- 647 mergers and acquisitions with Swiss involvement and deals worth a total of USD 138.5 billion in 2022

- Most active sectors included Telecommunications, Technology, Industrial Markets, Pharmaceuticals and Life Sciences

- At USD 21 billion, Royal DSM’s takeover of Firmenich SA was the largest M&A transaction of 2022

- Sustainability increasingly becoming a due diligence criterion: Players are ready to pay a sustainability premium of up to 10 percent for takeover targets.

Despite the gloomy economy, the number of mergers and acquisitions with Swiss involvement hit a new record high in 2022 – the number of mergers and acquisitions hasn’t been this high in over ten years. 2022 even surpassed 2021, which had been the record holder to date and featured 604 mergers and acquisitions worth just under USD 170 billion. “Brisk activity on the Swiss M&A market shows that mergers and acquisitions form an integral part of many growth-oriented corporate strategies and will continue to do so in the future. The fact that we’re once again seeing private equity firms involved in around a third of the deals also indicates a solid capital supply situation on the market,” explains Timo Knak, Head of Mergers & Acquisitions at KPMG. He also expects to see a lot of activity in the M&A business in 2023: “Despite ongoing supply chain problems, the war in Ukraine and rising interest rates, investor sentiment is still quite positive.”

Greatest activity in the Technology sector

Nearly half of all transactions took place in the Technology, Media and Telecommunications (TMT) sector, Industrial Markets as well as the Pharmaceuticals & Life Sciences sectors. With 124 transactions and a deal volume of more than USD 14.5 billion, the TMT sector was the most active M&A market, followed by Industrial Markets with 89 deals and a volume of USD 6.5 billion. 82 deals worth just under USD 13 billion were conducted in the Pharmaceuticals & Life Sciences sector.

Swiss companies bought up considerably more of their foreign counterparts than vice versa again in 2022, with 283 acquisitions vs. 152 sales. Domestic transactions (Switzerland/Switzerland) accounted for nearly one in five mergers and acquisitions with Swiss involvement (127 deals). Some 13 percent of all transactions were attributable to international transactions with Swiss vendors (85 deals).

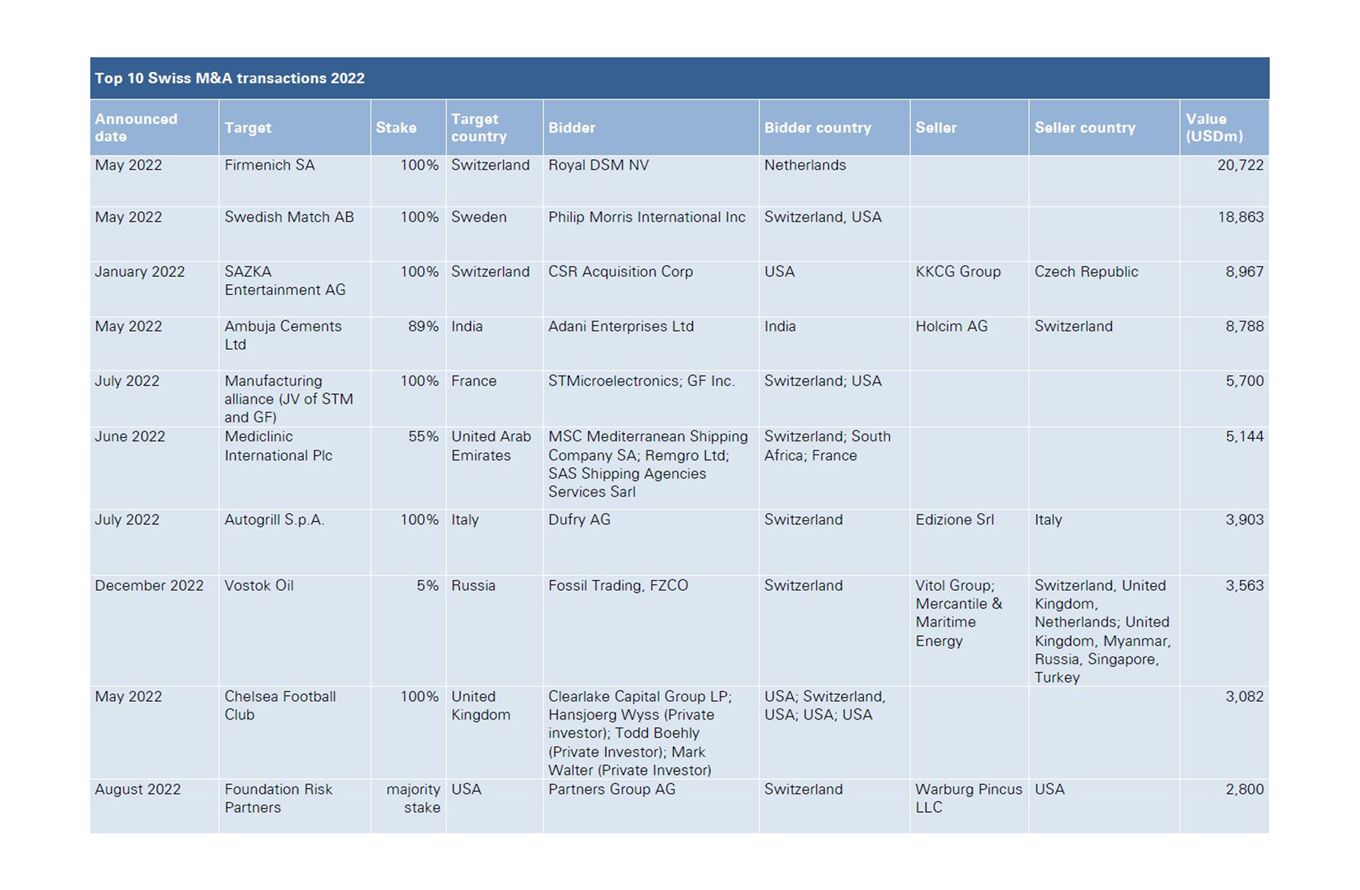

Two megadeals in the Chemicals and Consumer Goods sectors

The ten largest mergers and acquisitions of 2022 were valued at around USD 81.5 billion and accounted for just under 60 percent of the total volume. Valued at nearly USD 21 billion, the takeover of Firmenich SA, a fragrance manufacturer, by Royal DSM, a Dutch company and one of the world’s leading suppliers of food additives, is the year’s largest transaction. Second place goes to the acquisition of Swedish Match AB, a Swedish match and tobacco producer, by Swiss tobacco giant Philip Morris International, with the transaction volume coming in at around USD 19 billion.

Table: Ten largest transactions with Swiss involvement in 2022

Sustainability becoming an increasingly important decision-making criterion in takeovers

According to a KPMG survey*, 82 percent of market players factor sustainability considerations into their mergers and acquisitions. 40 percent of those surveyed indicated that they conduct ESG due diligence reviews on a regular basis – as opposed to 28 percent of the companies surveyed that currently refrain from conducting such reviews entirely. Based on the survey, KPMG anticipates that this value is likely to drop to 5 percent in the future.

According to Florian Bornhauser, Due Diligence Expert at KPMG, “sustainability factors impact the effective transaction price”. Accordingly, half of respondents are willing to pay a sustainability premium of 1-5 percent, 15 percent of those surveyed would pay 5-10 percent more and 3 percent would even pay a premium of more than 10 percent if ESG criteria are fulfilled. “This is due in part to the fact that acquiring companies are becoming increasingly aware of ESG risks and their potential for financial implications. On the other hand, a growing number of investors have realized that positive ESG performance is a hallmark of professional management and that this has a direct impact on a company’s value.”

At the same time, performing ESG due diligence reviews still poses major challenges. Aspects such as defining an appropriate scope for the review, obtaining reliable data from the target company and quantifying the results are proving particularly challenging for investors. In that context, the results of the survey also revealed how the most advanced investors – international financial investors in particular – approach and tackle these challenges.

*KPMG surveyed 151 M&A specialists, predominantly in Europe, 38 of which from Switzerland, on the topic of sustainability in the M&A business.

Discover more

Interesting topics for you: