Regulatory expectations for algorithmic trading

Regulatory expectations for algorithmic trading

Sound risk management practices for algorithmic trading issued by the HKMA

The HKMA undertook a round of thematic examinations focused on algorithmic trading (algo-trading) in 2019. Seven Authorized Institutions (AIs), mainly international banks using algorithms for making investment decisions, were covered in the thematic examinations.

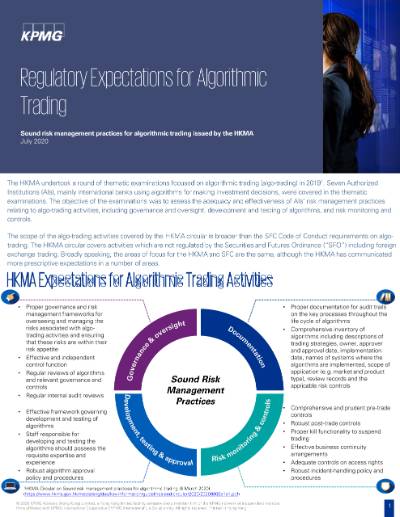

The objective of the examinations was to assess the adequacy and effectiveness of AIs’ risk management practices relating to algo-trading activities, including governance and oversight, development and testing of algorithms, and risk monitoring and controls. The scope of the algo-trading activities covered by the HKMA circular is broader than the SFC Code of Conduct requirements on algo-trading.

This publication summarises the HKMA’s expectations for algo-trading activities, and compares the HKMA and SFC requirements.

© 2024 KPMG Huazhen LLP, a People's Republic of China partnership, KPMG Advisory (China) Limited, a limited liability company in Chinese Mainland, KPMG, a Macau (SAR) partnership, and KPMG, a Hong Kong (SAR) partnership, are member firms of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

The KPMG name and logo are trademarks used under license by the

independent member firms of the KPMG global organisation.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance.