Supplementary guidance on tax treatment of nonresidents and non-PRC-domiciled residents are announced

Supplementary guidance on tax treatment of nonresidents

China Tax Alert - Issue 11, March 2019

The Ministry of Finance and the State Taxation Administration (“STA”) provided further guidance regarding the tax treatment of nonresidents and non-PRC-domiciled resident individuals on March 14, 2019 (hereinafter referred to as Announcement No. 35). This announcement is retroactively effective from January 1, 2019, supplementing the amended individual income tax (“IIT”) law and provides guidance on the following:

- Income sourcing rules methods for calculating non-domiciled individual’s PRC-sourced assessable employment income

- Methods for calculating non-domiciled individuals’ PRC IIT

- Application of Avoidance of Double Tax Agreement (“DTA”) for non-domiciled individuals

- Rules on collection and administration of PRC IIT pertinent to non-domiciled individuals

Salient points

Ⅰ. Determining PRC-sourced income and PRC IIT calculation methods for non-domiciled individuals

Determining PRC sourced income

Announcement No. 35 clarified that the PRC-sourced employment income derived by non-domiciled individuals who are concurrently employed by domestic and overseas entities, or employed solely overseas, shall be determined based on the individual’s PRC workdays. Workdays in the PRC are calendar days which are spent in the PRC for business purposes. A stay in PRC for less than 24 hours on a calendar day is counted as a half workday.

Workdays in the PRC include calendar days physically spent in the PRC for business purposes, and, public holidays, personal leave and days spent in training which accrue to one’s PRC employment, regardless of whether they are conducted inside or outside the PRC.

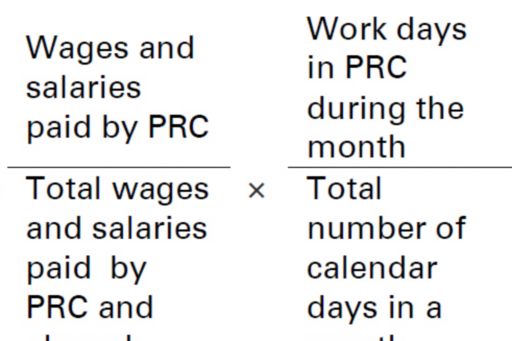

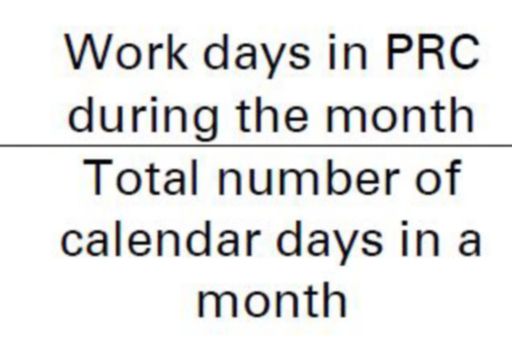

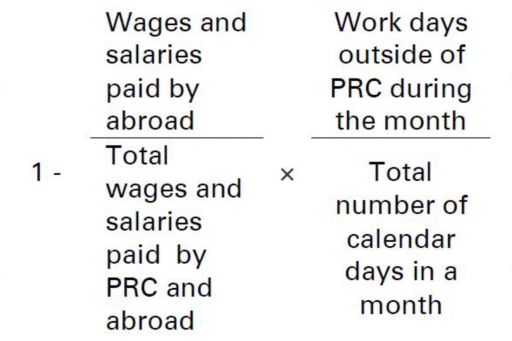

According to the position which a non-domiciled individual holds, and his physical presence in the PRC, PRC-sourced employment income shall be calculated according to one of the following formulae:

• For a non-senior executive whose physical presence in the PRC does not exceed 90 days

• For a senior executive whose physical presence in PRC does not exceed 90 days

Monthly taxable income = Income paid in or borne by PRC

• For a non-senior executive whose physical presence in PRC exceeds 90 days but less than 183 days

• For a senior executive whose physical presence in the PRC exceeds 90 days but less than 183 days / For a senior or non-senior executive whose physical presence in PRC is 183 days or more but less than 6 consecutive years

• Following being a PRC tax resident for a consecutive period of six years, senior or non-senior executive will be subject to PRC IIT on worldwide income (except for individuals whom have taken a single period of absence of more than 30 days within any calendar year of the six consecutive years concerned)

PRC IIT calculation

Resident taxpayer

Tax payable for annual comprehensive income = (annual salary income + annual independent personal services remuneration income + annual author’s income + annual royalty income - deduction of expenses - itemised deduction - additional itemised deduction - other deductions stipulated by PRC IIT law) x applicable tax rate - quick deduction.

Nonresident taxpayer

Salary and wages earned by nonresident taxpayers are subject to monthly PRC IIT withholding at the rates outlined in the Appendix after less deductions as stipulated by PRC IIT law.

Ⅱ. Determining PRC-sourced income and PRC IIT calculation method for bonus (multiple-month performance period) and equity income

PRC-sourced Income

PRC-sourced bonus or equity income = bonus or equity income x corresponding work days in PRC / corresponding calendar days of bonus or equity income’s sourcing period

PRC IIT calculation

After determining the amount of income derived from PRC, the tax amount for bonus and equity income for nonresidents shall be calculated as follows:

- For nonresident individuals who receive bonus amount(s) within a month, the tax payable shall be calculated separately from their monthly income, i.e. without combining it with wages and salaries in the same month, and according to the following formula:

Tax payable for bonus = [(bonus amount(s) ÷ 6) x applicable tax rate - quick deduction] x 6

In each calendar year, nonresident individuals can only apply this preferential tax treatment once.

- For nonresident individuals who receive equity income within a month, the tax payable shall be calculated separately from their monthly income, i.e. without combining it with wages and salaries in the same month, and according to the following formula:

Tax payable for equity income for the current month = [(cumulative equity income in this calendar year÷6) x applicable tax rate-quick deduction] x 6 - tax paid previously for equity income in this calendar year.

Ⅲ. Application of Avoidance of Double Tax Agreement

Announcement No. 35 also clarifies that a non-domiciled individual who is defined as a tax resident of the country where PRC has concluded a relevant DTA may enjoy the tax treatment of income from employment, independent personal services or business profits as stated under the DTA and shall be exempt from individual income tax in PRC if all conditions are met.

Where one of the following circumstances occur for an individual who is a tax resident of a country which has a DTA with PRC, the individual may elect to use the above mentioned method for determining PRC-sourced employment income under the non-senior executives method instead of the method for senior executives:

- DTA concerned does not include the “director’s fee“ article; or

- The “director’s fee” article is not applicable to the individual.

Royalties or technical services fee

Income from royalties or technical services obtained by non-domiciled individuals may be subjected to PRC IIT as per the tax rate stipulated in the relevant DTA. For example, according to PRC IIT domestic law, a 20% tax rate is usually applied to royalties. However, under the DTA PRC has concluded with certain countries, royalties may be taxed at a tax rate of 10%.

Ⅳ. Tax collection and administration of PRC IIT

Determining physical presence in PRC for non-domiciled individual

When a non-domiciled individual files tax for the first time during a tax year, he shall estimate his physical presence in the PRC for the tax year based on the relevant contractual agreement and personal circumstances to decide if he will be a tax resident or nonresident and prepay the monthly IIT accordingly. If the actual situation differs from the initial estimate, please refer to the summary table below on how the tax filing should be adjusted:

| Preliminary assessment | Year-end assessment | Adjustment required |

|---|---|---|

| Nonresident | Resident | File an annual reconciliation tax return before departure from PRC or after the end of calendar year. |

| Resident | Nonresident | Inform the tax bureau within 15 days after the end of the year once it has been determined that the individual will not qualify to be a PRC tax resident. The amount of tax payable shall be recalculated and any unpaid taxes should be paid immediately or apply for refund where there are overpaid taxes. There will not be any penalties or interest imposed on unpaid taxes. |

| Physically present in PRC for not more than 90 days (or not more than 183 days where DTA is applicable) | Physically present in PRC for more than 90 days (or more than 183 days where DTA is applicable) | Inform the tax bureau within 15 days after the end of the month where the DTA condition cannot be met. The amount of tax payable shall be recalculated and any unpaid taxes should be paid immediately. There will not be any penalties or interest imposed on unpaid taxes. |

Domestic employer’s reporting obligation for non-domiciled individuals

Domestic employer in PRC with non-domiciled individual being paid PRC-sourced employment income by overseas affiliated company has the obligation to make a report to the tax bureau. The non-domiciled individual can do a self-reporting for the PRC-sourced employment income or authorize the domestic employer in the PRC to assist with the monthly IIT reporting and withholding payment. If not authorized by the non-domiciled individual, the domestic employer is required to report the following relevant information to the local tax bureau within 15 days after the end of each month:

- Work arrangement of the non-domiciled individual;

- Overseas payments made to the non-domiciled individual;

- Non-domiciled individual’s contact details.

KPMG Observation

Announcement No. 35 clarifies various PRC IIT regulations for nonresidents and non-domiciled resident individuals. Compared with the pre-reform regulations, individual taxpayers and their withholding agents need to pay attention to the following:

Determining the source of income

Under the new PRC IIT regime, the method of determining what is PRC-sourced income first before applying the applicable tax rates, effectively reduces the probability of double taxation for non-domiciled individual. It also serves to reduce the tax cost for enterprises and / or individuals as well as being closer to current international practices.

There remain some practical challenges in determining whether days when an individual is on holiday should be counted as part of the working period in PRC. However, this may also imply the intention that the tax bureau will be stricter in enforcing the reporting and counting of the number of days a non-domiciled individual is working in PRC.

Bonus (multiple-month performance period) and equity incentive income

Bonus and equity income for non-tax residents and non-domiciled tax residents can be sourced to PRC according to the work days one spent in PRC. Compared with old IIT tax law where the entire bonus will be subjected to PRC IIT where the individual spends at least a day in PRC during a month and without considering the actual days one is working outside of PRC, the new IIT law is more reasonable and aligned to intentional standards. As a result, this should reduce the probability or extent of double taxation occurring due to the different sourcing rules of each country.

While Announcement No. 35 has clarified the sourcing rule for bonus and equity income, it remains unclear if similar rule can be applied to other special items e.g. severance payment received by non-tax resident and non-domiciled tax resident.

More reasonable basis for calculating PRC IIT for non-domiciled individuals

The PRC IIT calculation method has changed from including full income for tax before apportioning for work days outside PRC to that of deriving PRC sourced income first than applying applicable tax rates. This should result in a more reasonable amount of income being include for PRC IIT for non-domiciled individuals thus reducing their overall effective tax rates.

Faced with the changes as mentioned, employers should adjust the PRC IIT withholding tax calculation for non-domiciled individuals. As the new tax regulation is effective 1 January 2019, if employers after recalculating the taxes paid for January and February, realize that they had overpaid or underpaid taxes, they should seek refund from the local tax bureau or pay additional taxes in accordance with Announcement No. 35 in a timely manner.

Practical implications due to change in tax residency in a tax year

Announcement No. 35 has specified the way to deal with a change in tax residency in a tax year for non-domiciled individual. While one is expected to do additional reporting and pay up any unpaid taxes or seek relevant refund, the exact details on how this should be done (e.g. documents required to be submitted) remains unclear. As such, further clarifications are expected for this.

As for individuals on dual employment (“DE”) contracts, it is important to follow closely the travel pattern to PRC as estimated when setting up the DE (with consideration of reasonable allocation of remuneration costs) in order to ensure that the relevant calculation methods for PRC PRC IIT can be applied to achieve the intended tax savings.

Requirement for non-domiciled individuals to do self-reporting will reduce the PRC IIT withholding obligations for domestic employers and enhance the tax compliance

The promulgation of Announcement No. 35 also abolished the obligation of domestic employers to withhold wages and salaries paid to their employees by their overseas affiliates, which was indicated by the State Tax Administration No. 241 of 1999. It is recommended that domestic employers communicated and encourage the non-domiciled individuals (especially for those who are eligible for tax equalization policy, and whose PRC IIT are borne by the employer) to authorize them to assist with the PRC IIT tax reporting and payment. This will help to reduce the risk of individual non-compliant cases due to lack of understanding of the PRC IIT law.

Even if non-domiciled individual does not authorize the domestic employers to assist with the IIT withholding and payment, it is important for employer to fulfill the obligation of reporting the relevant information to the local tax bureau on time.

Application of DTA

"Measures for the Administration of the Treatment for Nonresident Taxpayers by Tax Agreements" (Announcement No. 60 of the State Taxation Administration in 2015, hereinafter referred to as "Announcement No. 60") is still valid after the promulgation of Announcement No. 35, which also means that non-domiciled individuals can still enjoy the treatment under DTA concluded provided that they meet all the relevant conditions, complete the required reporting and provide the information required to the tax bureau in accordance with the requirements of Announcement No. 60.

KPMG will continue to pay close attention to relevant regulations regarding the reform of individual income tax and to make regulation interpretation at the first time. All enterprises and taxpayers are welcome to contact us for the latest developments in the reform of individual taxation and the frontier information of taxation.

Annex: Monthly Converted Comprehensive Income Tax Rate Table

| Degree | Monthly taxable income | Tax rate(%) | Quick deduction |

|---|---|---|---|

| 1 | Not exceeding 3,000 | 3 | 0 |

| 2 | Part exceeding 3,000 but less than 12,000 | 10 | 210 |

| 3 | Part exceeding 12,000 but less than 25,000 | 20 | 1,410 |

| 4 | Part exceeding 25,000 but less than 35,000 | 25 | 2,660 |

| 5 | Part exceeding 35,000 but less than 55,000 | 30 | 4,410 |

| 6 | Part exceeding 55,000 but less than 80,000 | 35 | 7,160 |

| 7 | Part exceeding 80,000 | 45 | 15,160 |

© 2024 KPMG Huazhen LLP, a People's Republic of China partnership, KPMG Advisory (China) Limited, a limited liability company in Chinese Mainland, KPMG, a Macau (SAR) partnership, and KPMG, a Hong Kong (SAR) partnership, are member firms of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

The KPMG name and logo are trademarks used under license by the

independent member firms of the KPMG global organisation.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance.