Banks and their clients face numerous international compliance requirements. KPMG Switzerland offers a successful tax compliance technology called "Multishore Tax Reporting" (MTR).

KPMG’s tax reporting software is developed in-house, which makes it extremely agile. This is an advantage in today’s dynamic world, where regulations change frequently. Additionally, we are ensuring tax compliance leveraging KPMG’s global tax network. This makes for a powerful combination. Amongst other services, KPMG’s experienced and international team in Zurich produces high-quality tax reports with MTR. The tax reports are used by clients for their tax returns in their country of residence.

We serve some of the largest global private banks, cantonal banks as well as online banks by constantly offering new, efficient ways to support their clients’ need.

MTR represent who we are: agile, efficient, high-performing and ready to redefine the future of tax reporting.

> 1 Mio reports produced per year

22 countries covered

4-5 new country modules per year

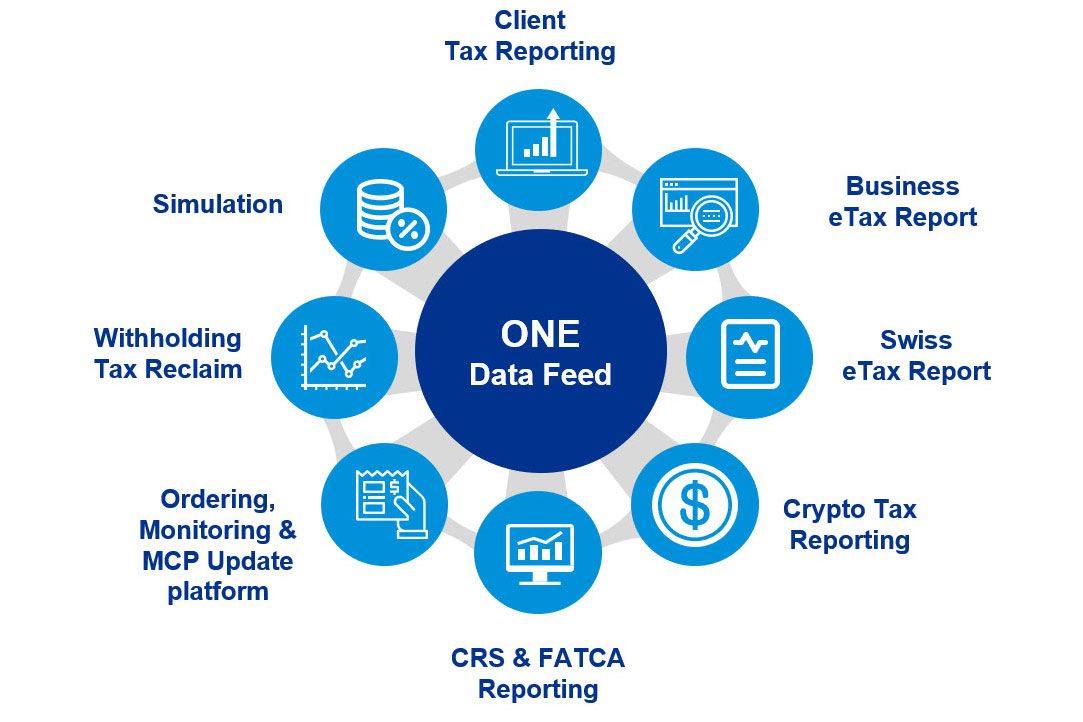

The MTR Ecosystem

ONE data feed – ONE process – SEVERAL services

MTR is much more than a tax report. Using our innovative solution, based on one data delivery and one end-to-end process for all MTR functionalities, our customers can benefit from additional services which are of importance and helpful to the bank clients:

- a simulation feature that allows you to view your tax position at any time (especially before years end, as well as before an investment)

- Withholding Tax Reclaim service

- special reporting types (Crypto, CRS & FATCA)

- eTax Reports for Switzerland

- eTax Reports for German business clients and many more.

Covered countries

MTR offers tax reports for the countries where your clients are domiciled. We are constantly expanding our coverage and it currently takes us only 3-4 months to add a new country module and can add up to 5 per year. Today, KPMG provides tax reporting services on a global scale. Countries served:

1. Argentina

2. Austria

3. Belgium

4. Brazil

5. Canada*

6. Denmark

7. Finland

8. France

9. Germany

10. Greece

11. Indonesia

12. Israel

13. Italy

14. Mexico

15. Netherlands

16. Portugal

17. South Africa

18. Spain

19. Sweden

20. Switzerland

21. Turkey

22. United Kingdom

23. US Generic Plus

Furthermore, we also provide Generic Plus Reports in six languages and several currencies.

*Semi-automated processing offered

Your benefits

There are numerous advantages when using KPMG’s Multishore Tax Reporting.

Only provider

One provider for various services with a unique in-house team combining software development and tax law.

High quality

High-quality tax reports according to current tax law for numerous countries, ensuring yearly country module updates.

Customer satisfaction

Our qualified and experienced experts in international tax law ensure a very high customer satisfaction level.

Banking secrecy

We produce in Switzerland and our services are provided in compliance with Swiss banking secrecy.

We currently support financial institutions in 7 countries

- Germany

- Monaco

- Singapore

- Spain

- Switzerland

- United Kingdom

- United States