- For the first time in over ten years, professional market participants expect declining prices for real estate investments.

- Economy slowing down: inflation and rising interest rates are weighing on investor sentiment.

- 90 percent of those surveyed feel that Switzerland has reached the end of the real estate investment supercycle.

- Price increases only expected for Zurich.

- Negative price expectations for retail, commercial and office space.

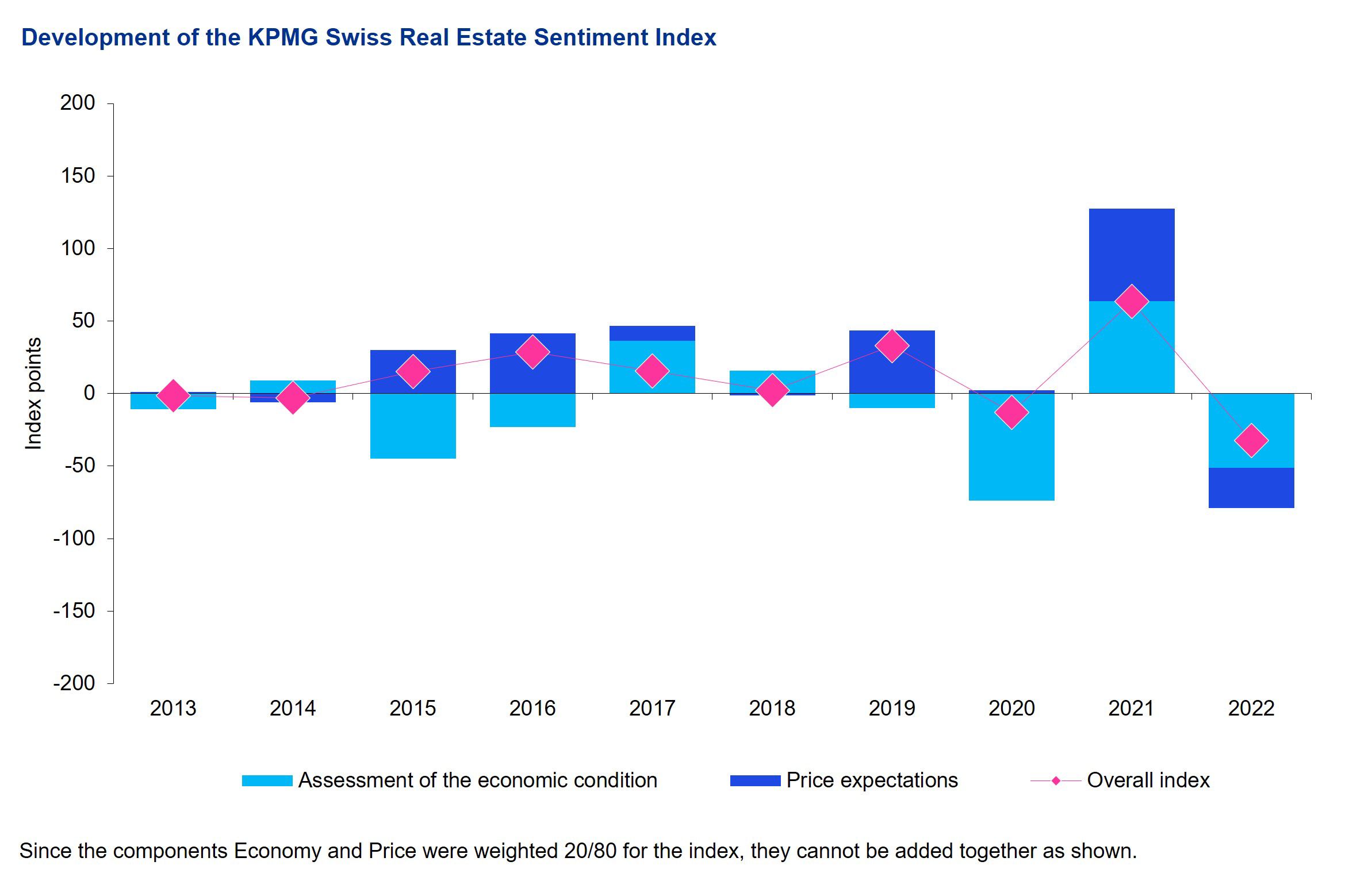

Inflation, interest rate risks, the economic environment and heightened insecurity are weighing on investor sentiment. While professional and institutional market players (such as pension funds, real estate funds, etc.) had anticipated positive economic development and rising real estate prices last year, their outlook is much more negative this year. Proof of this can be found in the Swiss Real Estate Sentiment Index (sresi®), which is a leading indicator of anticipated developments on the Swiss real estate investment market and reflects the expectations of investors, developers and appraisers. This index has plunged from its record high of +63.7 points to a new all-time low of -32.5 points.

Clearly negative economic development expected

The sresi sub-index that reflects assessments of the economic situation plummeted from +63.8 to -51.4 points. "The somewhat surprising sense of optimism that we saw in 2021 has dissipated as a result of the war in Ukraine and in the face of rising inflation and interest rates," says Beat Seger, Partner and Real Estate Expert at KPMG, on the reasons for this sharp decline.

Price development: all segments in negative territory except for residential properties

For the first time in the history of the Swiss Real Estate Sentiment Index, market participants’ sentiment regarding the price trends of real estate investments is clearly negative at -27.7 points. Last year’s score of +63.7 indicated that the market expected a distinctly positive price development; only 1 percent of respondents at the time had anticipated declining prices. More than forty percent of market participants currently expect the next twelve months to bring declining prices.

This holds particularly true with respect to retail spaces, which elicited negative responses most frequently at -86.9 points. Market participants also expect to see prices slump for commercial spaces (-58.3 points) and office properties (-47.4 points). Prices are only expected to continue rising slightly in the residential segment (+35.8 points), however to a much lesser degree than in the previous year (+119.2 points). Those surveyed still consider the supply of adequate investment opportunities in the residential segment as extremely meager.

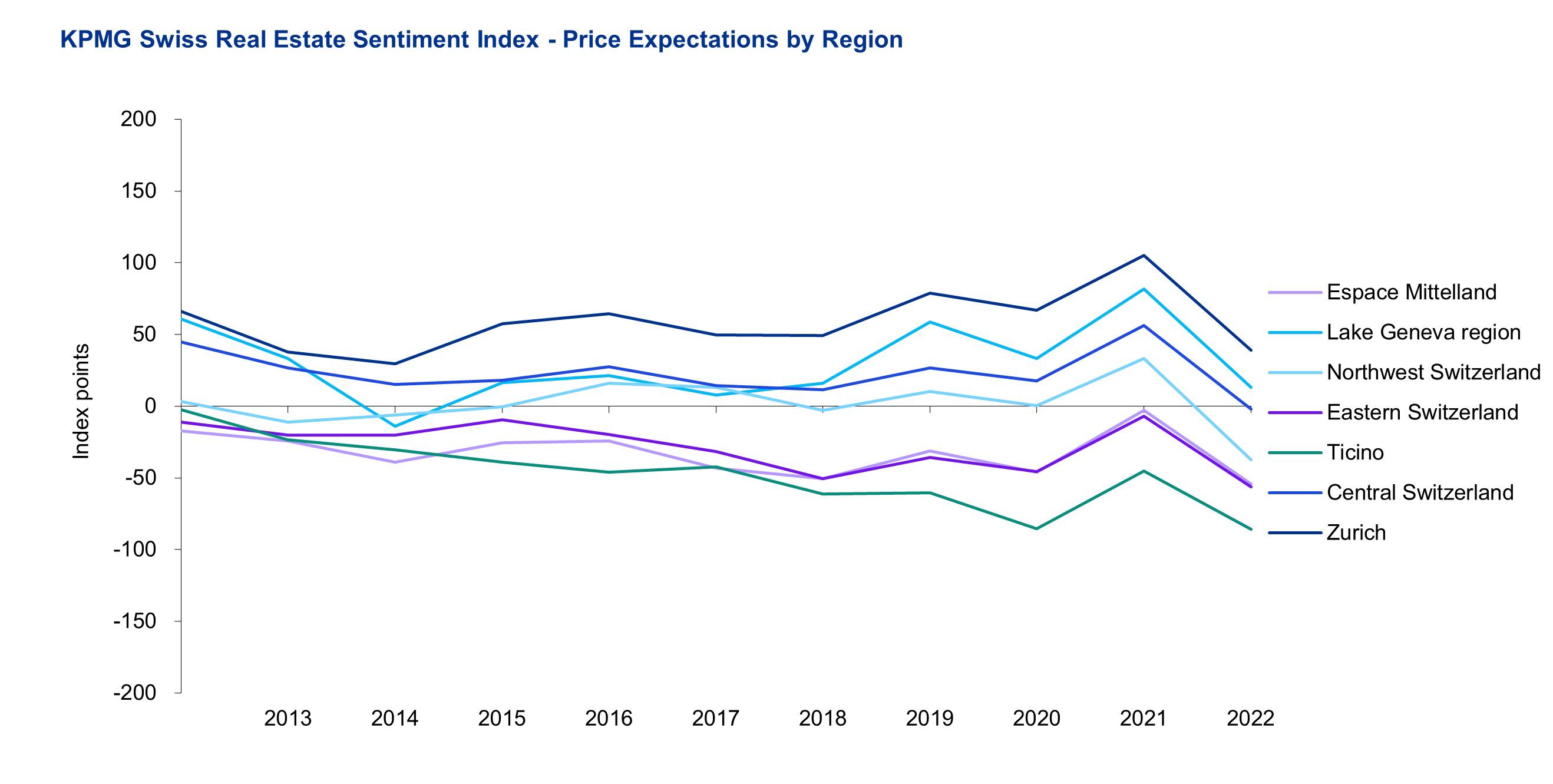

Optimism only expressed for Zurich – Ticino declines

The signs have reversed with respect to the regions, as well. Market participants still expect to see price increases in the greater Zurich region (+39.2 points), however their expectations are much more moderate year-over-year. The expected price declines are particularly large with respect to Ticino (-86.0 points), Eastern Switzerland (-56.4 points) and the "Mittelland" region (-54.3 points). After anticipating considerable price increases (+56.1 points) in the previous year, market participants now expect prices to remain stable in Central Switzerland (-2.2 points). The same applies to the Lake Geneva region (+13.3 points; previous year +81.6 points).

Price increases only expected in central locations

While price increases were expected for central locations as well as secondary centers and metropolitan areas last year, market participants only expect positive price development for central locations this year, that assessment is much more moderate compared to the previous year. The price index for that category still came in at +109.8 points in the previous year compared with merely +31.4 points this year. In contrast to last year, investors and appraisers expect prices for secondary centers and metropolitan areas to fall (-26.2 points). For peripheral locations, market players continue to anticipate a negative price development, although considerably more negative than in the previous year (-86.9 vs. 32.4 points).

Methodology

The KPMG Swiss Real Estate Sentiment Index (sresi®) serves as a leading indicator for anticipated developments in the Swiss real estate investment market. The main index is generated based on assessments of economic developments and price trends in the real estate investment market. The aggregated index reflects respondents’ assessments of the general economic situation (weighted at 20 percent) and the real estate price trend (weighted at 80 percent). The subindices express the opinions of market players with respect to individual market and use categories. This data was first collected in 2012, and the survey is repeated every year to generate an index which permits a comparison of market assessments over time. Some 200 real estate investors and appraisers from the Swiss real estate investment market participated in this year’s survey. The respondents represent an investment and appraised volume in excess of CHF 300 billion. The survey was conducted between 16 August 2022 and 10 October 2022.