Companies and the capital market play a key role as we transform our current economic system into a sustainable model. Investors and consumers alike expect – and need – more transparency on companies' sustainability strategy and performance. This is essential to enable a functioning market and ensure that the necessary funding flows into suitable projects as well as assessing whether the path taken is the right one.

In the following sections you will find detailed information on these topics:

Disclosure requirements in Switzerland

Sustainability information is also growing in importance for Swiss companies and is increasingly factored into the corporate and investment decision making of investors and other stakeholders. For many large companies in Switzerland, reporting on environmental, social and governance (ESG) aspects is already standard practice. According to KPMG’s Survey of Sustainability Reporting 2022 "Big shifts, small steps", 82%, of the 100 largest Swiss companies have already established sustainability reporting. However, smaller companies, and especially listed ones, are under increasing pressure to do so as well in light of the indirect counterproposal to the Responsible Business Initiative (RBI).

Indirect counterproposal to the RBI

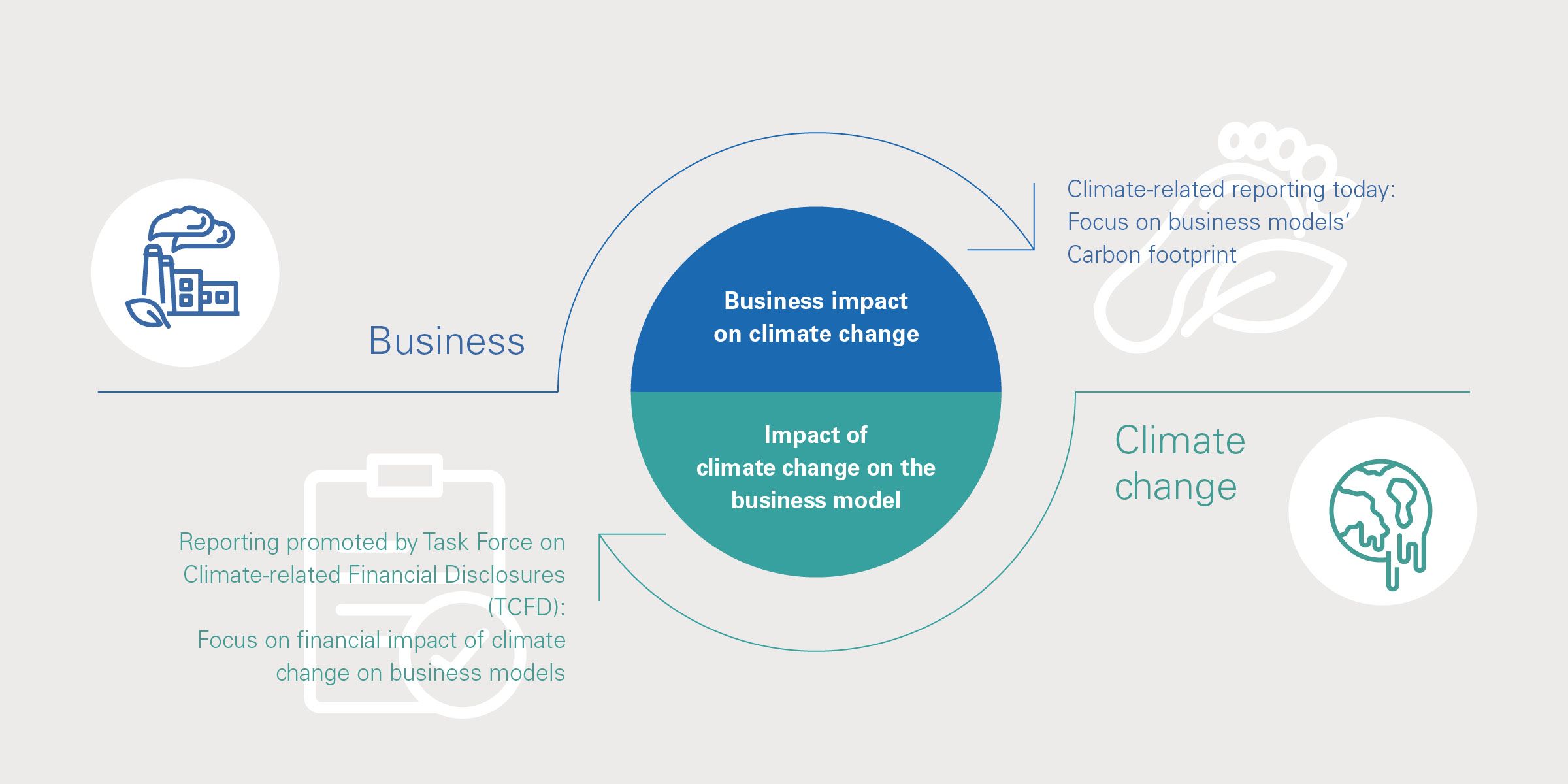

With regard to sustainability reporting, the indirect counterproposal provides for a reporting obligation based on the EU's Non-Financial Reporting Directive (NFRD). Public interest companies whose FTEs, revenue or balance sheet total exceed defined thresholds should report annually on environmental and social issues, employee issues, respect for human rights and anti-corruption. Disclosures must be made if they are relevant in order to understand the company's development, results of operations and financial position, as well as the company's impact on these issues (known as "double materiality"). The proposed law does not specify a reporting standard. This means that companies reporting for the first time can concentrate initially on those reporting elements required by law. Besides the general transparency requirements, new reporting and due diligence rules in the area of conflict minerals and child labor might be relevant for a broader scope of companies.

How do you asses the meaningfulness of the current non financial/sustainability report?

84% of asset managers and 89% of pension funds consider the current non-financial/sustainability report as not sufficiently meaningful.

Findings are from the 9th SWIPRA corporate governance survey, which is conducted annually together with researchers from the Department of Banking and Finance at the University of Zurich and concurrently surveys institutional investors and listed companies. KPMG supports this survey. www.swipra.ch/survey

Implementation of the TCFD recommendations

In addition to the due diligence and corresponding transparency requirements on child labor and conflict minerals contained in the counterproposal to the RBI, the Federal Council has instructed the Federal Department of Finance (FDF) to prepare for binding implementation of the recommendations of the global Task Force on Climate-related Financial Disclosures (TCFD). This means that in the foreseeable future, Swiss public companies will have to make disclosures on climate-related risks and opportunities and any financial impacts.

Besides the previous impact-focused reporting, the TCFD recommendations drive a new perspective that sets out the environmental, social and economic effects. Transparency is now explicitly required with regard to how climate change affects companies themselves, including any financial consequences that may result. As a result, this section of the report is more investor-oriented and – accordingly – prominent, which can also be associated with increased legal risks.

CSRD: Reporting obligations at EU level

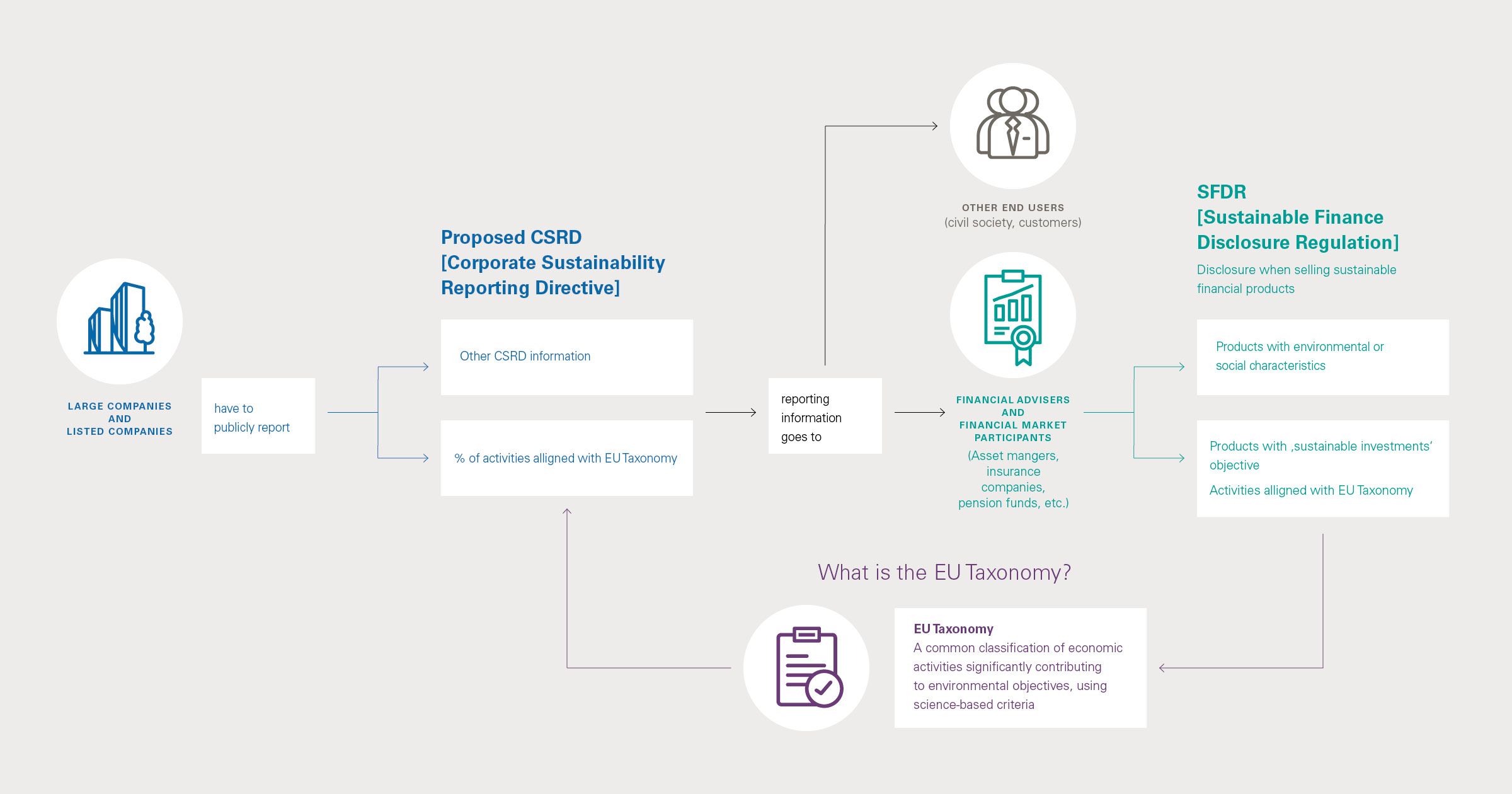

At the EU level, the Corporate Sustainability Reporting Directive (CSRD) is set to replace the current NFRD and could enter into force as soon as 1 January 2024 for the 2023 financial year. The CSRD already goes a major step further: the separate sustainability report has become obsolete – from now on, it will be mandatory for companies to communicate their non-financial information in the management report and to have this audited by an external auditor. In addition, the directive provides for mandatory application of uniform EU reporting standards.

This is the European Commission's way to increase the reliability and comparability of sustainability reporting. However, it also brings new and complex challenges, particulary to companies confronted with a reporting and auditing obligation for the first time. Companies need to act quickly to prepare their internal processes around content, formal requirements and the external assurance. In the future, around 49,000 EU companies – compared to 11,000 in the past – will have to report under the CSRD, including many offshoots of Swiss groups that will also have to deal with the new regulation.

EU taxonomy – a classification system for sustainable economic activities

The new regulations also include the requirements of the EU taxonomy, which is a uniform classification system for environmentally sustainable economic activities. A classification system for social aspects is also to be established at a later date. Under the EU taxonomy, financial market participants in the EU area as well as corporates, which are already required to report under the Non-Financial Reporting Directive (NFRD, Directive 2014/95/EU), will be subject to new information and reporting obligations in connection with their non-financial reporting and will have to communicate key figures relating to their taxonomy-compliant economic activities.

For financial market participants, this means that the EU taxonomy, with its predominantly quantitative criteria, will determine which financial products can actually be called sustainable.

The EU taxonomy obliges corporates to disclose “taxonomy ratios”, which make it easier for investors to identify which companies and investments are more sustainable and therefore to be favored in investment decisions. Specifically, the portion of sales, capital expenditures and operating expenses that are aligned with the taxonomy must be disclosed annually.

Swiss companies that are not directly subject to EU regulations may still find themselves affected by these requirements. As a common language between investors and companies, the taxonomy will gain widespread significance and be an essential consideration for access to financing and promotion of any organization's sustainability.

Looking ahead: What will future reporting look like?

The discussion of regulatory changes and requirements at EU level and in Switzerland shows:

Legislators – particularly in the EU but also in Switzerland – are taking capital market participants to task. Strong transparency requirements are seen as the basis for effective capital allocation that will enable sustainability targets to be met. For companies, this means disclosing more information. At the same time, this information will have to meet high standards in terms of quality. Longer term, increasing comparability and transparency will also have an impact beyond reporting. Companies will need to review their strategy, establish governance structures and introduce appropriate control and assurance measures in response to growing investor relevance. Implementation is an urgent task given that a majority of pending obligations will apply as early as 2023. The board of directors in particular, but also management, need to take action now.

Are any adjustments in the non-financial/sustainability report expected?

More than 90 % of companies expect adjustments or significant adjustments in their non-financial/sustainability report in the next two years.

Findings are from the 9th SWIPRA corporate governance survey, which is conducted annually together with researchers from the Department of Banking and Finance at the University of Zurich and concurrently surveys institutional investors and listed companies. KPMG supports this survey. www.swipra.ch/survey

Talk to our ESG experts

Companies face complex tasks in the first few years of application. If your company is subject to reporting requirements for the first time, you will need to examine the new requirements at an early stage, define responsibilities and consider their future reporting strategy. Our experts can support you in implementing these new requirements.

Hot topics & thought leadership

- Businesses must act sustainably (in German)

- RBI: Federal Council enacts changes to the indirect counter-proposal

- Net-zero commitments – Where's the plan? A guide for companies

- Towards net zero – World's largest companies report on climate risks

- The time has come – KPMG Survey of Sustainability Reporting 2020

- WEF IBC common metrics – Measuring Stakeholder Capitalism