The prolonged period of uncertainty – new and ongoing conflicts, recession and high energy prices – overshadowed M&A activity in 2023.

- Swiss players were involved in 484 deals with a combined deal value of USD 72.2 billion in 2023. In a ten-year comparison, 2023 stands out for the low volume of deals, surpassed only by the Covid outbreak year 2020.

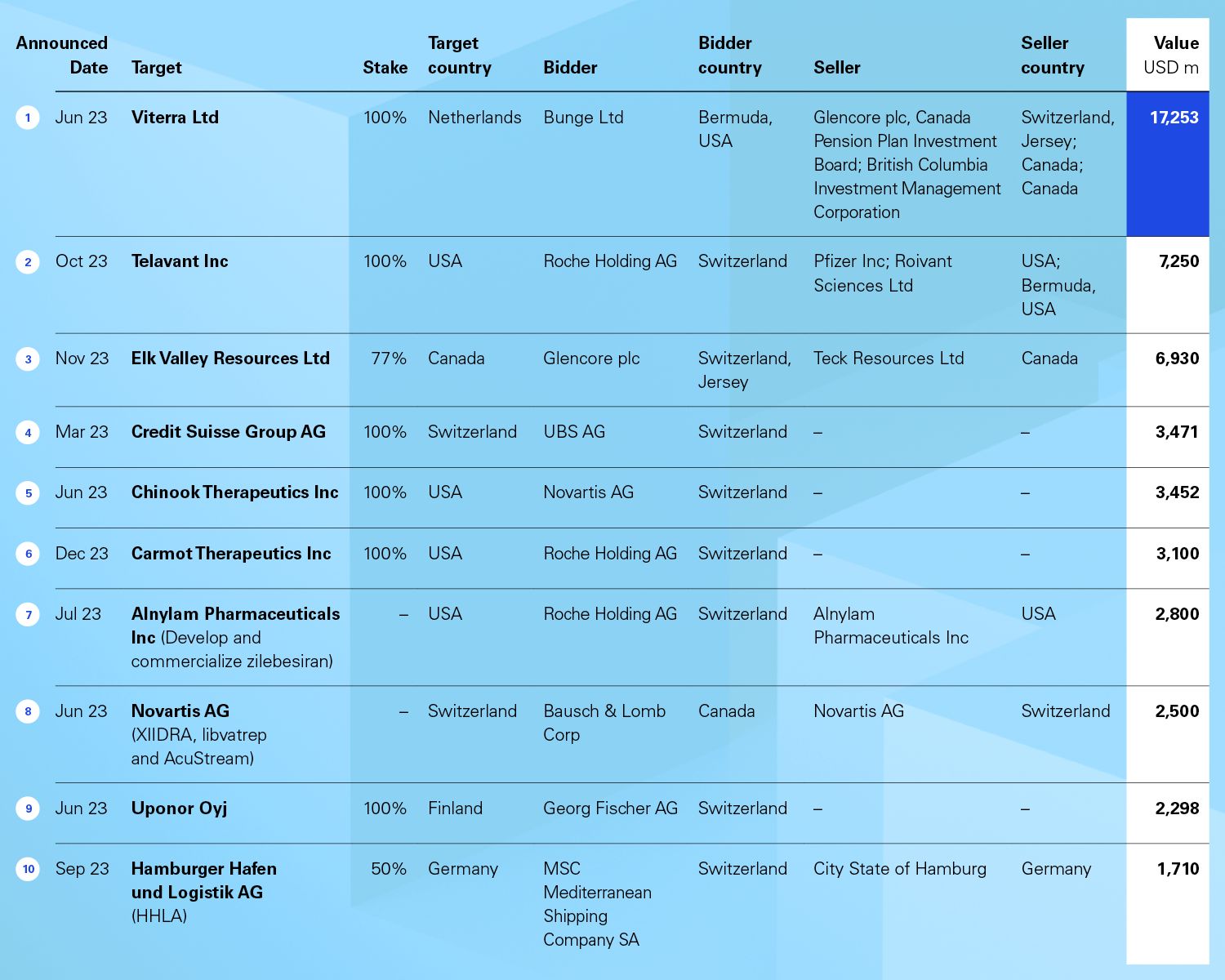

- The Bunge-Viterra merger – worth USD 17.3 billion – was the largest deal of the year by some margin.

- In terms of deal number, 2023 saw an average performance from a ten-year perspective but was unable to match the extraordinarily high level of the two preceding years.

- Industrial Markets, Technology, Media & Telecommunication and Pharmaceuticals & Life Sciences were the most active sectors in 2023. Two leaders emerged in terms of deal volume: Pharmaceuticals & Life Sciences and Commodities each witnessed deals worth USD 24.8 billion in total in the course of the year.

Hopes of a consistent return to pre-pandemic dealmaking were dashed in 2023. The strong performance of 2022 gave way to a mediocre 2023 when it came to deal numbers and the second-worst of the last decade in terms of volume.

The year 2023 also saw artificial intelligence (AI) take off as a global trend. Cutting-edge technologies have become the backbone of organizations’ business operations. Alongside the regular due diligence procedures, parties on both the buy-side and sell-side should consider how in-depth preparation for IT integration or separation can accelerate success and create long-term value.

Your guide to the Swiss M&A landscape

Our report brings together everything you need to know about transactions involving Swiss buyers or targets in 2023. KPMG has put together all the highlights of the last 12 months and provides an insightful outlook for 2024.

Browse deal statistics, read our key findings, get an overview of the most noteworthy transactions and understand trends and drivers that are impacting deal activity.

Search our Swiss deal database (from 2016-2023)

Deal figures in 2023

Average deal number but small deal volume

The number of deals involving Swiss businesses (outbound, inbound and domestic transactions) fell to 484 in 2023 – a 25% decrease on the prior year. Total deal volume plummeted to USD 72.2 billion compared to USD 138.5 billion in the prior year.

Western Europe once against dominated as the biggest investment partner for Switzerland in both outbound and inbound transactions. In deals with a foreign acquirer of a Swiss target, 64% came from this region; for foreign targets acquired by Swiss players it was 59%. North America maintained its position in second place, accounting for 21% and 19% of deals into and out of Switzerland, respectively.

The same three industry sectors as last year accounted for the most deals in 2023: Industrial Markets (20% of the total), Technology, Media & Telecommunications (16%) and Pharmaceuticals & Life Sciences (15%). Two leaders emerged in terms of deal volume: Pharmaceuticals & Life Sciences and Commodities each witnessed deals worth USD 28.9 billion in total over the course of the year.

IT – a key asset in M&A

Amid rapid technological advancement, the role of tech has shifted from a function supporting backend operations to the backbone of an organization’s business operations. IT has firmly established itself as a key driver of change; a pivotal differentiator; and a catalyst for transforming business processes.

Against this background, buyers and sellers in the M&A space must also consider the increasingly crucial role that IT plays in transactions. Involving IT at an early stage presents valuable opportunities and allows potential challenges to be identified and addressed proactively. Learn more and read the full article.

Talk to our experts

If you’re looking to acquire, divest, merge or restructure, KPMG’s multidisciplinary Deal Advisory team will help you deliver value – from strategy development through to successful implementation.

In addition, our IT M&A team specializes in guiding organizations to leverage the potential and mitigate the risks of technology within M&A dealings. We combine a keen eye for the financial aspects with profound technological proficiency, enabling a clear and positive impact on your deal’s value realization.

Credentials

Bucherer

KPMG Deal Advisory

acted as sole M&A lead advisor and provided sell-side financial, tax, real estate, valuation and pension services to the shareholder of Bucherer on the divestment to Rolex

Announced

Pacojet Group

KPMG Deal Advisory

acted as sole M&A lead advisor to the shareholders of Pacojet Group on the sale to Groupe SEB

April 2023

Mimacom Flowable Group

KPMG Deal Advisory

acted as sole M&A lead advisor and vendor assistance provider to the shareholders of Mimacom Flowable Group on the divestment to Ardian

April 2023

KLK Kolb

KPMG Deal Advisory

acted as sole M&A lead advisor and legal, VA, separation and tax services provider to KLK Kolb on the sale of its Paper Process Chemicals Business to Solenis

February 2023