The Environmental, Social and Governance ("ESG") and tax transparency debate is evolving quickly and ESG issues remain on top of the agenda in most board rooms.

Tax might not be the first sustainability factor which comes to mind. However, how much tax companies pay, where they pay it, and how they manage their tax matters is increasingly evaluated as an ESG or sustainability measure as the tax revenues available to governments and societies are a prerequisite for having this debate in the first place.

In the following sections you will find detailed information on these topics:

How is tax and ESG connected?

- E with the implementation of specific duties and incentives to foster environmental objectives, e.g. carbon/plastic taxes or renewable energy credits;

- S through the social awareness around tax and "paying your fair share"; and

- G as with the focus on sustainability, governance of all connected issues has become a key board room topic (e.g., tax governance framework).

Moreover, tax touches many of the United Nations Sustainable Development Goals ("SDGs") as tax revenues have a huge potential to impact how communities thrive and prosper. Reporting on tax is not only about "being transparent" or "how much tax you pay", it's more about the principles applied and the impact your tax footprint makes. In other words: It's actively demonstrating the impact your business is making on achieving sustainable and inclusive growth.

As part of this, numerous initiatives and standards have been initiated, are being worked on and have come or are coming into force. As a result, the tax transparency landscape is getting increasingly complex and the debate is significantly gaining momentum.

What are the driving forces?

While initially the tax transparency debate was driven by the financial crisis of 2007/2008 and public perception that large corporations are not paying their "fair share", it has developed into much more than this over the last decade. There are two main drivers: regulatory initiatives and market forces.

- Regulatory initiatives: International and/or domestic regulatory initiatives with the aim to enhance trust through transparency are already in place or gaining support. The debate is additionally impacted by COVID-19 and pressure on governments to justify rescue packages granted. Some of the regulations and standards are already mandatory (e.g., CbCR, CRD IV directive, EU accounting directive, national regulations in the UK, AUS, NOR, etc.), others are voluntary to implement (e.g., UN-PRI, GRI standards, etc.) and yet others are to be implemented in the near future (e.g., EU Public CbCR directive).

- Market forces: It is expected that companies reflect on their corporate purpose and contribution to society. With sustainability objectives and strategies in place, increased pressure is put on an organization's approach to tax transparency to align to such objectives, being consistent with the overall communication strategy and with positions taken by competitors. Additionally, investors are increasingly seeking to act more responsibly, and tax transparency is increasingly considered to be a relevant metric in sustainability rankings.

The following statement by David Linke (Global Head of Tax & Legal KPMG International) nicely summarizes the implications for companies:

"With social purpose at the forefront of most businesses today, organizations need to respond to the call for tax transparency in a way that aligns to their corporate values. This is imperative to enhancing and retaining public trust."

What does tax transparency actually mean though?

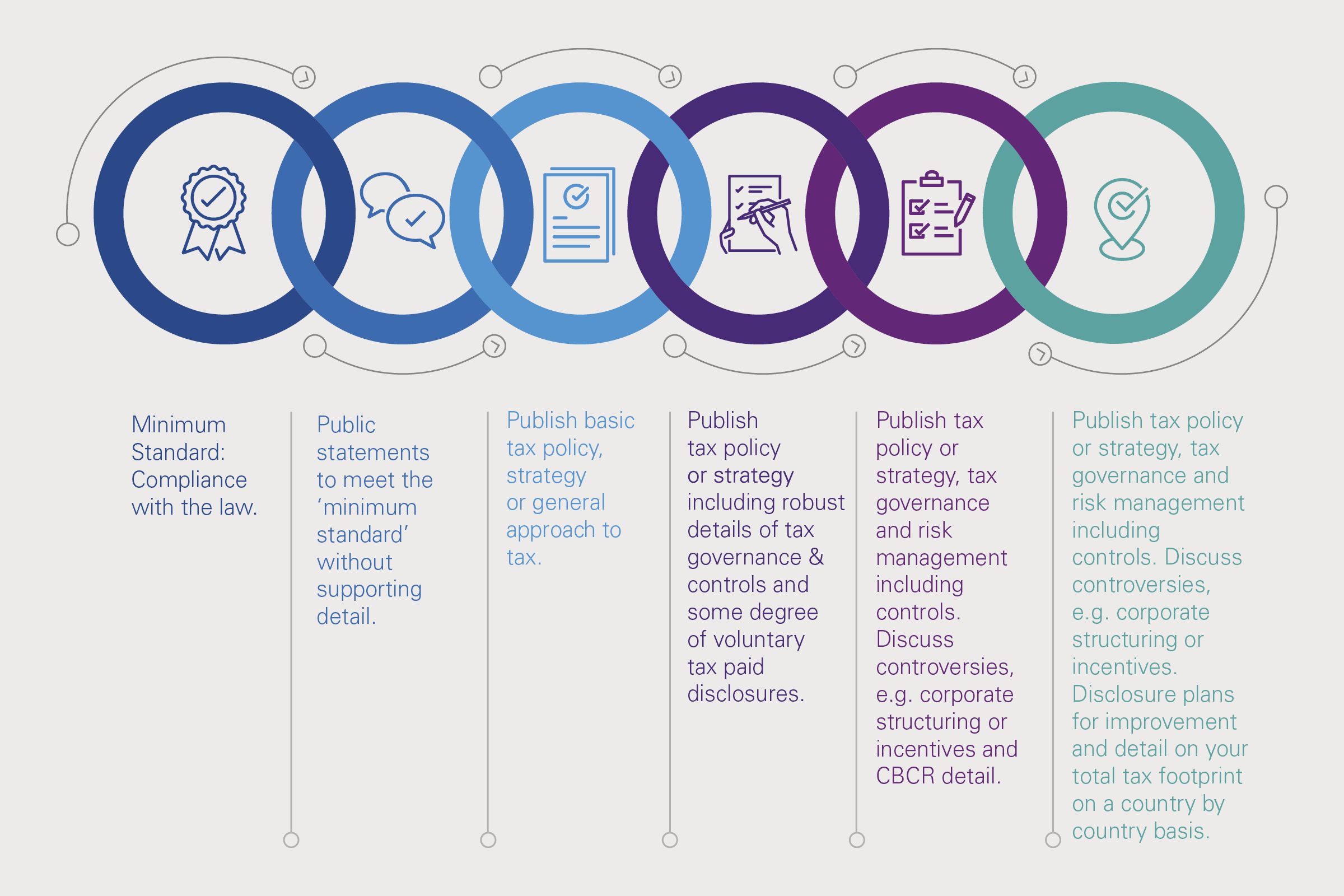

Tax transparency means different things to different people. Tax transparency standards all have different positions on what is "transparent" and tax transparency can be viewed as a spectrum. What is deemed "enough" by the business, the public, investors, and governments will change over time. Likely, "the norm" will move along the spectrum so that more disclosure will become necessary. This understanding of tax transparency can be illustrated as follows:

EU Public CbCR directive – A potential game changer?

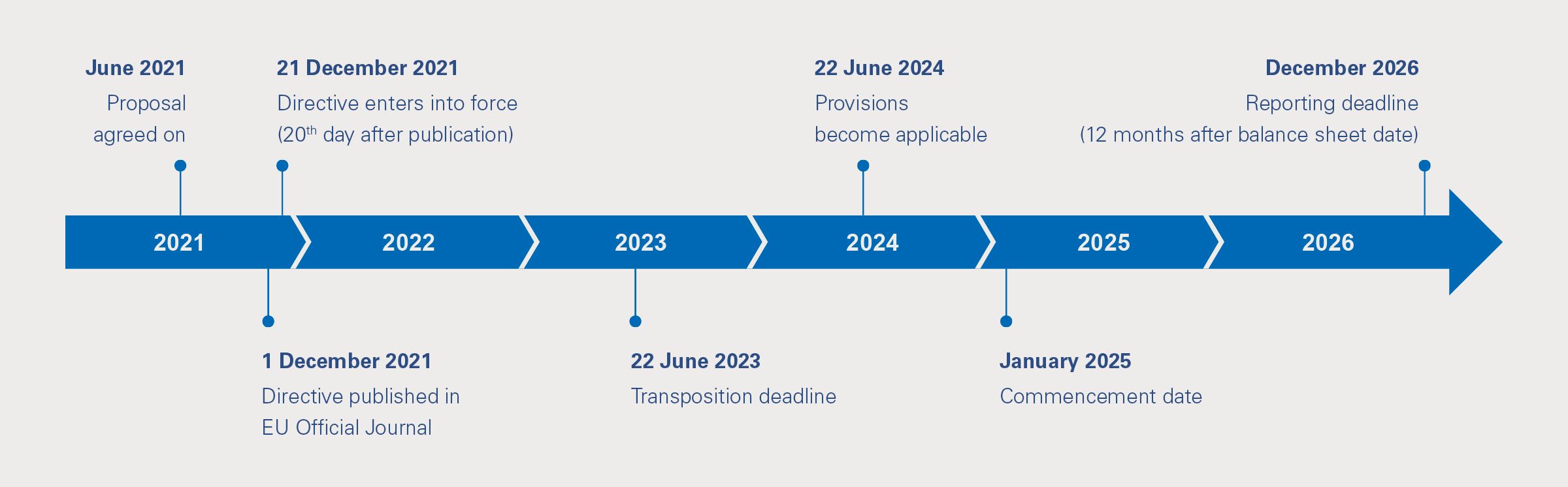

New rules of the EU Public Country-by-country Reporting ("CbCR") directive will enter into force on December 21, 2021.

The new rules require multinational groups with a total consolidated revenue of >EUR 750 million to report either if they are EU parented or otherwise have EU subsidiaries or branches of a certain size. The report will require information on all members of the group (including certain non-EU members) within seven key areas:

- A brief description of activities

- Number of employees

- Net turnover (including related-party turnover)

- Profit or loss before tax

- Tax accrued

- Tax paid

- The amount of accumulated earnings

The information must be broken down for each EU Member State where the group is active and also for each jurisdiction deemed "non-cooperative" by the EU or that has been on the EU’s "grey" list for a minimum of two years. Information concerning all other jurisdictions may be reported on an aggregated level.

Reports are to be published in an EU Member State business register, but also on the companies’ websites, where the CbC reports are to remain accessible for at least five years. When the ultimate parent is not governed by the law of an EU Member State, the reporting will generally have to be done by the EU subsidiaries or branches, unless the ultimate parent publishes a report including those subsidiaries and branches.

The provisional timeline for the implementation of the directive is as follows:

| Note that individual EU Member States may choose to apply the rules at an earlier date. Therefore, a close monitoring on the EU-countries' individual implementation schedules is required. |

Benchmarking survey

Our survey provides insights into how the tax transparency reporting landscape in Switzerland will develop and what companies are planning to do.

In line with international developments, it shows that while many companies are still taking a "wait and see" stance, a relatively small number of topic leaders is shaping the evolving best practice on tax transparency reports. The GRI 207: Tax standard is the preferred guideline and external assurance reports are highly valued.