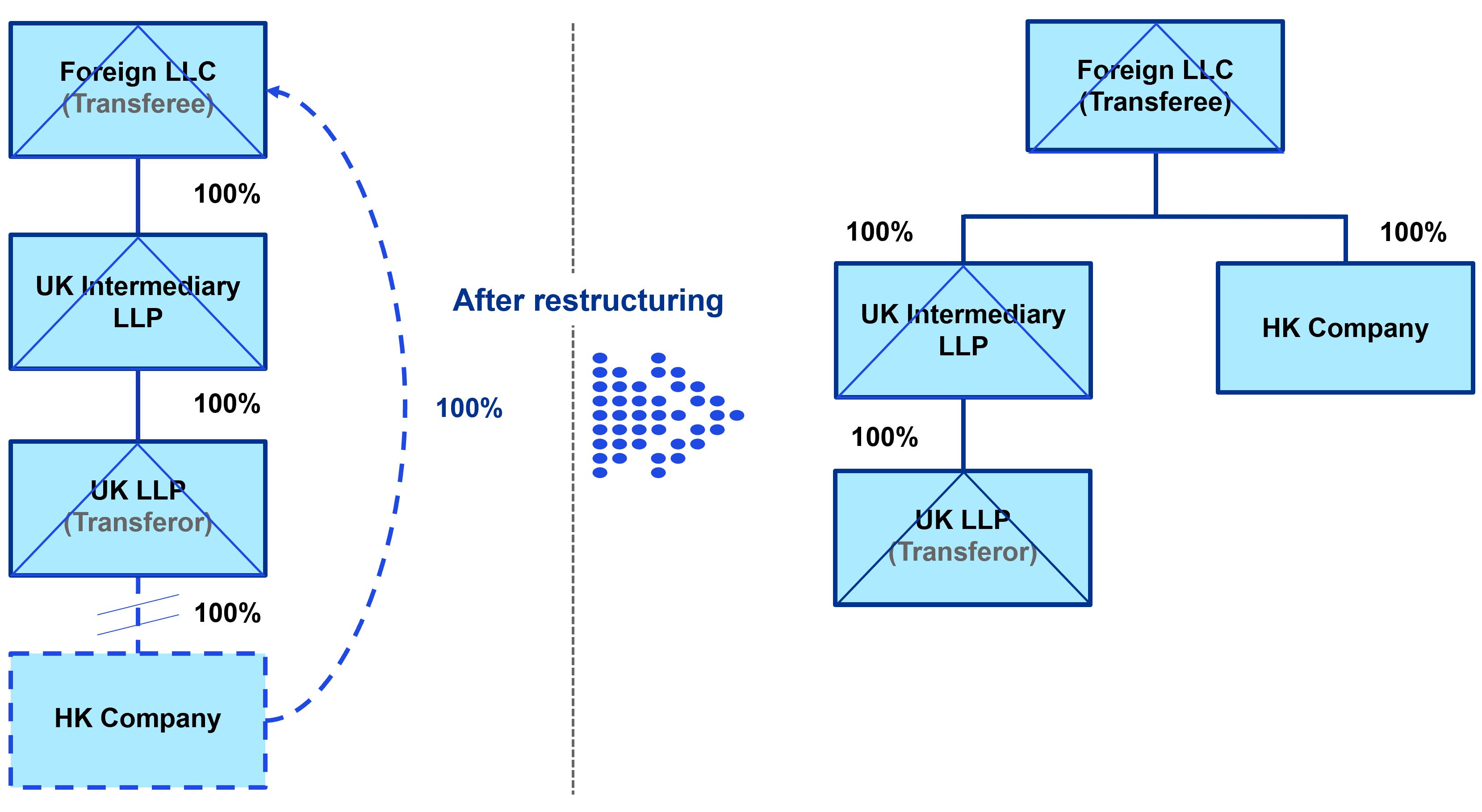

The District Court handed down its judgement in John Wiley & Sons UK2 LLP and Another v The Collector of Stamp Revenue1 on 15 July 2022. The case concerned an intra-group transfer of the shares of a Hong Kong company from a UK LLP to a foreign LLC as part of an internal group restructuring (see the diagram below).

Both UK Intermediary LLP and UK LLP were incorporated as an LLP in the UK under the Limited Liability Partnerships Act 2000 (LLP Act 2000). Both of them were a body corporate with legal personality separate from its members and had unlimited capacity. There is no requirement under the LLP Act 2000 that the capital of an LLP be organised into a denomination of a certain number of shares each of certain nominal value. Also, the LLP Act 2000 does not contain any provisions similar to those regulating the class, allotment, issuance and registration of shares under the Hong Kong Companies Ordinance. However, the subsidiary legislation of the LLP Act 2000 provides that all members of an LLP are entitled to share equally in the capital and profits of the LLP in the absence of any agreement between the members.

The basis on which UK Intermediary LLP and UK LLP were organised and the rights and obligations of their members were governed by the respective LLP agreements. In particular, the LLP agreements provided that (1) the initial members of the LLP shall contribute the specified capital to the LLP, (2) each of the initial members acquires a share in the LLP in accordance with the amount or value of its contribution to the LLP and (3) the members shall share any profits or losses of a capital nature in the same proportions as their capital contributions to the LLP.

The issue in dispute

The Appellants (i.e. Foreign LLC and UK LLP) applied for a stamp duty relief under section 45 of the SDO2 for the intra-group transfer on the basis that Foreign LLC (the transferee) and UK LLP (the transferor) were “associated” body corporates.

The Collector of Stamp Revenue (the Collector) rejected the application on the basis that (1) an LLP can be a parent of a group but cannot be a subsidiary of another body corporate as it does not have issued share capital and (2) the existence of “shares” is the key in deciding whether body corporates are “associated”.

The key issues in dispute are: (1) whether the term “issued share capital” as used in section 45 of the SDO has the same specific meaning as the term has in company law context and carries with it the same attributes and requirements (as to allotment, registration and reporting, etc.) as provided under the Hong Kong Companies Ordinance (the Collector’s Interpretation) and (2) whether the term forms part of the requirement of the “form of association” and not merely as part of the test of the closeness of the association between the body corporates concerned.

The District Court’s judgment and analysis

Below is a summary of the Court’s analysis and comments:

- the amendments made to the old Stamp Ordinance in 1981 (i.e. the concept of “body corporate” was introduced to replace “company with limited liability” as reflected in section 45 of the current SDO) indicated that the legislative intent was to open up the ambit of the section 45 relief to encompass all body corporates (including entities incorporated overseas under foreign law) regardless of whether they are incorporated as companies and whether they are limited liability entities;

- bearing the above in mind, there is no valid reason or purpose that the legislature would intend to selectively offer relief only to those associated body corporates with issued share capital but not the others, even though the closeness of association can be demonstrated by other means;

- the term “issued share capital” is not defined in the SDO and there were no previous Hong Kong or UK cases discussing the point at issue;

- the Court was not persuaded that the Collector’s Interpretation is the true and proper construction of the term - the term should be interpreted according to its natural and ordinary meaning in view of the legislative purpose of section 45 (i.e. the purposive approach of statutory interpretation);

- the legislative purpose of section 45 is to use the test of “closeness of association” to determine whether a transfer is between body corporates that are genuinely closely associated; and

- having regard to the context and purpose of section 45, the term “issued” should be construed to mean “having been legally given to in a legally completed transaction” and the term “share capital” simply means “the capital of a body corporate that is divided into quantifiable portions and all such portions together make up 100% of the total value of its capital that is legally recognized”.

Applying the above interpretation, the Court held that Intermediary UK LLP and UK LLP had “issued share capital” within the meaning of section 45 and that the transferor (i.e. UK LLP) and transferee (i.e. Foreign LLC) met the test of closeness of association as the transferor was ultimately wholly owned by the transferee. Accordingly, the two were “associated” body corporates and entitled to the section 45 relief.

KPMG observations

We set out below a number of interesting observations arising from this case:

- this is the first court case in Hong Kong dealing with the interpretation of “issued share capital” under section 45 of the SDO. Subject to any further appeal lodged by the Collector, the case set a legal precedent on the interpretation of the term for the section 45 relief purpose;

- the District Court’s judgment is a sensible outcome from a policy perspective and in the context of section 45 given the divergency in the forms of body corporate employed by business groups;

- business groups that seek to rely on section 45 of the SDO for a stamp duty relief on an intra-group transfer of Hong Kong company or immovable property involving an LLP, LLC or other forms of body corporate without issued share capital should closely monitor the development and final outcome of this case;

- the final outcome of this case will impact a number of ongoing disputes between business groups and the Stamp Office involving intra-group transfers where LLCs / LLPs are in the group structures. These disputes have arisen as a result of the Stamp Office changing its practice in relation to section 45 relief applications involving LLCs;

- regardless of the final outcome of the case, to provide certainty to businesses and strengthen Hong Kong’s position as an international business and investment holding hub, we suggest that the HKSAR Government amends the wording of “issued share capital” in section 45 of the SDO to make it clear that the association relationship under that section can be effected through any form of “ownership interests”; and

- the case also highlights that challenging the Hong Kong tax authority through the courts remains a viable option.

1 The judgement of the case can be accessed via this link: https://legalref.judiciary.hk/lrs/common/ju/ju_frame.jsp?DIS=145761&currpage=T

2 Section 45 of the SDO provides a stamp duty relief for transfer of Hong Kong stock or immovable property between associated body corporates if certain conditions are met. Under section 45, two body corporates are “associated” if one is the beneficial owner of at least 90% of the issued share capital of the other, or if a third party body corporate is the beneficial owner of at least 90% of the issued share capital of each of the two body corporates.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia