Summary

On 2 July 2020, several Shenzhen municipal authorities jointly issued implementation guidance for the Greater Bay Area (GBA) preferential individual income tax (IIT) policies. This sets out specific details on eligibility and procedural requirements. Businesses looking to access these incentives should pay close attention.

Background

On 2 July 2020, the Shenzhen Human Resources and Social Security Bureau (HRSS), Shenzhen Science and Technology Innovation Committee (STIC), Shenzhen Finance Bureau (SZFB), the State Taxation Administration (STA), Shenzhen Municipal Taxation Administration (SZMTA) jointly issued a notice on the implementation of the GBA preferential IIT policy (“the Notice”), effective from 10 July 2020 (see the KPMG tax alert on the original 2019 GBA policy announcement here). On the same date, HRSS, STIC and SZFB also issued guidelines (“the Application Guide”) for foreign individuals with high-end and urgently-needed skills, working in Shenzhen, to apply for the 2019 IIT-related subsidy. The subsidy is intended to produce an effective low IIT outcome for the individual, equivalent to the tax burden they would be subject to in Hong Kong SAR.

KPMG Observations

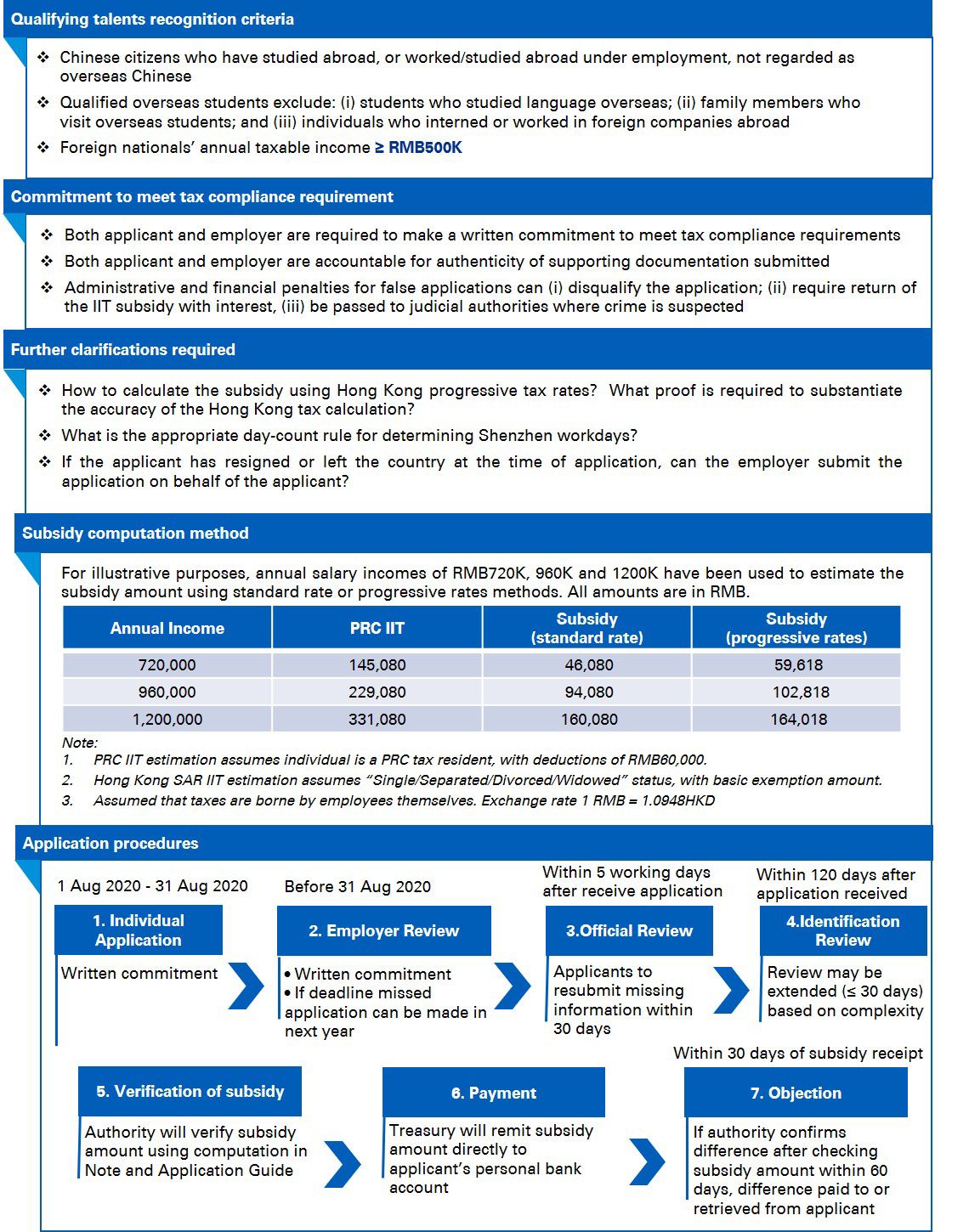

Compared with the implementation rules for the other eight GBA cities, Shenzhen’s Notice and Application Guide is flexible on subsidy determination, enabling a greater degree of personal tax relief. Alongside the subsidy qualification criteria, the rules note that the social credit ratings/personal tax credit ratings of both applicant and employer are inputs in assessing the application. Key aspects of the rules and areas needing clarifications are as follows:

KPMG Recommendations

- Employer should assess eligibility of their employees for IIT subsidy and formulate a plan for applications to be made in accordance with rules in the Notice and Application Guide.

- To ensure a smooth application process, both employer and applicants should review existing arrangements and plan ahead. For instance, applicants need to ensure that a Chinese bank account is in place throughout the application process as the subsidy will be remitted into that account; for employees whose taxes are borne by the company, the employer should agree with the employee in advance on how and when the subsidy should be repaid to the company.

- Applicants and their employers should ensure that all information submitted is accurate and truthful. Inaccurate applications may adversely impact applicant and employer’s credit rating and their eligibility for future application.

KPMG will continue to update you on the latest developments with GBA policies, and share our observations and insights via alerts and workshops.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia