The Swiss Real Estate Sentiment Index (sresi®) is a measure of the expectations for developments on the real estate investment market over the next twelve months.

Key findings

Over 350 industry representatives took part in the 2023 sresi survey. Together, they represent an investment and valuation volume of around CHF 350 billion. This means that the Swiss Real Estate Sentiment Index presents a representative and broadly based picture of expectations for forthcoming developments in the Swiss real estate investment market.

The series has now been running for more than 10 years, making it possible to evaluate and analyze the current situation in the context of historical trends.

sresi at a new all-time low

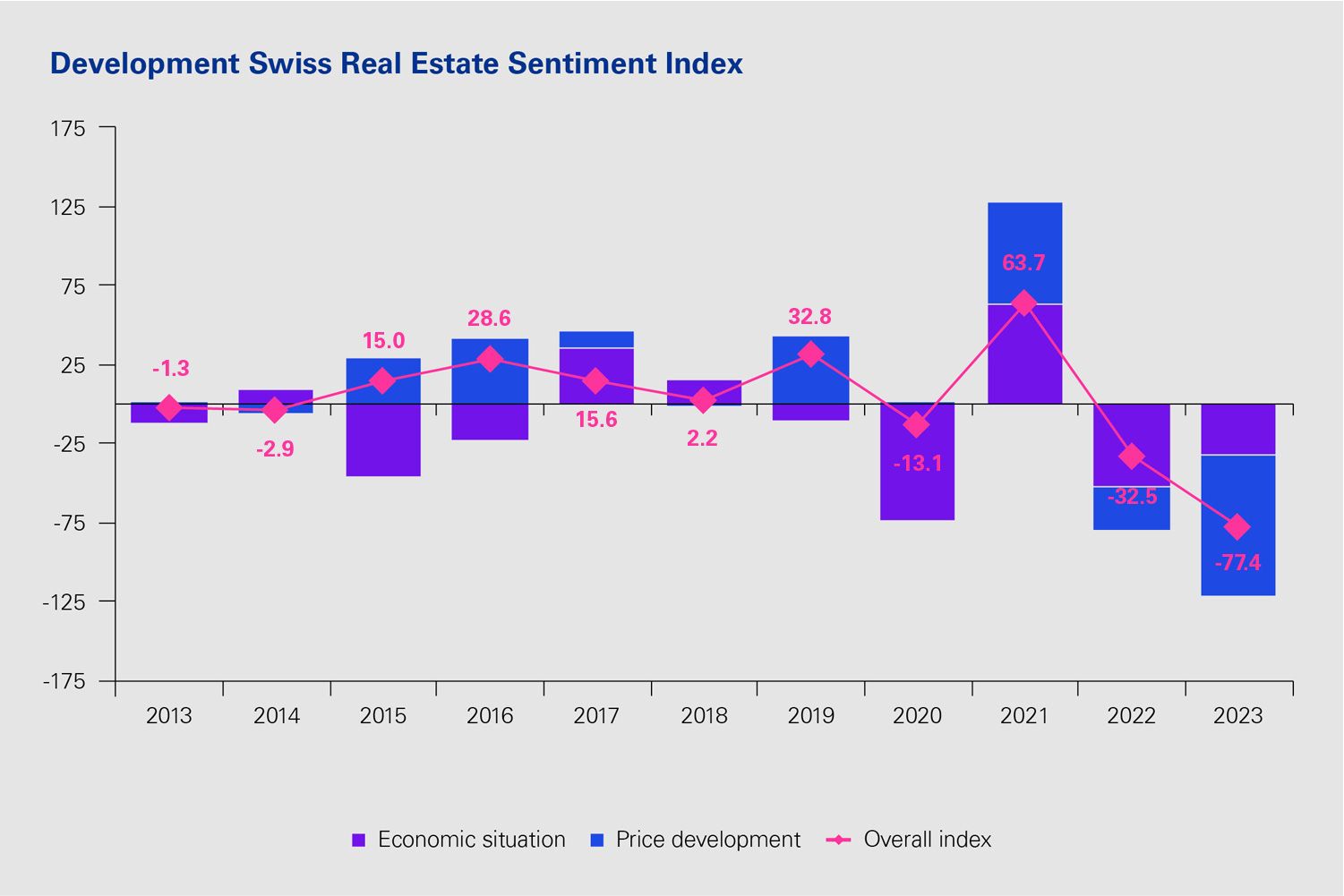

The aggregated index shows that sentiment in the Swiss real estate investment market is currently worse than it has ever been since the Swiss Real Estate Sentiment Index was first compiled. Whilst expectations for economic growth are a little more optimistic than last year, the assessment of price trends is distinctly negative, once again dragging the sresi to an all-time low.

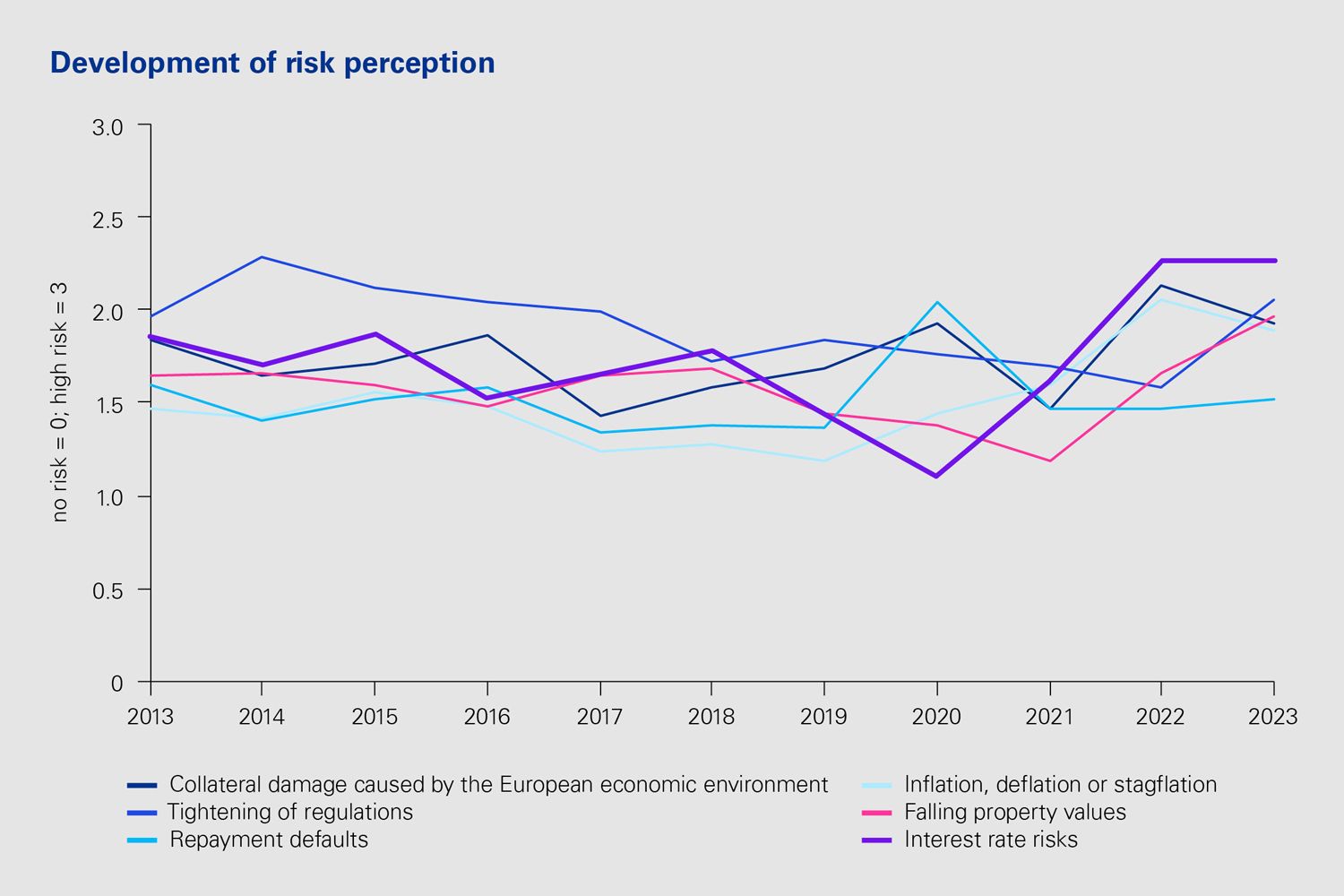

An indication of the reasons for this development can be found in market participants’ assessment of risk. The perceived interest rate risk has more than doubled compared to 2020 and has increased since last year. The perceived risk of falling property values and tighter regulation has also continued to increase.

Learn how index movements and assessments of risk vary across the different respondent groups. Visit our interactive dashboards with all the survey results over the entire series.

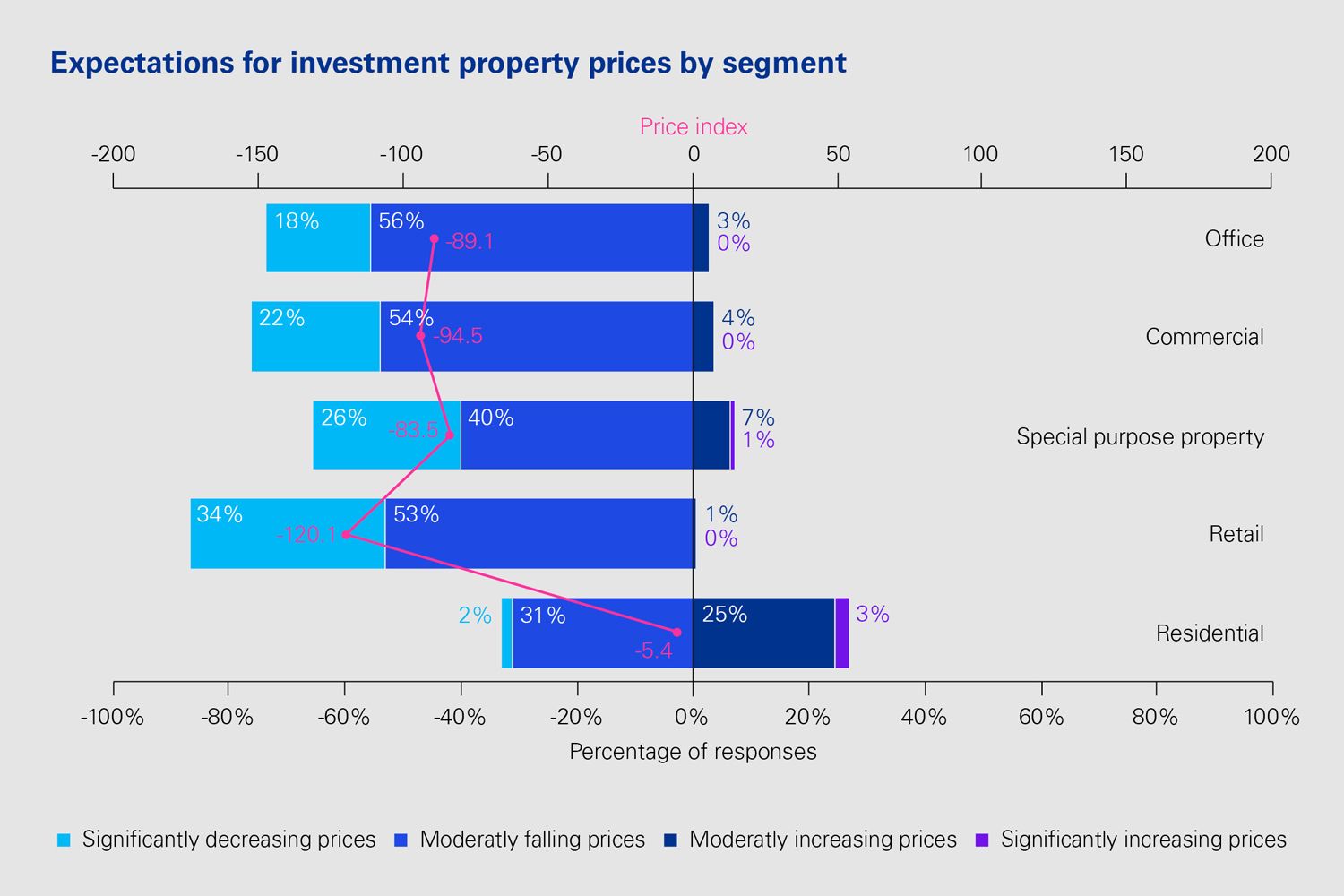

Negative price expectations for all segments and locations

For the first time since the launch of the sresi survey, price expectations are negative for all real estate segments. One-third of survey respondents expect prices to fall even for residential properties. Well over 50% report negative expectations for the other real estate investment segments.

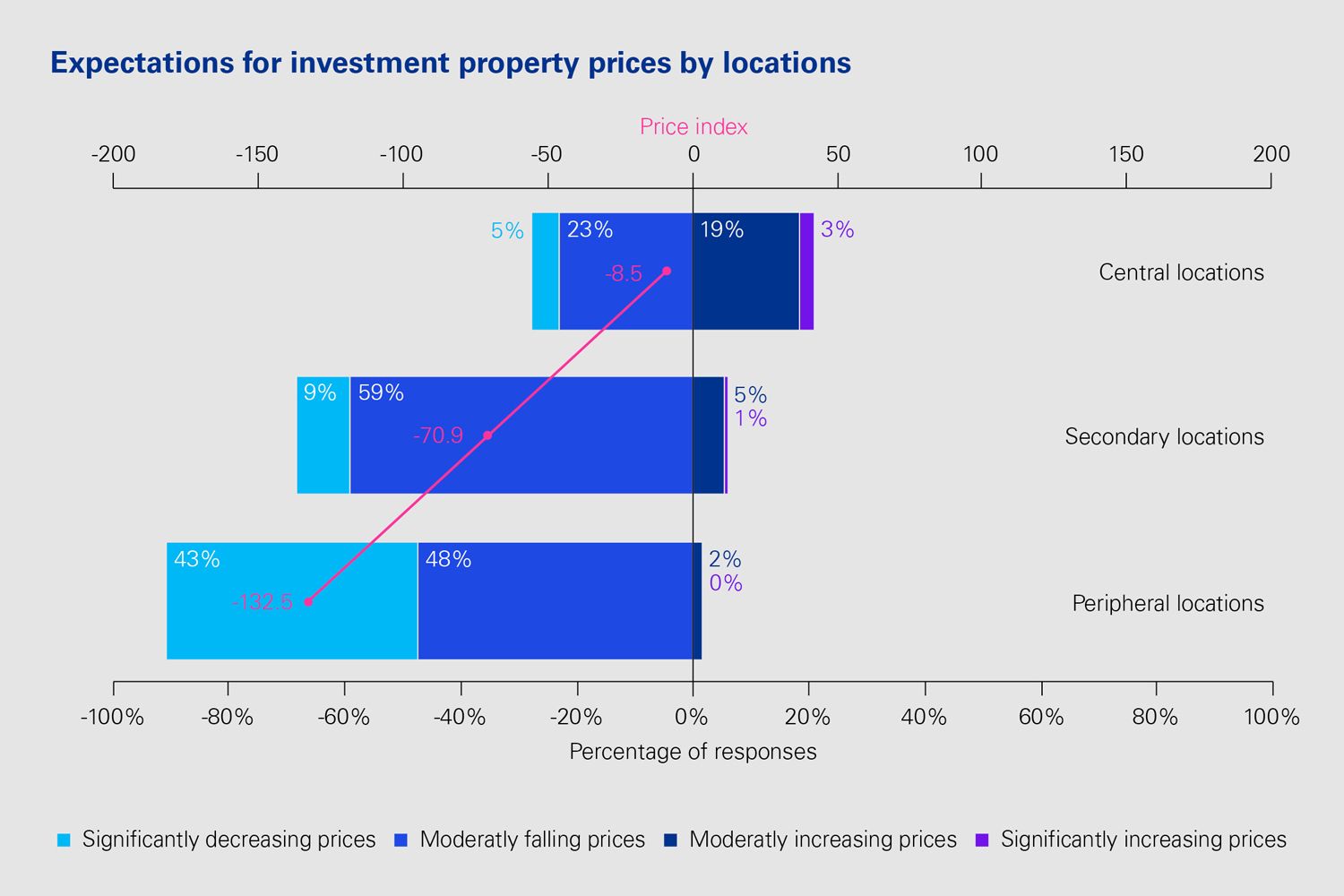

Expectations for movements in prices in central locations have never before been negative. 28% of survey respondents expect prices to fall in the principal centers, dragging the price index into negative territory. Almost 100% of those surveyed expect prices in peripheral locations to fall.

Learn how movements in the index vary between individual economic centers and major regions. Visit our interactive dashboards with all the survey results over the entire series.

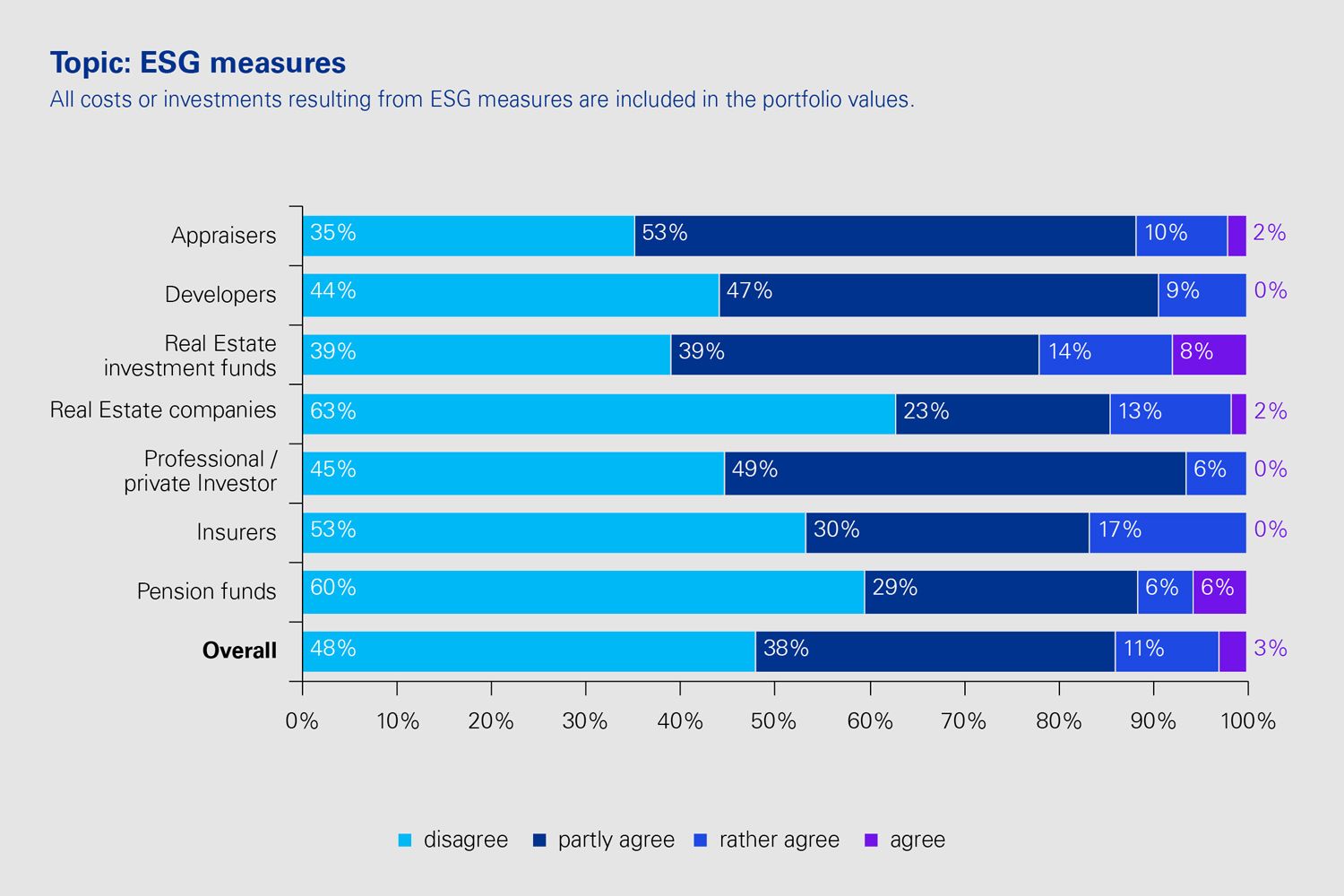

Special topic ESG: clear-cut opinions

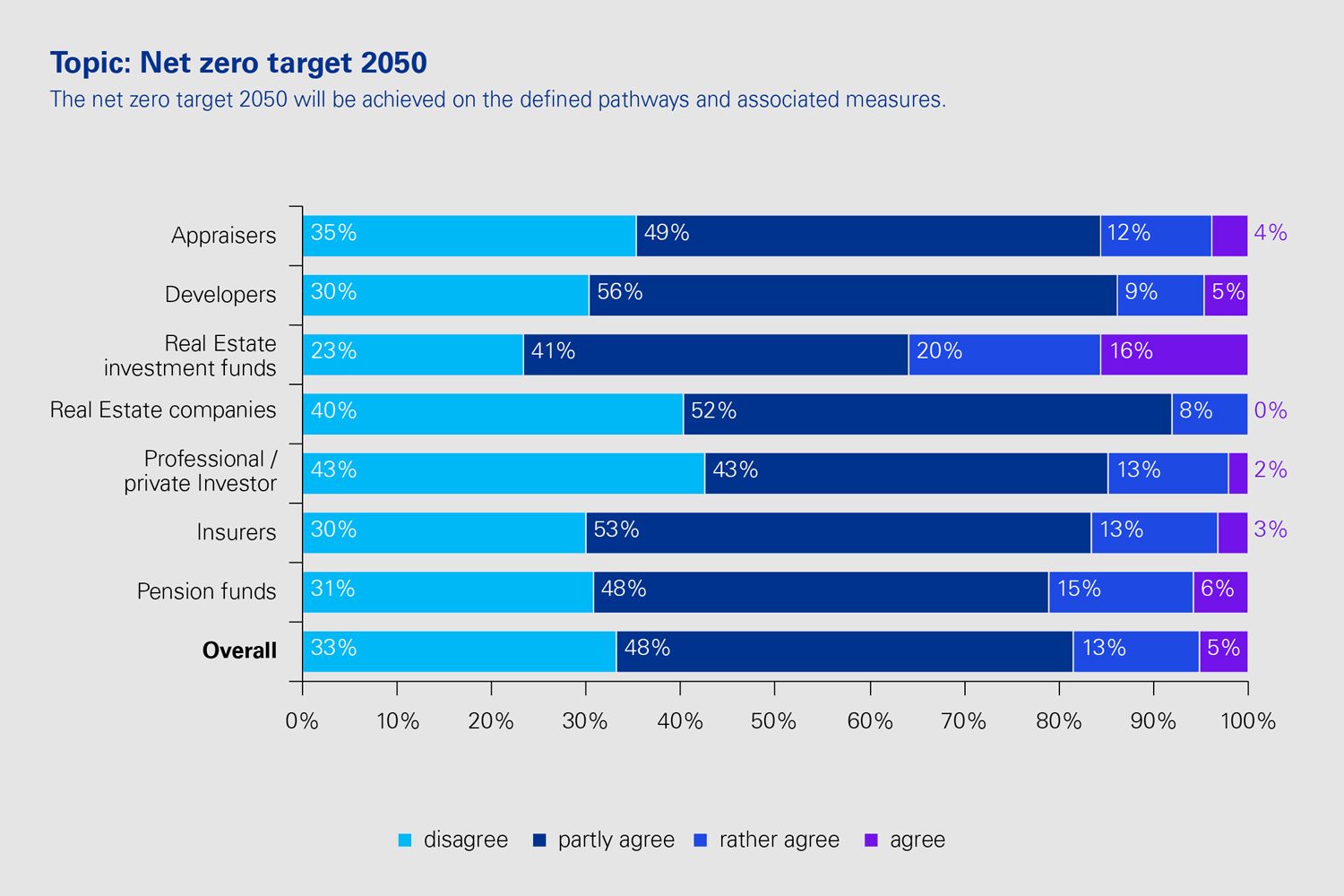

Only 18% of those surveyed believe that the 2050 net zero target can be achieved by following the defined reduction routes and associated measures. Those representing the real estate funds are the most confident that this can be achieved.

Discover market participants’ opinion on other ESG-related topics – e.g. ESG key data and social considerations in real estate valuation and regulation. Visit our interactive dashboards with all the survey results over the entire series.