Summary

- The 2020 tax year in China is coming to an end soon. Therefore, time for making year-end adjustments to the amount of tax withheld during the year is also fast approaching. If an employee has changed resident status during the year, and this has not already been reflected in the monthly withholding from the date of that change of status, a rectification filing might be required. The deadline for such corrections is 15 January 2021.

Background

Different tax calculation methods and filing obligations apply depending on whether a non-domiciled individual is Resident or Non-resident in the tax year concerned. In some cases, the resident status can only be determined with hindsight. Therefore, an adjustment to the withholding might be required to ensure the total tax withheld is correct.

KPMG Observations

Distinction between “resident” and “non-resident” under IIT

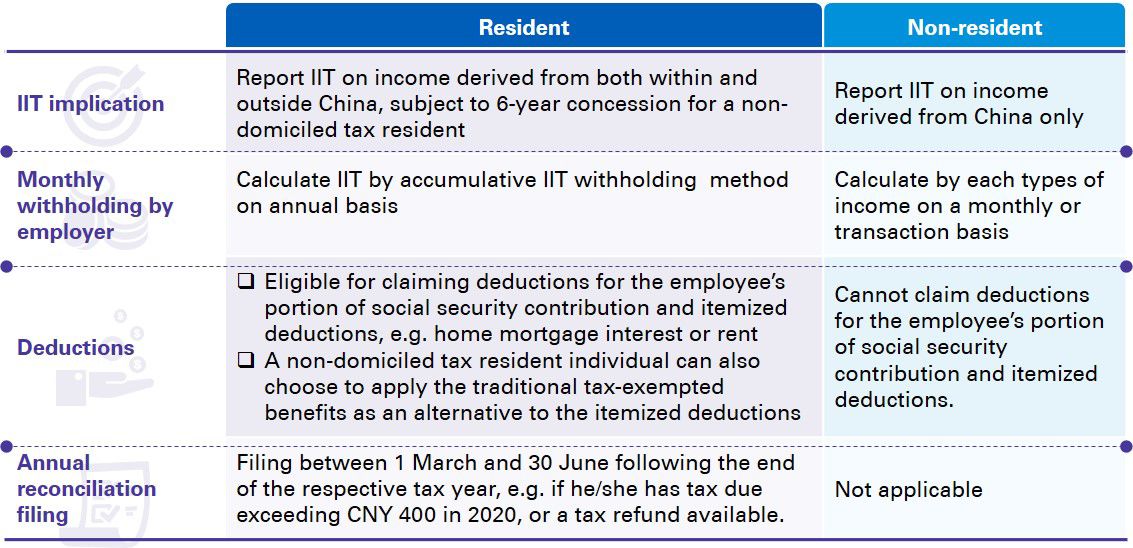

The IIT obligation and calculation mechanisms for resident individual and non-resident individual are different. Consequently, a change of tax residence status could result in different IIT payable. The table below summaries notable differences between “resident” and “non-resident” requirements:

Filing obligation due to residence status change

According to prevailing PRC IIT regulations, employers shall make a pre-assessment of its employees’ tax residence status in China from the first monthly IIT filing based on his or her estimated number of days in China during a tax year.

Resident to Non-resident

If a non-domiciled employee is pre-determined as a tax resident but later determines that he/she would not physically stay in China for 183 days or more in the tax year concerned, the employer should report and remit tax shortfall/claim tax refund due to change in residency status to the in-charge tax authority by no later than 15 January immediately following the end of the respective tax year. No interest surcharge is imposed if the due date (15 January) is met.

Non-resident to resident

In contrast, if the monthly tax of the employee is withheld using the non-resident method and the employee becomes a resident in the tax year concerned, the monthly IIT calculation method for non-resident shall continue to apply. The rectification filing should be performed via the annual reconciliation filing from the following 1 March to 30 June.

KPMG suggestions

In 2020, due to the pandemic spread of COVID-19, China has implemented travel restriction policies that have prevented the return of foreign expatriates to the workforce in China. In other cases, foreigner employees may have remained in China longer than expected. As a consequence, actual days in China during 2020 may have changed significantly from the expectation at the start of the year. This change could affect the tax residence status of the foreign expatriates. With expatriates returning home during the early days of the pandemic, and then having difficulty returning to China, we anticipate more resident to non-resident cases arising during the year.

In this regard, we suggest employers:

- Review the residency status during December by collecting travel information of employees, identifying cases where residence status may have changed and recalculating IIT for the employees whose resident status has been changed to non-resident;

- The employer is also highly recommended to consult with in-charge tax officials or KPMG in advance regarding the practicalities of the rectification filing process and documents required, as these may vary between different tax bureaus;

- For the coming year of 2021, we recommend that employers reconsider expatriates’ expected tax resident status based on their arrangements in light of the worldwide travel restrictions. The residence status should be determined accordingly at the beginning of the year.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia