Companies and the capital market play a key role as we transform our current economic system into a sustainable model. Investors and consumers alike expect – and need – more transparency on companies' sustainability strategy and performance. At the same time the pressure from regulators increases.

This is essential to enable a functioning market and ensure that the necessary funding flows into suitable projects as well as assessing whether the path taken is the right one.

Swiss companies are particularly affected by a large number of different legal requirements that can impact on different parts of the company depending on its capital market orientation and Group structure.

In addition to country-specific regulations in various subsidiaries, two main legal developments are particularly relevant: The amended Code of Obligations and the Corporate Sustainability Reporting Directive (CSRD). Taken together with other regulations, these will define the compliance environment and access to the European Union market.

Hence, communicating on an organization’s ambitions, targets and actions in a compliant and inspiring way is not an optional exercise anymore, but a mandatory requirement.

Overview of the most relevant disclosure requirements for Swiss companies

According to KPMG’s Survey of Sustainability Reporting 2022 "Big shifts, small steps", 82%, of the 100 largest Swiss companies have already established sustainability reporting on a voluntary basis.

However, with the amendment to the Code of Obligations which was enacted with the indirect counterproposal, Switzerland introduces non-financial reporting and due diligence requirements, including TCFD reporting for a large number of companies for the first time.

The disclosure requirements under the amended Swiss Code of Obligations are based on the EU's Non-Financial Reporting Directive (NFRD). Public interest companies whose FTEs, revenue or balance sheet total exceed defined thresholds now have to report annually on environmental and social issues, employee issues, respect for human rights and anti-corruption.

CSRD: Reporting obligations at EU level

With the CSRD, the Corporate Sustainability Reporting Directive, the EU is creating a new set of regulations that will introduce additional reporting obligations for all larger companies, including unlisted ones in the EU and abroad.

Under the CSRD, the separate sustainability report has become obsolete – from now on, it will be mandatory for companies to communicate their non-financial information in the management report. In addition, an audit requirement will be introduced (limited assurance, plus reasonable assurance potentially required at a later date). The directive provides for mandatory application of uniform EU Sustainability Reporting Standards (ESRS).

How does KPMG support their clients on the sustainability reporting journey?

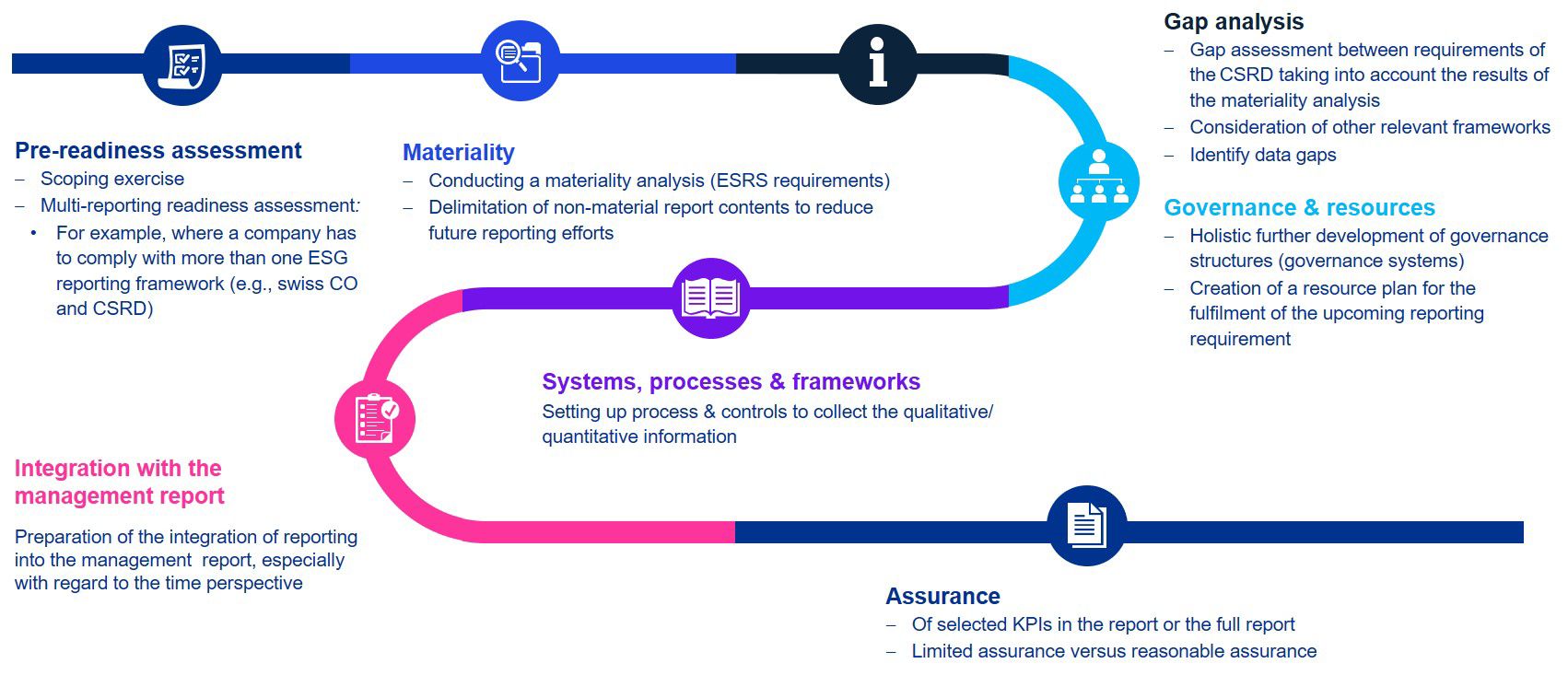

We have developed a proven sustainability reporting journey and are happy to support you at every step:

1. We suggest starting with a pre-readiness assessment to identify the regulatory requirements and define the best future reporting option

2. Based on the regulatory requirements, we can support you with developing a compliant and auditable (double) materiality assessment

3. This is followed by identifying gaps between your current reporting and the reporting requirements, as well as developing a roadmap to address these gaps.

4. This will give you a solid basis to define and set up the appropriate governance structure and allocate the right and sufficient resources

5. Designing and implementing appropriate processes and controls for already existing or new KPIs is important for data quality and efficient data gathering

6. We help you ensure audit readiness of your data and

7. Support you with developing nonfinancial reporting content and integrating it into your management report.

The role of EU Taxonomy in ESG reporting

Reporting according to the EU Taxonomy will be mandatory for many Swiss companies operating in the EU starting in 2025. The European Union adopted the Taxonomy Regulation 2020/852 to clearly classify economic activities according to their contribution to sustainability. This should facilitate and encourage the evaluation of companies and their sustainable investments. Read more in our blog (in German).

In the second edition of our EU Taxonomy Disclosure Survey, we analyze 281 European non-financial companies and provide valuable insights and guidance on ESG practices and strategies.

Automation of ESG Reporting

Watch our recent webinar to gain insight into how to automate ESG reporting in your organization. We cover a variety of topics, including:

- The relevance for businesses and organizations in Switzerland.

- How to report on EU Taxonomy in an automated way.

- The methods to collect financial and non-financial data.

- How to leverage existing technology while maintaining a clear audit trail.

Meeting this challenge requires diverse teams that combine financial, ESG, technology, and data skills. Let us show you how to best combine these skills, streamline your reporting process, and make informed decisions.

Assurance to help provide confidence in your data – and meet future legal requirements

What do we mean by assurance?

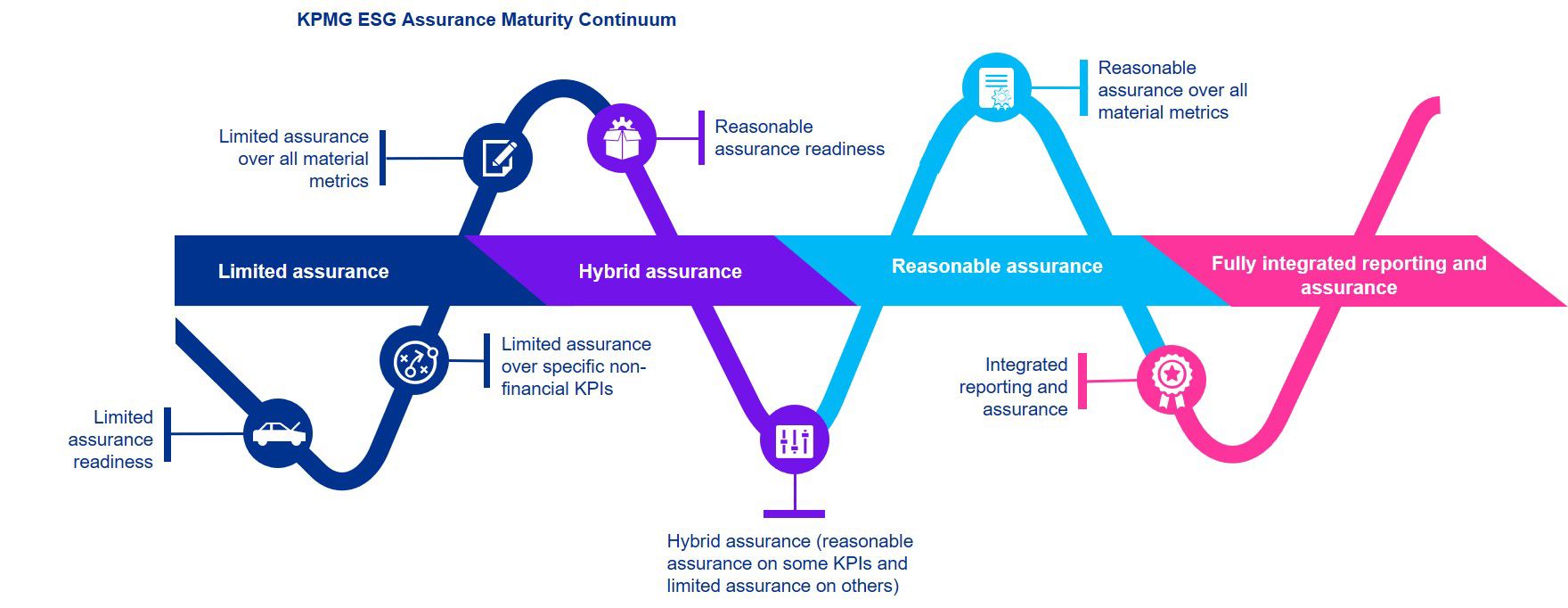

The most widely used external assurance standard for non-financial information is ISAE 3000 and, to a lesser extent, ISAE 3410 for Greenhouse Gas Key Performance Indicators (KPIs). The scope of independent assurance obtained is either:

- Limited assurance – e.g. the opinion provided on a half-year review of financial statements is an example of a limited assurance; or

- Reasonable assurance – e.g. the opinion provided for an audit of financial statements is an example of a reasonable assurance conclusion.

What are the benefits of ESG assurance?

The benefits of obtaining independent third-party assurance on non-financial information are not limited to legal compliance. Rather than a tick-the-box exercise, it is an opportunity for companies to improve and communicate the credibility of their sustainability efforts to relevant stakeholders.

Accordingly, the scope of what is covered in an ESG assurance engagement and the amount of testing effort required depends on the level of assurance an organization obtains.

Currently, given ESG reporting is relatively nascent across most companies and sectors, most reports provided by an independent practitioner have been an ISAE 3000 limited assurance opinion. However, companies that are more sophisticated and advanced with ESG reporting are beginning to obtain reasonable assurance opinions under ISAE 3000 for selected KPIs.

Readiness for upcoming requirements

The last five years have been characterized by a growing and rapid proliferation of regulations that have put compliance models to the test. Examples include 1) the upcoming EU regulations on sustainability reporting from 2024 onwards, and 2) non-financial reporting requirements under the Swiss Code of Obligations in line with the current EU non-financial reporting directive (NFRD), and regarding due diligence and transparency in relation to minerals and metals from conflict-affected areas and child labor.

- Raise internal awareness for upcoming regulations and the need for more robust processes and controls

- Avoid surprises at a late stage

Establish trust

External stakeholders such as investors and debt holders increasingly rely on non-financial information for their decision making. Internal stakeholders might use KPIs for bonus schemes. Trust in published and internal information on ESG performance becomes therefore important, both for reporters and readers.

- Improved stakeholder communication and credibility

- Better sustainability ratings

- Trust in your own processes and controls

Obtain insights and improvements

Getting ESG data right requires a systemic approach based on optimal, efficient and sustainable control and compliance models. With the right foundation in place, companies have access to insights that will help them in the continuous improvement of their processes.

- Get valuable insights on how to improve processes and data quality

- Improved understanding of how information flows into external reporting

How KPMG can help

Readiness assessment

A readiness assessment is an important first step in establishing whether your company is ready for assurance and in identifying improvement potential. KPMG performs assurance procedures on selected parts of your sustainability report. Rather than issuing an assurance statement, we provide you with an improvement letter that sets out key findings of the assessment and recommendations to close existing gaps.

Once the selected subjects and indicators are ready for assurance, we can officially provide assurance on selected parts of your sustainability report or the entire report. The scope and amount of testing will depend on whether you choose limited or reasonable assurance.

Reasonable assurance

In a reasonable assurance engagement, we aim to reduce engagement risk to an acceptably low level in the circumstances of the engagement as the basis for our conclusion. Extensive procedures are required.

Limited assurance

In a limited assurance engagement, the nature, timing and extent of procedures is limited compared with that necessary in a reasonable assurance engagement but is planned to obtain a level of assurance that is, in our professional judgment, meaningful. Upcoming regulations currently require a limited assurance. It is also the most commonly used option for assurance.

Improvement letter

We want to support you on your journey and therefore will provide you with more than just an assurance opinion. Our service also includes concrete recommendations to improve your sustainability reporting in all aspects, e.g. governance, policies, processes, data gathering and disclosures to support you on the road to reasonable assurance.

Contact our ESG experts

Most Swiss Groups will be impacted by the new reporting regulations in the short to mid-term. An analysis of the Group’s legal structure and upcoming requirements to identify which entities fall within the scope of the new regulations, and by when, is highly recommended. Based on this, a strategy and roadmap can be developed on how to best adhere to these upcoming regulations.

Assurance of non-financial information is already or will be a direct or indirect requirement for many Swiss Groups, especially when doing business with the EU. We can help you in your preparations for assurance and provide assurance services for you.

We are looking forward to hearing from you!