The Base Erosion and Profit Shifting (BEPS) Project addressing the Tax Challenges arising from the Digitalisation of the Economy – resulted in a two-pillar approach:

- Pillar One aligns taxing rights more closely with local market engagement and departs from using physical presence as a nexus.

- Pillar Two is an agreement on a global minimum level of taxation of 15%.

Pillar Two is relevant for groups that have reported annual revenues of EUR 750 million or more in their consolidated financial statements in at least two of the four preceding fiscal years. If your group does not meet the threshold, you should still check – based on the ownership structure – that the group does not belong to a larger group with an obligation to consolidate (e.g. a family office, foundation, etc.).

Work on both Pillar One and Pillar Two is under way, but Pillar Two is more advanced. Originally expected for 2023, the global minimum tax of Pillar Two is unlikely to be in place that early. Although some questions remain open, international developments indicate that Pillar Two is on track for implementation at the start of 2024 in many countries – including Switzerland.

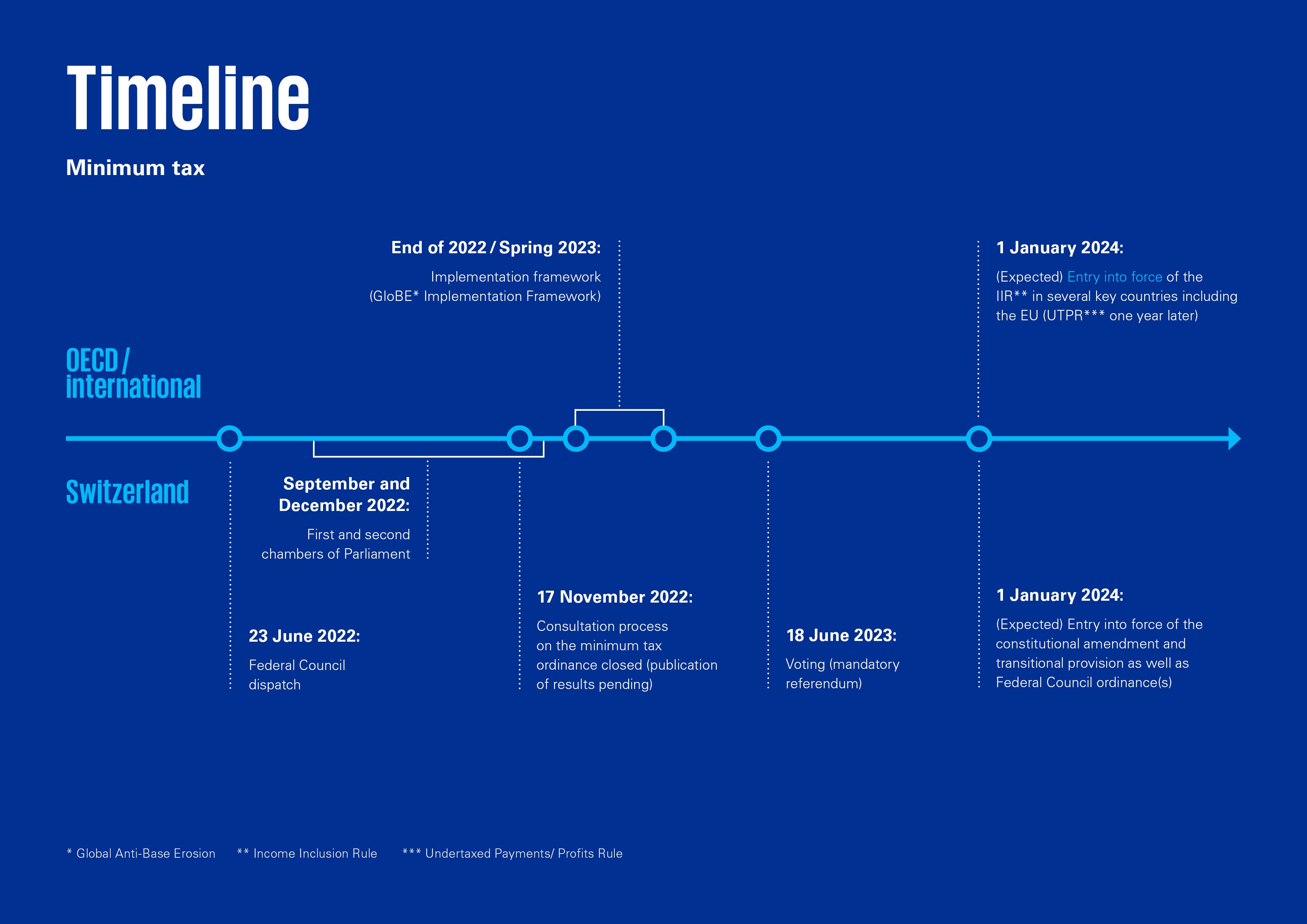

Swiss and OECD timeline for Pillar Two

Switzerland is on track to meet the OECD’s timeline for the introduction of global minimum tax.

The Pillar Two concept will be implemented by more than 100 countries worldwide. Your specific reporting and compliance obligations will be driven by the implementation timeline.

While there is still some uncertainty for a small number of countries, it seems likely that most countries – including Switzerland – will implement Pillar Two for financial years starting on or after 31 December 2023. This means you’ll need to be able to quantify and report the possible additional tax burden in 2024. By then you’ll need to have implemented the relevant governance, processes and systems.

For most MNE groups, the first Pillar Two tax return will likely have to be filed in June 2025 or later. However, companies should be aware that investors may expect disclosures about the potential impacts before changes to local tax laws are finalized. If you expect the global minimum taxation to significantly affect you, and this information is relevant to the users of your financial statements, you should consider providing disclosures in your 2022 annual report.

Further information in this regard can be found here: Global minimum top-up tax under BEPS 2.0.

What information will you need to collect?

The GloBE model rules published by the OECD for Pillar Two address about 150 different data points and elections that need to be managed. We have a proven data mapping approach to align the GloBE rules with the data available in your organization. We offer a full-day Discovery Workshop to help you identify the relevant data in your systems and data landscape.

Your group will have to decide between designing your own Pillar Two computation engine, licensing a product from the market or outsourcing the computation to an external provider.

The KPMG BEPS 2.0 Model has been designed to model the Pillar Two impact on your group based on your specific circumstances (see also below).

Our project approach

Our phased approach helps you prepare for Pillar Two – wherever you currently stand on your implementation journey.

Phase 1: Kick-off

First of all, we align on status and timeline and then define relevant stakeholders and team members.

Phase 2: Assessment

We help you determine pilot countries/entities for data mapping and perform an initial high-level impact calculation using the KPMG BEPS 2.0 Model if appropriate.

Phase 3: Selection

This is about process definition and structuring, including definition of end-to-end data management and choosing appropriate technology.

Phase 4: Implementation

In this phase, we focus on compliance requirements and technology implementation.

Contact our experts

Our team of experts is experienced in guiding groups through the implementation process. We’re ready to support your Pillar Two project through an approach that:

- Is tailored to your needs, timeline and in-house skills and capacities

- Reflects the KPMG Pillar Two project methodology

- Includes access to KPMG’s Global Pillar Two working group – and all our lessons leaned on Model Rules interpretation, best practices and technology