- In 2022 Swiss courts reached verdicts on 78 cases of white-collar crime, including seven cases related to Covid-19 loans.

- Total losses came to CHF 581 million, with public institutions accounting for nearly three quarters of this amount.

- Fraudsters victimized private individuals in more than half of the cases.

- Private individuals constituted the largest group of perpetrators, followed by management and professional fraudsters.

- The largest number of cases went to trial in Central Switzerland, while the largest individual case was heard in the Lake Geneva region.

According to the latest edition of the KPMG Forensic Fraud Barometer, Swiss courts examined 78 cases of white-collar crime in 2022 involving per-case losses of at least CHF 50,000. This corresponds to an increase of 10 cases or 15 percent over the previous year. The total loss amount also rose slightly, from CHF 567 million to CHF 581 million. Actual figures are likely to be substantially higher since many cases are never reported in the first place.

Since 2019, white-collar crimes heard by the courts have been on the rise. 48 cases were judged by Swiss courts at that time. "One reason for the increase is that white-collar criminals have found new ways to engage in fraudulent activities in the wake of the Corona pandemic," says Bob Dillen, Head of Forensic at KPMG Switzerland.

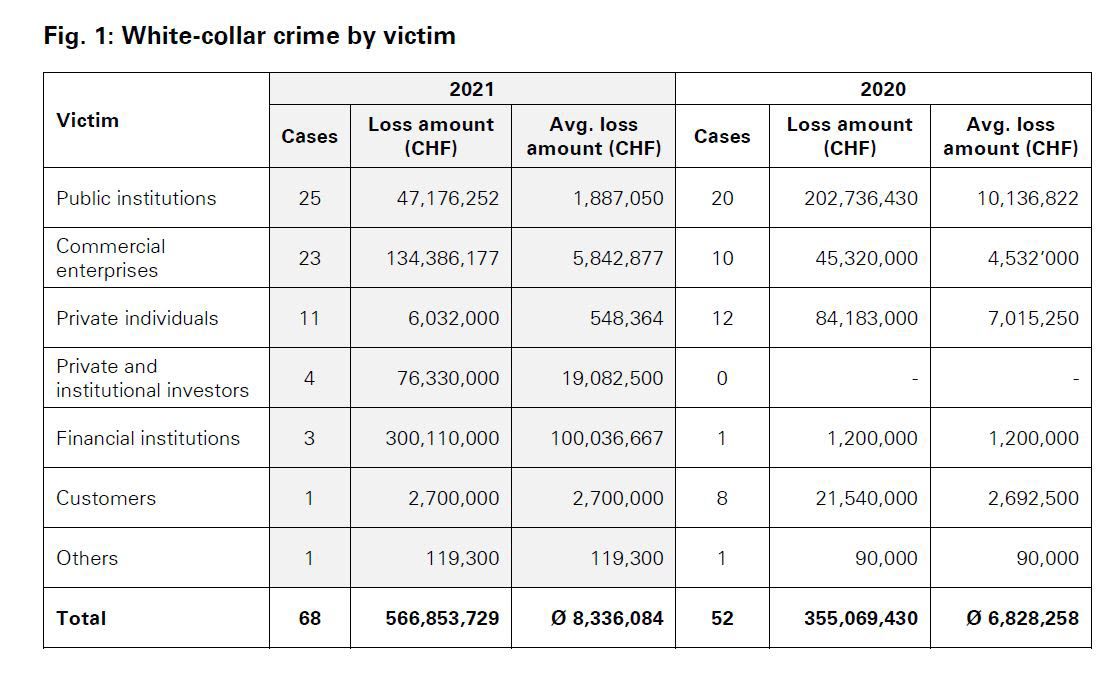

Private individuals hit most frequently by white-collar crime

For the first time in years, private individuals have replaced public institutions as the largest group of victims, with 40 of the total of 78 cases tried by the courts relating to this group. The number of court cases involving private individuals as victims was much lower in the previous year (11 cases).

Public institutions faced biggest loss amount

Public institutions, which had been fraudsters’ most frequent target in past years, were the victims in a comparatively large number of major cases again in 2022. 19 cases of white-collar crime were reported – involving CHF 419 million in losses. This corresponds to nearly three quarters of the total losses and an average per-case loss of over CHF 22 million. “Reasons for the high attractiveness of the public sector for white-collar criminals are, on the one hand, the considerable financial resources managed there and, on the other hand, the often complex structure of public institutions, which can foster weaknesses in the internal control system,” explains Bob Dillen.

Seven cases culminated in convictions related to unlawfully obtained Covid-19 loans. "We expect more white-collar crimes related to the pandemic to come to light, as these can take years to be detected, investigated, and tried in court," says Bob Dillen.

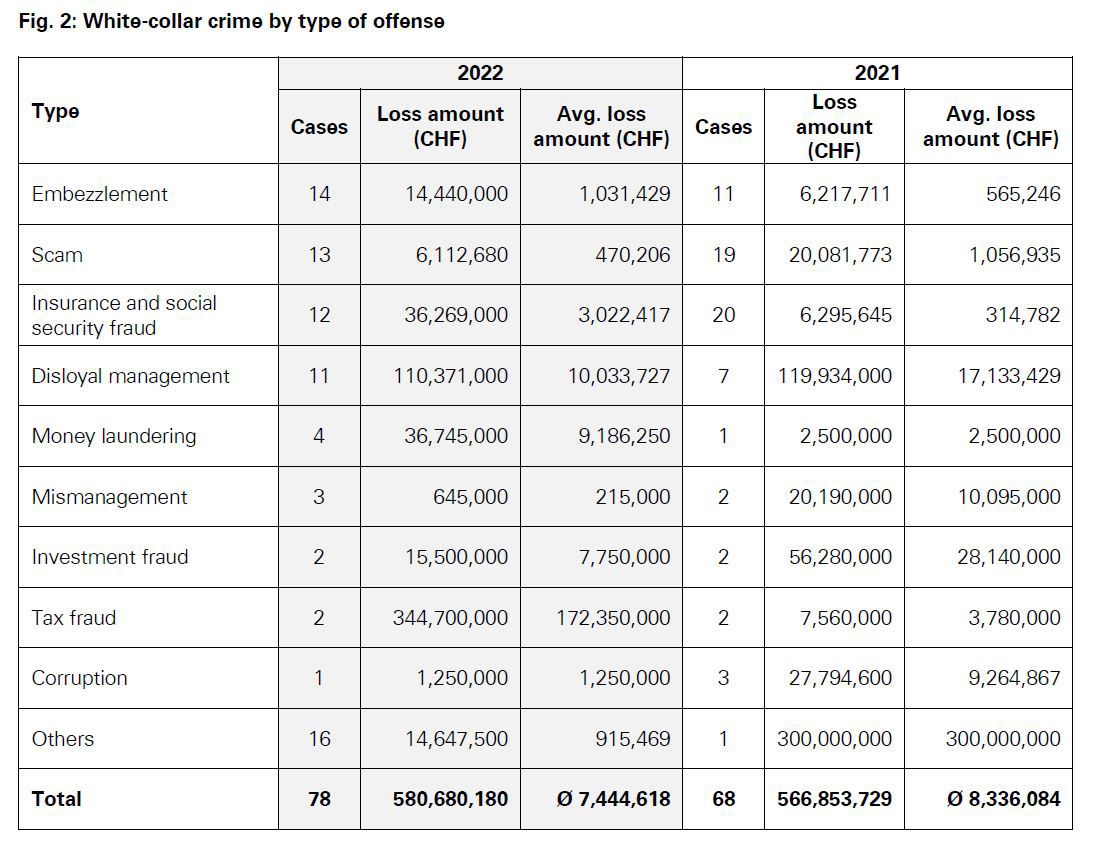

Most common types of crimes: embezzlement and social security / insurance fraud

Despite seven cases related to unlawfully obtained Covid-19 loans, social security / insurance fraud was only the third-most-common type of crime in 2022. While the number of court cases of this nature declined from 20 to 12 year over year, the average loss sustained per case rose nearly ten-fold. Accounting for 14 cases tried in court, embezzlement was the most common type of crime in 2022 – involving an average loss of around CHF 1 million. One remarkable trend is the strong year-over-year increase in the number of cases involving disloyal management – with 11 cases heard in this category in 2022 compared to just seven cases in the previous year.

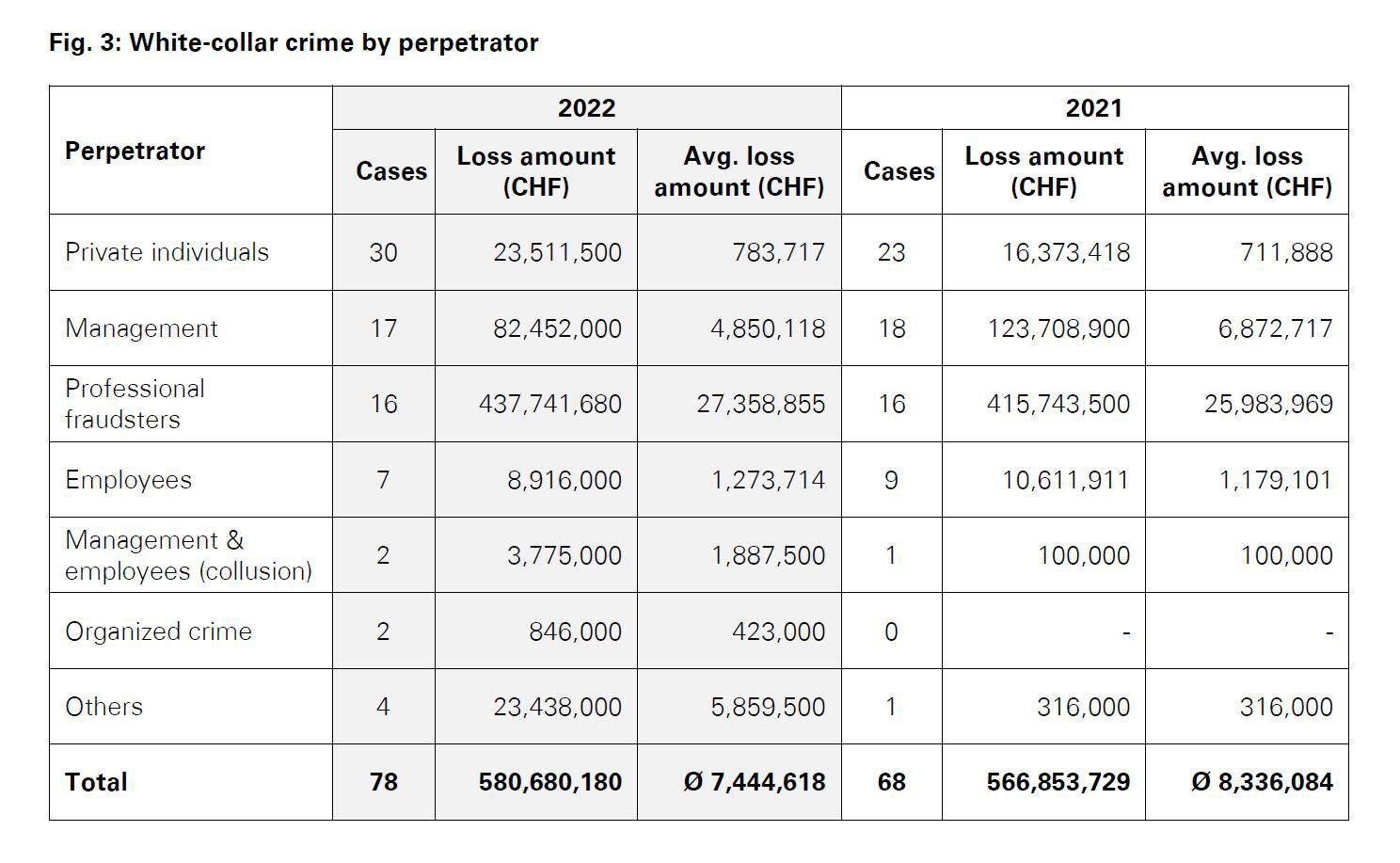

Private individuals remain largest group of offenders

As in the previous year, private individuals comprised the largest group of perpetrators in 2022, with this group being responsible for 30 of the 78 cases of white-collar crime that went to court. The average loss sustained per case amounted to just about CHF 800,000. Members of management were the second-largest group of perpetrators and responsible for 17 cases involving a total loss amount in excess of CHF 82 million. The average loss sustained per case amounted to nearly CHF 5 million, making it around six times higher than the per-case loss attributable to private individuals as perpetrators.

Even though companies and public institutions had fewer court-prosecuted white-collar crimes than in the previous year, one-third of the crimes were committed in the workplace. "The danger from within should not be underestimated," Dillen points out. For those companies and institutions that have not yet fully adapted their compliance requirements and security systems to the new circumstances, the forensics expert recommends upgrading and using available data as well as the latest technologies like machine learning and AI to help prevent and detect fraud. "Since fraudulent activities can never be completely ruled out, additional measures such as introducing a whistleblower platform where employees can report criminal activities and suspected cases are recommended," Dillen continues.

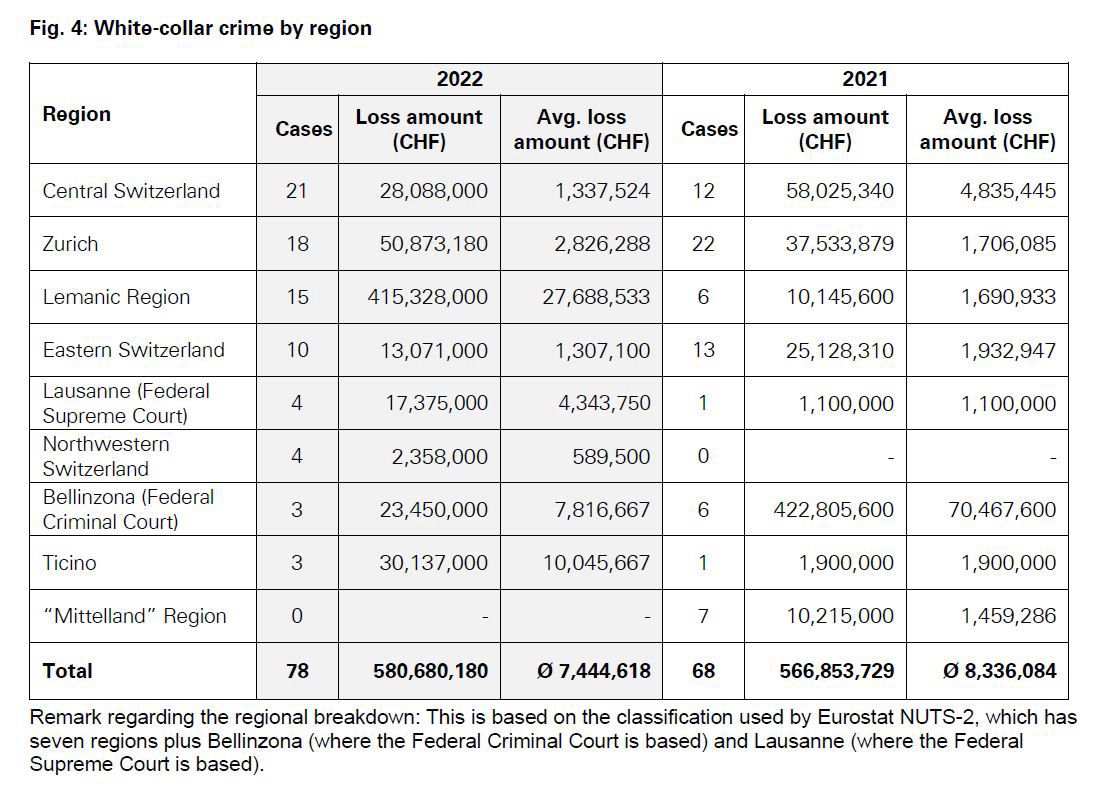

Case count highest in Central Switzerland, largest individual case in the Lake Geneva region

With 21 of 78 cases, just over a quarter of the crimes tried were attributable to Central Switzerland – compared to just 12 cases in the previous year. The region of Zurich reported the second-highest number of cases (18). The Lake Geneva region saw 15 cases of white-collar crime go to court in 2022 compared to six cases in the previous year. One thing that stands out in this region is the high loss amount of over CHF 415 million, which accounts for more than 70 percent of the total loss amount. This is due to a single tax offense (committed by a private individual) involving a loss of CHF 340 million.

| Methodology The KPMG Forensic Fraud Barometer covers all court cases tried in public and reported in the media related to white-collar crime over the course of the year. Data for the study was compiled by analyzing more than 4,500 relevant articles from several different Swiss media outlets in 2022. The current edition of the KPMG Forensic Fraud Barometer only included articles concerning cases of white-collar crimes that have resulted in convictions and involved losses in excess of CHF 50,000. |