- Swiss Tax Report: slight decline in tax rates levied on corporate profits and top incomes

- Tax transparency: 80 percent of the 150 largest SIX-listed companies do not publish tax transparency reports.

- Environmentally related taxes account for roughly 6 percent of total tax revenue in the European Union and will become increasingly important given the challenges looming ahead.

- Global minimum tax: tight timetable for Switzerland

The global tax landscape is in a state of flux – with consequences for Switzerland and companies domiciled in the country. Switzerland might be an attractive location for both businesses and private individuals, but when it comes to the introduction of a global minimum tax for large corporations, the country needs to take swift action to prevent the risk of disadvantages. The topics of environmentally related taxes and tax transparency are also becoming increasingly important and could pose challenges for some companies.

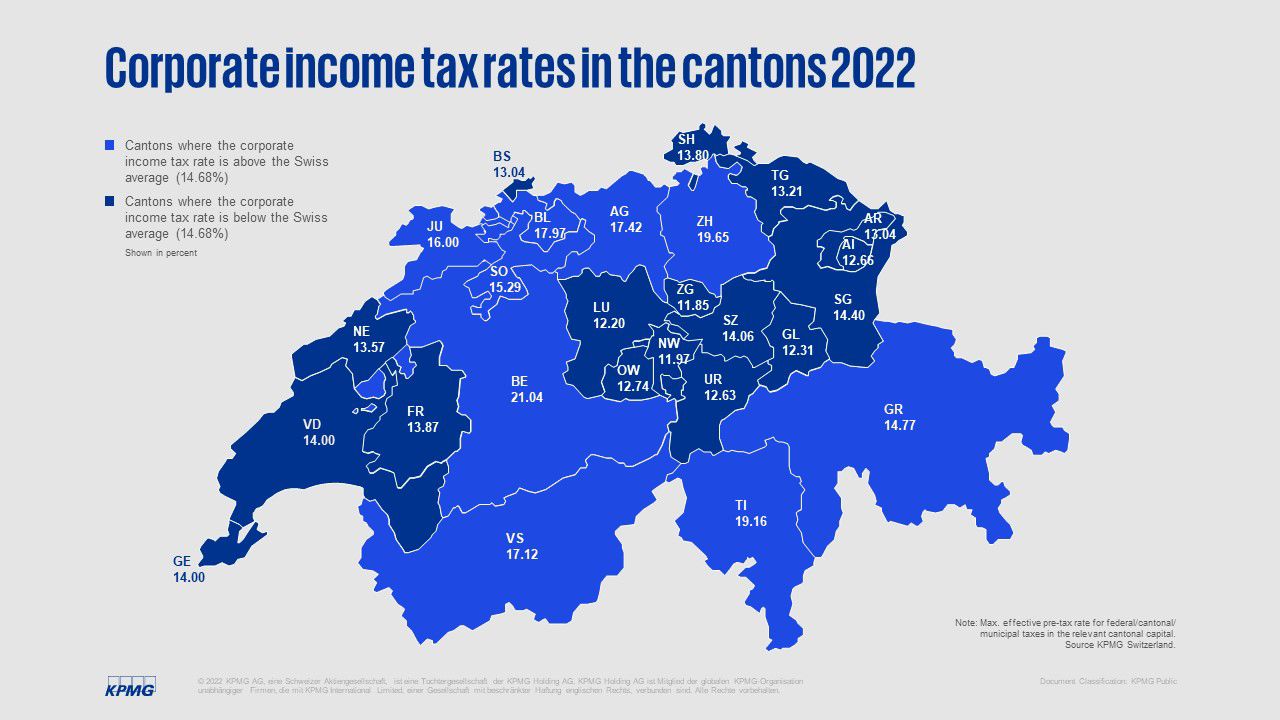

Corporate tax rates in Switzerland down slightly

The ordinary corporate tax rates for businesses in Switzerland have declined slightly year over year – from 14.9 percent to 14.7 percent. That is due in particular to the tax cuts made in the cantons of Valais (-1.6 percentage points), Aargau (-1.1 percentage points, subject to popular referendum on 15 May 2022) and Jura (-1.0 percentage points). The cantons of Central Switzerland and the cantons of Glarus and Appenzell Innerrhoden still levy the lowest ordinary corporate tax rates. The Canton of Zug, for instance, tops the rankings with a rate of 11.9 percent, followed by the cantons of Nidwalden (12.0 percent) and Lucerne (12.2 percent). The Canton of Bern brings up the rear with a corporate tax rate of 21.0 percent.

Compared with other countries around the world, Switzerland taxes companies at a low rate. Lower tax rates than those levied in the low-tax cantons can only be found in the traditional offshore domiciles, Guernsey, Qatar and a few countries in (South-)Eastern Europe. Ireland remains Switzerland’s most important competitor in Europe.

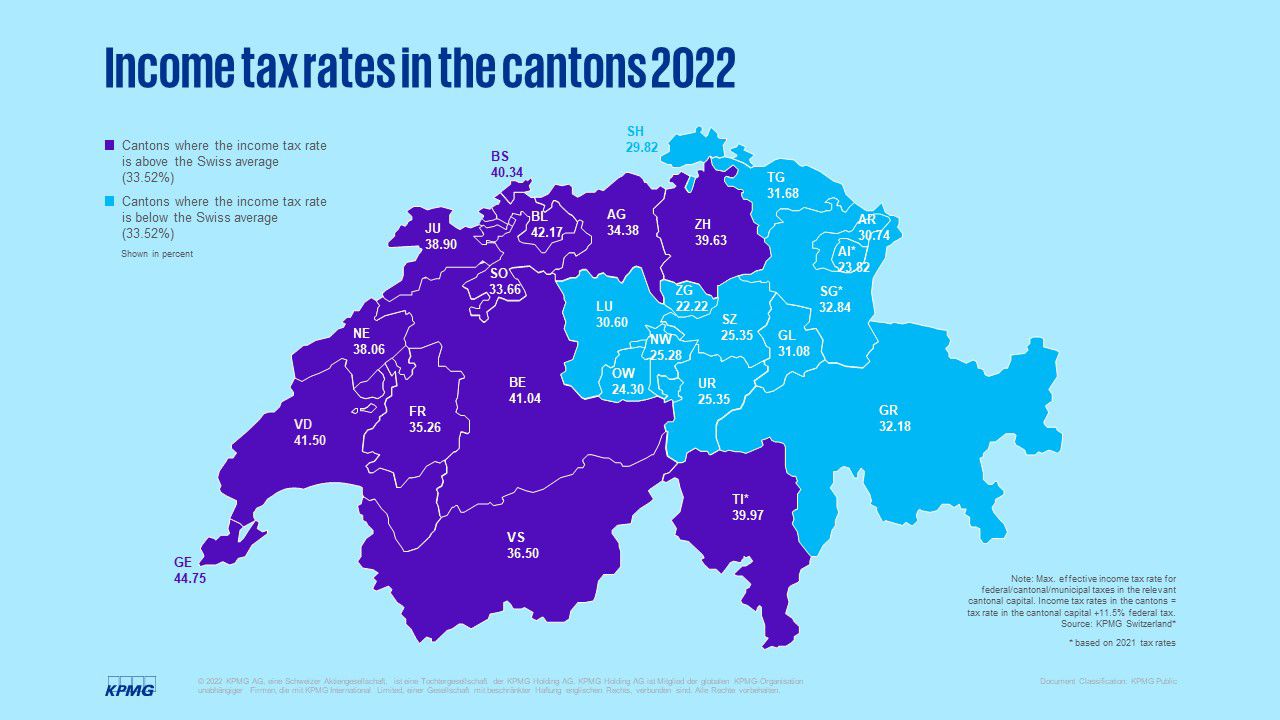

Nearly half of the cantons offer breaks to top earners

Even Swiss tax rates for top incomes have declined slightly compared to the previous year, from 33.7 to 33.5 percent, due to the fact that twelve cantons made slight cuts to their tax rates for top incomes. The biggest cuts were made by the cantons of Schwyz (-1.5 percentage points), Schaffhausen (-1.0 percentage points), Thurgau and Lucerne (roughly -0.6 percentage points each).

Top incomes are taxed at the lowest rates in the cantons of Zug (22.2 percent), Appenzell Innerrhoden (23.8 percent) and Obwalden (24.3 percent). The highest tax rates are applied in the cantons of Geneva (44.8 percent), Basel-Landschaft (42.2 percent) and Vaud (41.5 percent).

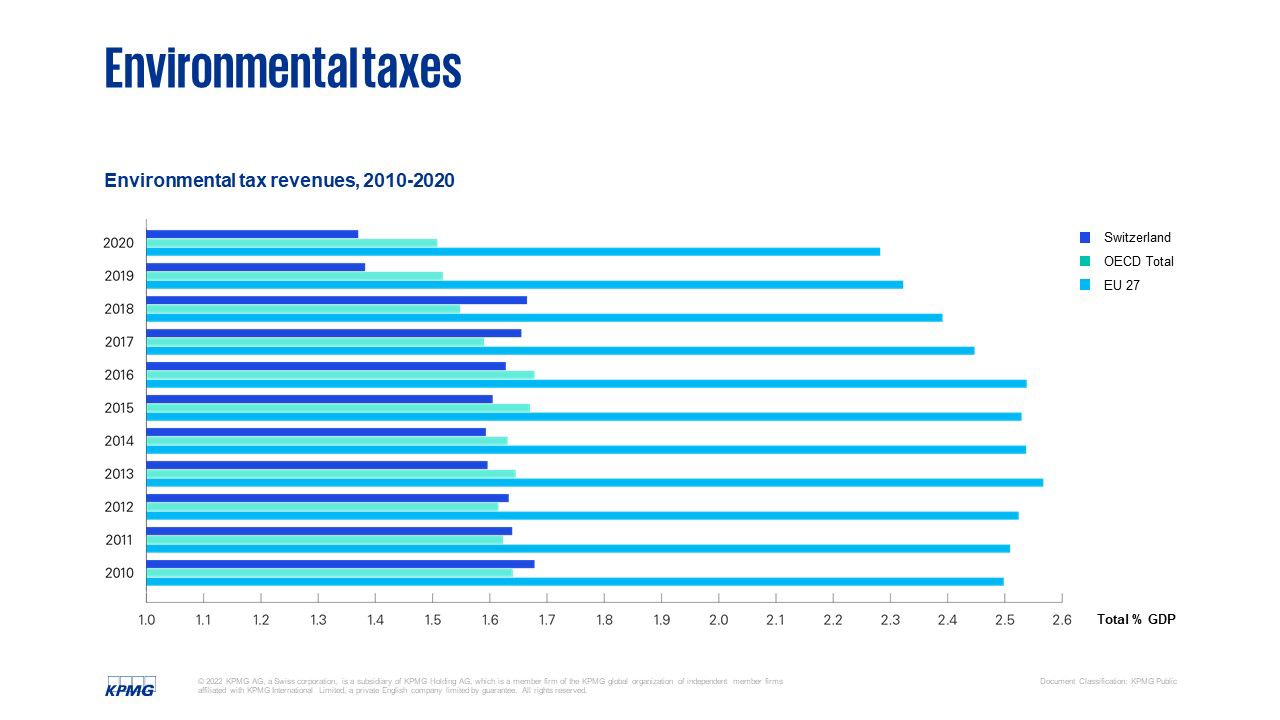

Focus on environmentally related taxes

Nations around the world are banking on so-called “green” taxes in an effort to both boost tax revenue and implement the polluter-pays principle on environmental issues. These taxes cover a broad spectrum of approaches that ranges from energy taxes and emission-based measures to traffic taxes and even taxes levied based on environmental pollution, resource management and waste disposal. Environmentally related tax revenues are still low as a percentage of GDP, with OECD statistics showing that they amount to around 1.5 percent in OECD member states, approximately 2.3 percent in the EU and some 1.4 percent in Switzerland.

“The expected entry into force of major environmental policy measures regarding the taxation of CO2 emissions and plastic will trigger a substantial increase in the share of environmentally related taxes as a percentage of total tax revenue going forward,” forecasts Anne Marie Anselmi, tax expert at KPMG.

Despite the fact that recent statistics indicate a slight decline in environmental tax revenue relative to GDP from 2019 to 2020, this decline mainly reflects delays in environmental policy implementation and adaptations to tax regulations made during that timeframe. “While countries’ focus in the past two years has primarily been on coping with the coronavirus pandemic, governments need to act swiftly to shift the focus of their budgets on the next looming crisis: climate change. Environmentally related taxes are one way of boosting tax revenue while simultaneously creating targeted incentives to promote a more sustainable economy,” says Anselmi.

Since environmentally related taxes are implemented quite differently in each individual country, businesses’ scope for action with respect to environmental policy is often unclear, especially when it comes to companies with international operations.

Only 19 percent of companies in Switzerland publish tax transparency reports

At the same time, businesses are finding the topic of tax transparency increasingly challenging as it is evolving into an important metric for assessing a company’s governance concept and is closely linked to other ESG metrics. While many large Swiss enterprises currently publish sustainability reports, these reports only rarely provide a detailed explanation of the tax-related aspects.

A KPMG analysis of the 150 largest companies listed on the SIX Swiss Exchange shows that merely 19 percent of the companies publish tax transparency reports. That will change in the future, since numerous enterprises are expected to be subject to the EU’s Public CbCR directive from 2025 onward. This directive calls for new disclosure requirements for multinational companies that have a presence in an EU country and revenues of more than EUR 750 million a year. The new directive will substantially increase the number of tax transparency reports published.

Global minimum tax: Switzerland needs to hurry

Switzerland cannot escape international tax developments, a fact also made visible by the upcoming introduction of a global minimum tax: The tax rates of 18 cantons are below the minimum corporate tax rate of 15 percent targeted by the OECD. If these cantons or Switzerland neglect to raise their corporate tax rates to this threshold for the companies in question, the difference could be taxed in another country. “At least in the short term, the federal government estimates that the Swiss tax authorities would miss out on around 1 to 2.5 billion Swiss francs in tax revenue that it shouldn’t pass up, particularly in light of the consequences of the pandemic as well as the challenges looming ahead of us,” warns Olivier Eichenberger, tax expert at KPMG.

Given the ambitious timetable defined by the OECD and the G20 nations – with the first components of the minimum tax regulation already entering into force on 1 January 2023 – Switzerland and its political system are facing a major challenge. The Federal Council, for example, has decided to implement the minimum tax by means of a constitutional amendment and to enact a temporary ordinance aimed at ensuring that the minimum tax can be rolled out on 1 January 2024. The electorate is scheduled to vote on the issue on 18 June 2023.

Regardless of the results of that vote, the global minimum tax will have far-reaching implications for international locational competition. It limits the latitude of low-tax countries to position themselves by implementing competitive fiscal policies. “The burden now falls on countries like Switzerland to take targeted steps to cultivate their other location factors, such as access to specialists and flexible labor market conditions,” says Stefan Kuhn, Head of Tax and Legal at KPMG.

Discover more

Interesting topics for you: