These uncertain times present great challenges and opportunities for different parts of a business. For financial reporting functions, the current environment stress-tests the robustness of various processes and presents an opportunity for differentiation.

In this Financial Reporting Hot Topics newsletter, we highlight some areas of focus in the run up to 2020 year-end financial reporting.

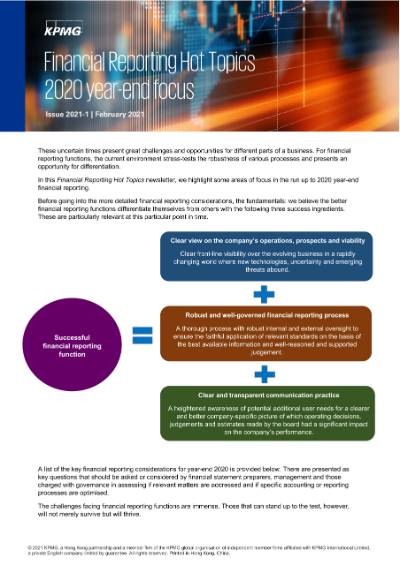

Before going into the more detailed financial reporting considerations, the fundamentals: we believe the better financial reporting functions differentiate themselves from others with the following three success ingredients. These are particularly relevant at this particular point in time.

A list of the key financial reporting considerations for year-end 2020 is provided below. There are presented as key questions that should be asked or considered by financial statement preparers, management and those charged with governance in assessing if relevant matters are addressed and if specific accounting or reporting processes are optimised.

The challenges facing financial reporting functions are immense. Those that can stand up to the test, however, will not merely survive but will thrive.

Key financial reporting considerations for 2020 year-ends

Visit also our ‘IFRS News’ site for further information on the financial reporting implications of the COVID-19 pandemic, including webinars, newsletters, web articles and a COVID-19 resource centre.

Going concern The decision that the financial statements should continue to be prepared on a going concern basis may now involve more judgement than usual. [IAS/HKAS 1.25-26] |

How challenging is the going concern assessment? Is the assessment based on updated and realistic assumptions? Where the going concern assessment involves significant judgement and estimate:

|

|---|---|

Impairment of non-financial assets Pervasive impairment indicators may exist. Likelihood of impairment may increase. [IAS/HKAS 36.8-17] |

Have uncertainties been adequately reflected in the impairment assessment? Where an impairment test is performed:

|

Revenue recognition Contracts with customers may no longer be enforceable or collectability may be in doubt. [IFRS/HKFRS 15.9-16] |

Should revenue recognition be suspended for some contracts due to significant changes in circumstances?

|

Historical revenue estimates may become less predictive if customer behaviour has changed. [IFRS/HKFRS 15.50-59, 91-104, B14-B27, B39-B47] |

Have the myriad considerations of revenue estimates been adequately updated to reflect current circumstances?

|

Provisions A contract may become onerous if fulfilment costs rise (e.g. higher production costs or shipping costs). A contract may also become onerous if expected benefits become lower (e.g. falling sales prices). [IAS/HKAS 37.66-69] |

Could there be some loss-making contracts due to changes in circumstances?

|

Trade receivables There may be adverse changes to debtors’ willingness and ability to repay. Evaluation could become more judgemental. [IFRS/HKFRS 9.5.5.17-5.5.20, B5.5.28-B5.5.55] |

Has the estimation of expected credit losses (ECLs) of trade receivables been adequately updated to reflect changing circumstances? Where ECLs are measured:

|

Fair value measurements Greater estimation uncertainty and reduced market activity may necessitate revisions to assumptions and the use of more judgement. Changes to valuation techniques may now involve the use of more unobservable inputs. [IFRS/HKFRS 13.2-3] |

How robust is the process around fair value measurements? Have the measurements been appropriately determined and adequately disclosed? Where an asset or a liability is measured at fair value:

|

Leases Rent concessions may be received/granted. The concessions could be in various forms (e.g. one-off rent reductions, rent waivers or payment deferrals). [IFRS/HKFRS 16.44-46B] |

Have rent concessions been accounted for appropriately, in the right period? If you are a lessee:

If you are a lessor:

* Amendment to IFRS/HKFRS 16, Leases – COVID-19-related Rent Concessions – see Issue 2020-3 of our Financial Reporting Hot Topics newsletter for further details. Please note that, at the time of writing, the International Accounting Standards Board (IASB) is planning to extend the time limit from 30 June 2021 to 30 June 2022. If the time limit is to be extended, the amendment would be issued by the end of March and early application would be allowed. The HKICPA is expected to follow any decisions made by the IASB by issuing conforming amendment to HKFRS 16. |

Government grants Significant government assistance in different forms may be received. [IAS/HKAS 20.7, 12, 20, 29] |

Have government grants been recognised in the right period? Have the grants been presented appropriately?

|

Disclosures There may be heightened user expectations for better information in particular around significant judgement and major estimation uncertainties. [IAS/HKAS 1.122-133] |

Have sufficient transparent disclosures about significant judgement and major estimation uncertainties been provided?

|

| Others |

|

If you have any questions about the matters discussed in this publication, please feel free to contact the following partners or your KPMG contacts.

Paul Lau

Partner,

Head of Professional Practice/Capital Markets

KPMG China

+852 2826 8010

paul.k.lau@kpmg.com

Jim Tang

Principal,

Professional Practice

KPMG China

+852 2685 7610

jim.tang@kpmg.com

Ivy Tsoi

Director,

Professional Practice

KPMG China

+852 2978 8241

ivy.tsoi@kpmg.com

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia