Summary

The Court of First Instance (CFI) handed down its judgement in Newfair Holdings Limited v Commissioner of Inland Revenue on 20 April 2022 – see this link for the judgement.

The CFI allowed the taxpayer’s appeal and overturned the Board of Review (BOR)’s decision in Case No. D14/20. It ruled that (1) the taxpayer did not carry on a business in Hong Kong and (2) its profits did not arise from commercial operations in Hong Kong. The profits are therefore offshore sourced and not chargeable to Hong Kong profits tax.

Background

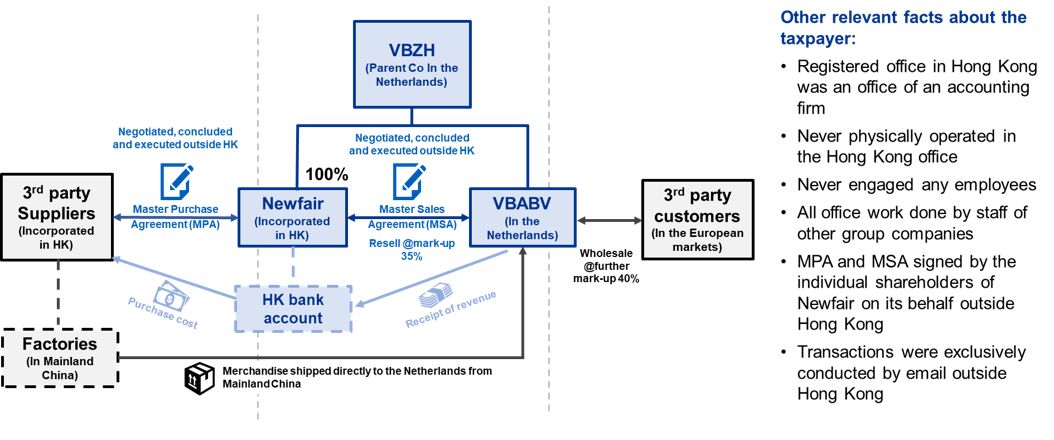

The taxpayer, Newfair Holdings Limited (Newfair), is a Hong Kong incorporated company within a group whose principal business was distribution of electronic products in the European markets sourced from manufacturers in the Far East. Newfair was interposed between a Dutch group company and the third-party suppliers for Dutch tax mitigation purposes. Please refer to the diagram below for the business model and transaction flow of the group.

The case dealt with the appeal lodged by the taxpayer against the BOR’s decision to the CFI. The CFI judgement contained both of the CFI’s decisions to (1) grant leave to appeal to the taxpayer and (2) allow the taxpayer’s appeal on the substantive issues involved in the case.

The two substantive issues in the case

Issue 1: Whether Newfair carried on a business in Hong Kong?

The BOR’s decision

The Board concluded that Newfair carried on a business in Hong Kong based on the following three “Pivotal Factors” identified by it:

- a Hong Kong bank account was used to receive revenue and pay the Suppliers (Pivotal Factor 1);

- the Suppliers were all Hong Kong incorporated companies managing the shipments from Hong Kong (Pivotal Factor 2); and

- an inference was drawn from the MSA that the contracting parties intended Hong Kong to be the principal place of business, where the acceptance of the orders was supposed to take place (Pivotal Factor 3).

The CFI’s judgement

The CFI held that Newfair did not carry on a business in Hong Kong based on the following analysis:

- “carrying on of business” usually calls for some activities on the part of the taxpayer in the pursuit of commercial gains;

- the operations that gave rise to Newfair’s profits were sales of goods and all merchandise contracts were concluded outside Hong Kong;

- the receipt of revenue and paying to suppliers (Pivotal Factor 1) are only incidental administrative acts and not the revenue generating activities – both activities could not show a business was carried on in Hong Kong;

- the location where the suppliers managed the shipments or carried on their businesses (Pivotal Factor 2) is irrelevant to where Newfair carried on its business; and

- Designating a principal place of business (Pivotal Factor 3) was not the same as identifying the place where the profits actually arose.

With regard to the Commissioner of Inland Revenue (CIR)’s argument that Newfair’s business model (i.e. interposition of Newfair between VBABV and the Suppliers) did amount to a profit-generating activity and the presence of Newfair together with the associated arrangements in Hong Kong were the effective cause of producing Newfair’s profits, the CFI held that these relate to Newfair’s role within the group but not its acts/operations that gave rise to profits. For imposing a profits tax liability, one should look at what an entity does as opposed to what the entity is.

Issue 2: Whether Newfair’s profits derived from the Hong Kong business arose in Hong Kong?

The BOR’s decision

The Board concluded Newfair’s profits were derived from Hong Kong as:

- Newfair actively operated its Hong Kong bank account to pay the Suppliers and receive revenue, which was an essential part of its chain of business activities;

- Newfair held the legal title to the goods sold to VBABV, which amounted to valuable assets held in Hong Kong; and

- there was fiscal significance in the internal mark-up regime within the group and Newfair’s business model did amount to identifiable profit-generating activity.

The CFI’s judgement

The CFI applied the various principles established in the case law on source of profits and held that Newfair’s profits were not sourced in Hong Kong. In particular, the CFI pointed out that:

- profits arising from merchandise trade should be taken as arising in or derived from the place where the contracts of purchase and sale were effected;

- in Newfair’s case, the profit-generating transactions were the purchase of goods from the Suppliers and the resale of the same at a fixed mark-up to VBABV, and the negotiations and conclusion of the purchase and sale contracts were effected outside Hong Kong;

- regarding the Board’s contention, the CFI found that:

- the operation of the Hong Kong bank could not amount to profit-producing operations;

- the Board’s finding on Newfair’s legal title to the goods was not supported by any evidence so there was an error in law; and

- the CIR could not impose profits tax liability on what Newfair was but what it did – the tax planning was not a commercial operation that generates profits.

Accordingly, the CFI ruled that the Board’s decisions on both issues were contrary to the only true and reasonable conclusion and allowed the taxpayer’s appeal on both issues.

KPMG observations

We welcome the CFI’s judgement on the source of profits in this case. In our view, the judgement has upheld the principles of Hong Kong’s territorial tax regime and reaffirmed the proper test for determining the source of profits as established by case law. In the case of trading profits, the place(s) where the purchase and sale contracts are effected remain to be the determining factor of the source of the profits.

More generally, the judgement highlights the importance of identifying and focusing on the taxpayer’s own profit-generating activities in determining the source of profits. Other considerations such as: (1) a Hong Kong company is being set up and used to facilitate/effect the transactions, (2) the suppliers are Hong Kong incorporated companies, (3) no tax is being paid overseas or the profits are not subject to tax in anywhere, etc. should not be relevant. Although not mentioned in the judgement, it is also important to draw a distinction between “carrying on a business in Hong Kong” and “carrying on a business with someone in Hong Kong”.

This case can have a potentially widespread impact on the Inland Revenue Department’s current practice of assessing offshore claims. It has yet to see whether the CIR will lodge a further appeal against the CFI’s judgement to a higher court. In the meantime, taxpayers with any outstanding offshore claims to be agreed by the IRD should revisit their cases and consider whether there are any fresh arguments to support their claims in light of the CFI judgement in this case.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia