The Inland Revenue Department (IRD) issued its Departmental Interpretation & Practice Note No. 61 (DIPN 61) updating its guidance on the application of Hong Kong’s tax exemption rules for funds in Hong Kong. Some of the commentary in DIPN 61 provides helpful guidance for the funds industry likely to make use of the funds exemption. The IRD clarifies application of the exemption to investment holding platforms and the obtaining of a tax residence certificate for funds and investment holding companies. The IRD’s views with respect to some aspects of the guidance remain the same, especially with respect to performance fees and debt investments. However, on the whole the guidance is a step in the right direction in reinforcing Hong Kong’s position as a global asset management hub.

The IRD issued DIPN 61 on 30 June 2020 outlining its interpretation of The Inland Revenue (Profits Tax Exemption for Funds) (Amendment) Ordinance 2019, also known as the Unified Fund Exemption regime (UFE). The UFE is Hong Kong’s main tax exemption regime for funds and applies to both Hong Kong and non-Hong Kong domiciled funds. The guidance has been long awaited by the funds industry in Hong Kong.

In most part, the IRD has sought to adopt a positive approach to facilitate the use of the exemption by funds in Hong Kong. The release of DIPN 61 also ties in well with the Government’s passing of the Limited Partnership Fund (LPF) legislation which becomes effective on 31 August 2020.

The effect of both the UFE and the LPF regimes is that GPs and asset managers will now have a choice to fully onshore their operations in Hong Kong through either a LPF fund structure, or instead domicile the fund offshore but have the day-to-day fund management activities situated in Hong Kong.

The UFE is broad in its coverage and should apply to most private equity funds. However, unfortunately any hope of the exemption extending to interest income on debt instruments has been shut down, meaning that Asian focussed credit funds will instead likely continue to domicile in other jurisdictions such as Singapore where the tax treatment is more favourable.

Effective date

The UFE applies for years of assessment commencing on or after 1 April 2019. DIPN 61 makes clear that for funds with a 31 December year end, the UFE will apply to profits from specified transactions occurring on or after 1 April 2019.

For periods prior to 1 April 2019, funds will need to rely on the provisions within section 20AC of the IRO for exemption from profits tax. However, this exemption only applies to funds which are tax resident outside of Hong Kong.

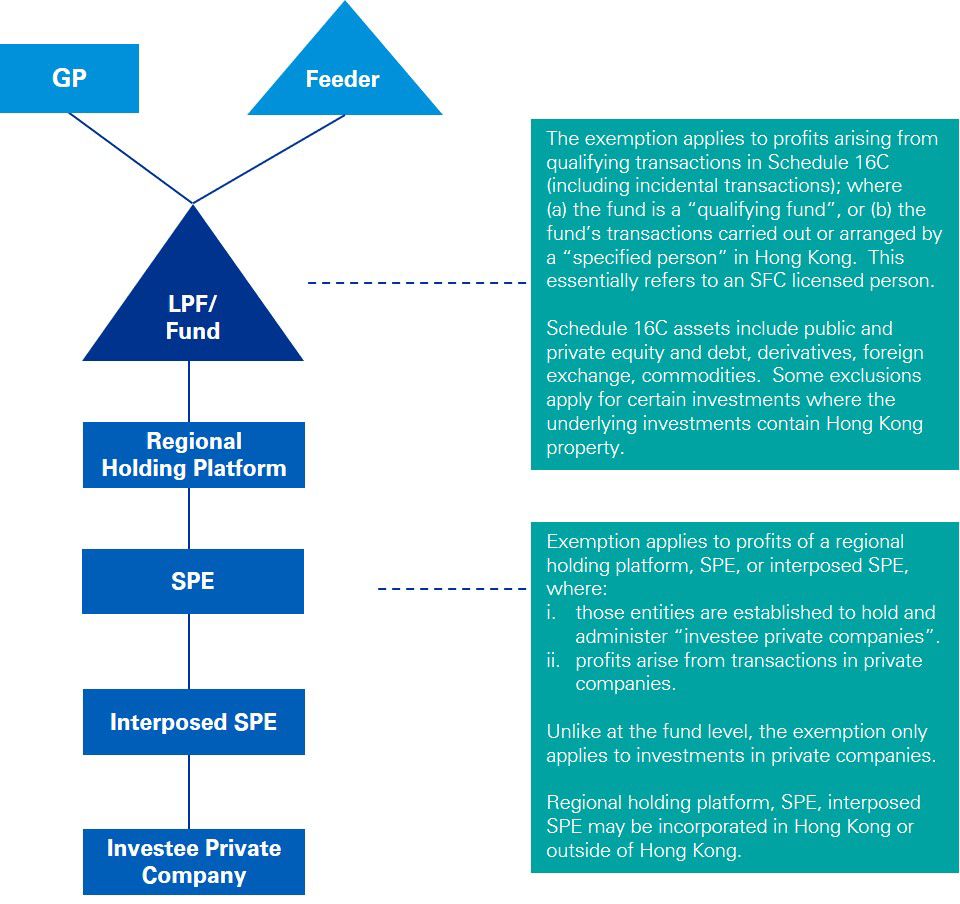

Application of the Hong Kong Fund Exemption to a LPF or Fund

Fund of one

The IRD is of the view that where the intention is for the fund to have one investor, the fund is unlikely to constitute a fund for the purposes of the UFE.

KPMG comment: It is not uncommon for funds to be established with a single investor and there may be many commercial reasons for this. The IRD’s view is disappointing given that a fund may register under the new LPF regime with one general partner and at least one limited partner. As such, we may have a situation where a fund is established under the LPF regime as a fund of one, but may not qualify as a fund for tax purposes. If the Government’s intention is to encourage onshoring of funds in Hong Kong, the tax exemption should apply to a fund of one under the LPF regime.

Pension and similar funds

A sovereign wealth fund is specifically defined to be a fund under the UFE. However, pension funds are not specifically included in the definition of a fund and little clarity is provided by the IRD as when a pension may qualify as a fund. It is based on facts and circumstances. On the other hand, for the purpose of considering whether a fund can be treated as a “qualified investment fund”1, the IRD states that a pension fund, insurance company or a sovereign wealth fund will be counted as a single investor, even though they themselves have a large number of participating persons and beneficiaries.

KPMG comment: Whether a Pension fund itself may be considered a fund is not affirmed in DIPN 61, although the Government’s written responses to the Bill introducing the UFE provisions suggested that a pension fund could qualify as a fund under the regime if all of the conditions were met.

1 Profits derived by a qualified investment fund will be able to avail of exemption from tax under the UFE in relation to qualifying transactions, even where the transactions are not carried out or arranged by a specified person. Broadly, a qualified investment fund is fund which has greater than 4 investors, where capital commitments made by investors exceeds 90% of the aggregate capital commitments, and where not more than 30% of net proceeds from the funds investments are distributed to the originator.

Tax residence certificates

A fund will be issued with a tax residence certificate (TRC) if it can be established that the general partner exercises central management and control onshore in Hong Kong. This means that for both LPFs operating fully onshore in Hong Kong and funds established offshore, the IRD will issue a TRC if the general partner exercises central management and control in Hong Kong.

Further, if the regional investment platform is situated in Hong Kong the IRD will attribute the substance of the Hong Kong entity to the fund for the purpose of issuing a TRC.

To avail of the tax exemption, SPEs’ (including regional holding companies which would also generally be expected to be characterised as a SPE) permitted activities are restricted to only administering and holding shares/debt in private companies. The IRD considers that as a starting point and in the absence of facts to the contrary an SPEs’ tax residence will follow that of the fund.

However, despite the limited nature of permitted activities the IRD will issue a TRC to an SPE if it can be proved that the SPE is tax resident in Hong Kong with substantial business activities of its own in Hong Kong (eg, permanent office and level of staff) and is not a mere conduit.

KPMG comment: The IRD’s comments for SPEs are helpful given the IRD’s current inconsistent approach to issuing TRCs to entities across all industries. However, the IRD could have gone further by automatically granting SPEs TRCs if the fund itself is able to obtain a TRC in Hong Kong, and also in cases where it is clear that a Hong Kong SPE is being managed and controlled by a licensed investment manager situated in Hong Kong, irrespective of the level of activities situated in the SPE itself.

Multi-vehicle fund structures

To accommodate investor preferences many fund structures have master-feeder vehicles or parallel funds and other side-car arrangements. The IRD states that the totality of facts will need to be considered to decide whether such vehicles may individually be considered a “fund” as defined under the UFE, having regard to the fund vehicles’ constituent documents, investment mandate and management agreements. Characterisation of the entities in a fund group is important since different tax rules will apply to a “fund”, SPE or regular entity.

The IRD is of the view that where parallel funds are aggregated say for the purposes of the overall fund size cap, and investors in the principal and parallel funds are aggregated for the purposes of voting, the funds will collectively be considered a single fund. On the other hand, feeder funds established purely for the needs of investors from different jurisdictions would generally not be considered separate funds, and collectively the master and feeder funds would also not be considered as a single fund.

KPMG comment: When setting up a fund it should be ensured that the constituent documents and inter-company agreements support the intended roles of the entities within the fund group so that their characterization for tax purposes is clear, and that ultimately they may all be entitled to avail of the exemption.

Listed vs unlisted securities

The guidance clearly provides that exemption for SPEs only applies to a transaction in a private company. However, where the fund invests directly, the category of qualifying investments is much broader

It is common for funds to look to exit share investments by way of an initial public offering (IPO). In this respect, a sale of listed shares could strictly not be regarded as a transaction by a SPE in a private company under the UFE. However, the IRD has taken a positive approach by treating gains arising from exiting an investment through an IPO as still qualifying for the exemption. Furthermore, if a SPE is required to continue to hold shares in a listed company for a period of time post-IPO, the exemption from tax should also still be available.

Similarly, if a SPE purchases shares in a listed company whose shares are then taken private, the exemption should apply for any gain arising on eventual sale of shares in the private company.

KPMG comment: Clarification on these points is particularly welcomed, since without flexibility on how to divest from equity investments it would be difficult to see funds ever relying on the exemption.

Credit funds

The guidance reaffirms the IRD’s long-standing view with respect to the taxation of interest under the exemption.

Whilst SPEs are permitted to undertake transactions in debentures, loan stocks bonds or notes, the IRD states that it does not regard the receipt of interest as a “transaction in securities”, since the receipt of interest merely gives effect to rights attached to the debt instrument, unlike a purchase and sale of debt securities between two parties.

Interest income received by credit funds is therefore not be exempt under the UFE provisions unless it can be regarded as an “incidental” transaction, and in such cases, only to the extent to the extent interest income does not exceed 5% of gross trading receipts.

KPMG comment: The IRD’s interpretation as to what constitutes a transaction in securities is disappointing as it means Hong Kong misses the opportunity to help attract credits funds to establish in Hong Kong. Separately, for purchases of distressed debt, it may be asked whether the repayment of loan principal should similarly be viewed as merely reflecting rights attached to the debt instrument, rather than constituting a “transaction in” the debt instrument. If this interpretation were to apply then realized write-ups in distressed debt would not be exempt under the UFE. In this regard, Appendix 2 to DIPN 61 appears to suggest that any gain (other than interest income) arising from purchases of distressed debt should be eligible for exemption – provided that the debt is structured in the form of a security.

Going forward

Hong Kong has implemented a number of initiatives to strengthen its funds regime to attract asset managers and GPs to set up in Hong Kong, albeit this has largely been in response to the lead taken by other asset management hubs in Asia and elsewhere. With the IRD’s overall positive approach in DIPN 61 and the Government’s introduction of the LPF regime, Hong Kong provides asset managers and investors with a robust regulatory framework and improved certainty of tax treatment for various investment classes.

However, the IRD’s views on the taxation of interest income under the UFE means that Hong Kong has missed an opportunity to compete in attracting credit funds to establish here. As DIPN 61 is the third practice note on the taxation of funds (DIPN 43 and DIPN 52 being the other practice notes), it is difficult to see the IRD changing its views in this respect unless the necessary changes to the UFE are legislated.

It is expected that draft legislation will shortly be introduced that will afford concessional tax treatment for Carried Interest, and with it hopefully an opportunity to enhance the UFE further and have it best in class for all fund types.

Darren Bowdern

Head of Financial Services Tax, Hong Kong

KPMG China

Vivian Chui

Partner, Head of Securities & Asset Management, Hong Kong

KPMG China

Neil Macdonald

Director, Wealth and Asset Management Centre of Excellence Leader

KPMG China

Sandy Fung

Partner, Tax

KPMG China

Simmy Ko

Partner, Audit

KPMG China

Arion Yiu

Partner, Audit

KPMG China

Kenneth Hui

Partner, Audit

KPMG China

Anthony Pak

Director

KPMG China