Summary

Background

The new GAC guidance is entitled as the Interim Measures on Taxation on Domestic Sales of Processing Value-added Goods in Yangpu Bonded Zone (“Interim Measures”, Shu Shui Han [2021] No. 131). In parallel, the Haikou Customs Office has also issued implementation rules. This preferential policy is a key element in the June 2020 overall plan for the construction of the Hainan Free Trade Port (FTP) and is expected to foster manufacturing and integrate Hainan into regional value chains.

KPMG Observations

The preferential policy will reduce the tax burdens of relevant enterprises and make their products more price competitive, though regard must be had to the following requirements.

| Relevant enterprises (all criteria must be satisfied) | Fall within ‘Encouraged Industries’ Catalogue | Relevant goods | Goods processed in the Zone without imported materials |

| Registered in the Zone | |||

| A legal entity | Goods using imported materials and with 30% or more value-added processing in the Zone | ||

| Make record filings with Yangpu Economic Development Zone management committee |

Specific requirements are as follows:

- Enterprise falls within Hainan FTP ‘encouraged industries’ catalogue: Main enterprise businesses must be listed in the catalogue and revenue from ‘encouraged industry’ businesses must be at least 60% of the total.

- Imported materials: Refers to bonded goods imported from overseas.

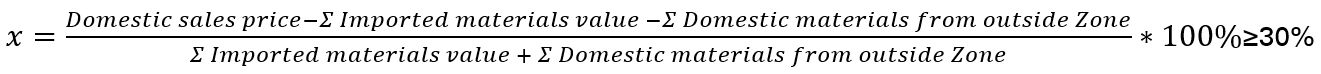

- 30% value-added processing threshold: The guidance gives consideration to (i) the value of all imported materials and (ii) ‘domestic materials’ purchased from outside the Zone (i.e. elsewhere in China). The value-added manufacturing/processing must meet/exceed a 30% threshold (i.e. a 30% mark-up on materials from outside the Zone). The policy caters two the circumstance where goods under processing pass between several enterprises in the Zone in the course of this processing.

Calculation method and procedures are as follows:

1. Self-assessment: Calculation of value-added part based on the formula below:

The following matters are also worth noting:

- If the 30% value-added threshold is not met, the “selective” tax levying policy for comprehensive bonded areas can be applied to the domestic sales. The taxpayer can select to pay the import tariff based on either the value of the original imported goods or the finished products, whichever delivers the lower tariff rate.

- Tariffs cannot be exempted in the following situations, even if the 30% threshold is met:

- Where the imported materials are subject to tariff quota management. Under this, if the quantity of imported goods exceeds a set limitation, then the imports will not be cleared. To note, this does not apply to materials imported to bonded areas but it does affect domestic sales;

- Goods subject to minimal processing, such as mixing, replacement or combined packaging, splitting, cutting, simple grinding;

- Where the import tariff determination is also subject to other regulations.

- Collection and calculation of other costs incurred alongside the processing (e.g. royalties, service fees etc.) yet be clarified.

KPMG suggestions

We would suggest enterprises to consider the following:

- Enterprises in the Zone should study the guidance in advance with a view to optimizing their supply chains to take full advantage of the preferential policy;

- Enterprises outside the Zone should conduct feasibility studies for possible business arrangements in Yangpu and Hainan island to access the preferential policy;

- Pay attention to compliance issues such as customs valuation and classification;

- Keep an eye on follow-up Hainan FTP policies to maximize benefits;

- Enhance internal management and document retention using digital tools in SAP/ERP management systems.

The formula set out above solely considers materials value, with the treatment of intangible asset costs still to be clarified. The value put on intangible assets or imported materials inputs could give rise to transfer pricing issues, requiring holistic consideration.

KPMG is closely monitoring the development of Hainan FTP. With its extensive experience, the firm can provide deep insights, advice and services in relation to industrial development planning, surveys on policy incentives, tax and customs optimization, and assistance in accessing preferential regimes.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia