Re-shaping financial statement presentation

Proposals aim to bring more comparability, transparency and discipline.

Proposals aim to bring more comparability, transparency and discipline.

8 April 2020

Highlights

- New income statement structure with three new mandatory profit subtotals

- Improved disaggregation and tightening of requirements to present analysis of operating expenses

- More transparency and guidance in the use of management performance measures

- Have your say – Comment deadline is 30 September 2020

Proposed changes to how companies report their financial performance in response to investors’ demand for more comparability

A re-shaping of the presentation of financial statements to improve their usefulness is proposed under a new IFRS® Standard that would replace IAS®1 Presentation of Financial Statements.

Proposals from the International Accounting Standards Board (the Board) in their exposure draft (ED) General Presentation and Disclosures could introduce significant changes for many companies in how they present and/or disclose financial information in the financial statements, particularly in the income statement. Presentation choices in the cash flow statement would also be reduced, improving comparability.

The proposals offer greater comparability and transparency in financial statement presentation – a clear benefit to investors and other users. Companies may see significant changes in their income statement – with new subtotals and/or aligning their self-defined subtotals with the new definitions in the proposals. The impact on companies may vary, depending on current presentation practice under IFRS Standards.

Proposed new income statement structure

With no set structure for the income statement under current IFRS Standards, companies use different formats to present their results, making it difficult for investors to compare financial performance across companies.

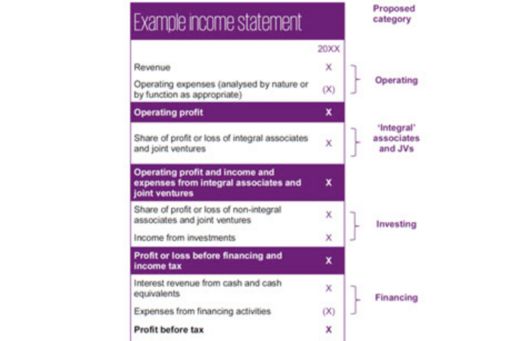

Under the proposals, companies would be required to present three new subtotals in their income statement, effectively allocating their income and expenses between four major categories, as illustrated below.

Click to enlarge graphic (JPG)

Income and expenses from ‘integral’ associates and joint ventures would be presented separately in the income statement. Determining which of its equity-accounted associates and joint ventures are ‘integral’ could require a company to make potentially significant judgements.

When classifying income and expenses into each of the categories, companies would also need to consider the nature of their business activities. For example, if a company provides financing to customers as its main business activity (e.g. a bank), it would classify in the operating category, income and expenses from financing activities, and interest and expenses from cash and cash equivalents related to providing financing to customers.

Improved disaggregation and analysis of operating expenses

As well as changes to the structure of the income statement, the proposals introduce new requirements for companies to provide an analysis of their operating expenses on the face of the income statement – either by nature or function – selecting the method that provides the ‘most useful’ information. The proposed approach would explicitly prohibit ‘mixed presentation’ of operating expenses on the face and would remove the option to present analysis in the notes only.

To further improve disaggregation, the proposals introduce disclosure requirements and guidance for ‘unusual’ items and other changes to discourage aggregation of items into large, single numbers.

The proposals also introduce more transparency and guidance on the disclosure of management’s own performance measures1 (MPMs).

More transparency and guidance in the use of MPMs

Companies are increasingly using ‘non-GAAP information’ to explain their financial performance because it allows them to tell their own story and provides investors with useful insight into a company’s performance.

Acknowledging investors’ demand for MPMs, the Board is proposing that MPMs used in public communications outside the financial statements are required to be disclosed in a single note to the financial statements. Companies would also be required to explain why the measures provide useful information and how they are calculated, and provide a reconciliation to the most directly comparable profit subtotal specified by IFRS Standards.

These proposals are broadly aligned with guidelines prescribed by regulators on alternative performance measures (APMs) disclosed outside the financial statements.

Have your say – Comment deadline is 30 September 2020

The International Accounting Standards Board has extended the comment period by three months to 30 September 2020 due to the COVID-19 pandemic. Read our web article.

Read our New on the Horizon (PDF 1.6 MB) publication, which explores some of the potential impacts and offers illustrative examples showing how financial statements might be presented.

For further information on the proposals, speak to your KPMG contact.

1 The ED defines management performance measures (MPMs); these measures are currently commonly known as non-GAAP measures, alternative performance measures (APMs), or key performance indicators (KPIs).

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

© 2024 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.