Within the banking sector, operational resilience is defined as the ability of a bank to deliver critical operations through disruption. It enables a bank to identify and protect itself from threats and potential failures and respond and adapt to, as well as recover and learn from disruptive events - in order to minimise their impact on the delivery of critical operations.

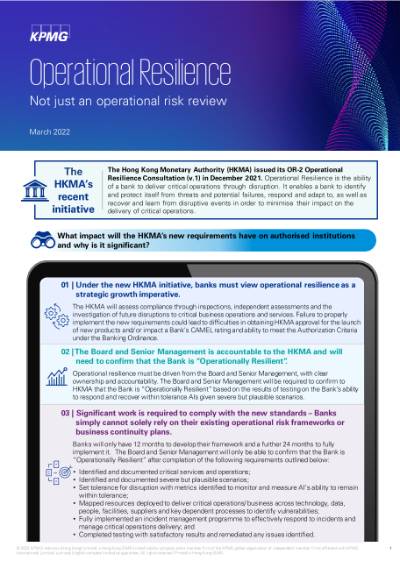

In December 2021, The Hong Kong Monetary Authority (HKMA) issued its OR-2 Operational Resilience Consultation (v.1). Under the new HKMA initiative, banks must view operational resilience as a strategic growth imperative. The Board and Senior Management is accountable to the HKMA and will need to confirm that the Bank is “Operationally Resilient”. Significant work is required to comply with the new standards – banks simply cannot solely rely on their existing operational risk frameworks or business continuity plans.

This brief outlines key regulatory components of the new initiative and how KPMG can help banks to identify gaps and accordingly implement a strategy to strengthen their operational resilience capabilities.

Cara Moey

Operational Resilience Solution Lead

KPMG China

Tom Jenkins

Partner, Governance Risk and Compliance

KPMG China

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia