Von Erkenntnissen über Chancen bis hin zu Ergebnissen – die Global Strategy Group von KPMG bietet neue Perspektiven wenn es darum geht, Strategien zu entwickeln und umzusetzen, bei denen Agilität, Kundenorientierung, Widerstandsfähigkeit und operative Exzellenz im Mittelpunkt stehen, um in dynamischen Märkten erfolgreich zu sein.

Das Marktumfeld ist geprägt von sich schnell verändernden Marktbedingungen und disruptiven Kräften gepaart mit der beschleunigten Entwicklung neuer Technologien. Eine robuste, nachhaltige und wandlungsfähige Unternehmensstrategie beinhaltet ein sich stetig weiterentwickelndes Verständnis für das Wechselspiel zwischen Innovation, Wertschöpfung und Werterhaltung.

Wir begleiten Sie bei der Umsetzung anspruchsvoller finanzieller Ziele unter Berücksichtigung der Kernelemente eines nachhaltigen Geschäftsmodells und dem Streben nach operativer Höchstleistung.

Die Global Strategy Group ist der Strategieberatungszweig von KPMG, der nahtlos mit den KPMG-Teams für Audit, Tax/Legal, Deal Advisory und Management Consulting zusammenarbeitet – aufbauend auf 150 Jahren Geschichte und Expertise in allen Wirtschaftszweigen und Regionen, mit erstklassigen Referenzen und geeint durch die Integrität und Glaubwürdigkeit der Unternehmens-DNA.

Unsere Lösungen: durch die Gegenwart navigieren und die Zukunft gestalten

Unser umfassendes Dienstleistungsangebot unterstützt Kunden darin, ihre Strategien und Wachstumsambitionen zu definieren, kritisch zu hinterfragen und zu erreichen.

Im Rahmen von Transaktionen und darüber hinaus bieten wir starke fachliche Unterstützung, von der Definition der Wachstumsambitionen eines Unternehmens (organisch vs. anorganisch) bis hin zur Evaluierung und Abwicklung einer Transaktion und/oder strategischen Transformation.

Transaktion

Strategieberatung vor und nach der Transaktion für Ihre Fusionen und Übernahmen (M&A) sowie Desinvestitionen

Commercial Due Diligence

Überprüfung der Markt- und Wettbewerbsposition eines Zielunternehmens, um dessen Geschäftsplan kritisch zu prüfen und sowohl Geschäftsrisiken als auch Potenziale zu identifizieren.

Fortgeschrittene Unternehmensplanung

Unterstützung bei der Erarbeitung aussagekräftiger Geschäftspläne, die sich an Investoren richten und den Wert sowie die strategische Position eines Unternehmens unterstreichen.

Synergiebeurteilung

Quantifizierung der wirtschaftlichen Vorteile einer Fusion. Auf der Grundlage firmeneigener Daten, Benchmarks und Erfahrungen aus vorangegangenen Transaktionen ermitteln wir konkrete, greifbare Wertpotenziale und Wachstumschancen.

Separation Due Diligence

Einschätzung der operativen und finanziellen Auswirkungen (Risiken/ Vorteile) einer Ausgliederung – aus Verkäufer- oder Käuferperspektive. Überprüfung, ob das Ausgliederungskonzept im Hinblick auf eine Transaktion tragfähig ist und die Geschäftskontinuität nach Abschluss der Transaktion sichergestellt ist.

Separation Assistance

Unterstützung von Verkäufern in Carve-out-Situationen durch die Ermittlung der wichtigsten Verflechtungen mit der Unternehmensgruppe («Separation Hotspots»), Erarbeitung von Lösungen zu deren Entflechtung («Standalone Target Operating Model») und Darstellung der finanziellen Auswirkungen der Ausgliederung («Standalone Cost Adjustments»). Mit unserem nahtlos integrierten, funktionsübergreifenden Team, das über funktionale, steuerliche, rechtliche und regulatorische Fachkenntnisse verfügt, begleiten wir auch die operative Planung und Umsetzung von Ausgliederungen, vom Vertragsabschluss bis zur Nachbearbeitung.

Unterstützung bei der Eingliederung

Durchgehende Unterstützung, angefangen bei der Prüfung vor Vertragsabschluss und der strategischen Planung über den Integrationsplan, die Gesamtplanung und «Day-1-Readiness» bis hin zur Unterstützung bei der Implementierung nach Vertragsabschluss, um Ihren Unternehmenswert zu schützen und gleichzeitig die Beeinträchtigung Ihres laufenden Geschäftsbetriebs zu begrenzen.

Anorganische Wachstumsstrategie & Zielobjektsuche

Hilfestellung bei der Bestimmung der Rolle von Fusionen und Übernahmen, Joint Ventures und Partnerschaften im Kontext Ihrer Unternehmensstrategie sowie Unterstützung bei der Entwicklung von Kriterien für die Zielobjektsuche und Long/Short-Listen spezifischer Akquisitionsziele.

Wertschöpfung

Die KPMG-eigene Methode zur Wertbestimmung und -quantifizierung für Transformationen, Restrukturierungen und Transaktionen unserer Kunden. Wir kombinieren Daten, Erkenntnisse und Umsetzungskompetenzen, mit denen wir schnell und sicher Prioritäten setzen und Wertschöpfung erzielen können.

Transformation

Unterstützung bei kommerziellen und operativen Strategieprojekten als Ihr bevorzugter Transformationspartner.

Strategie-Stresstest

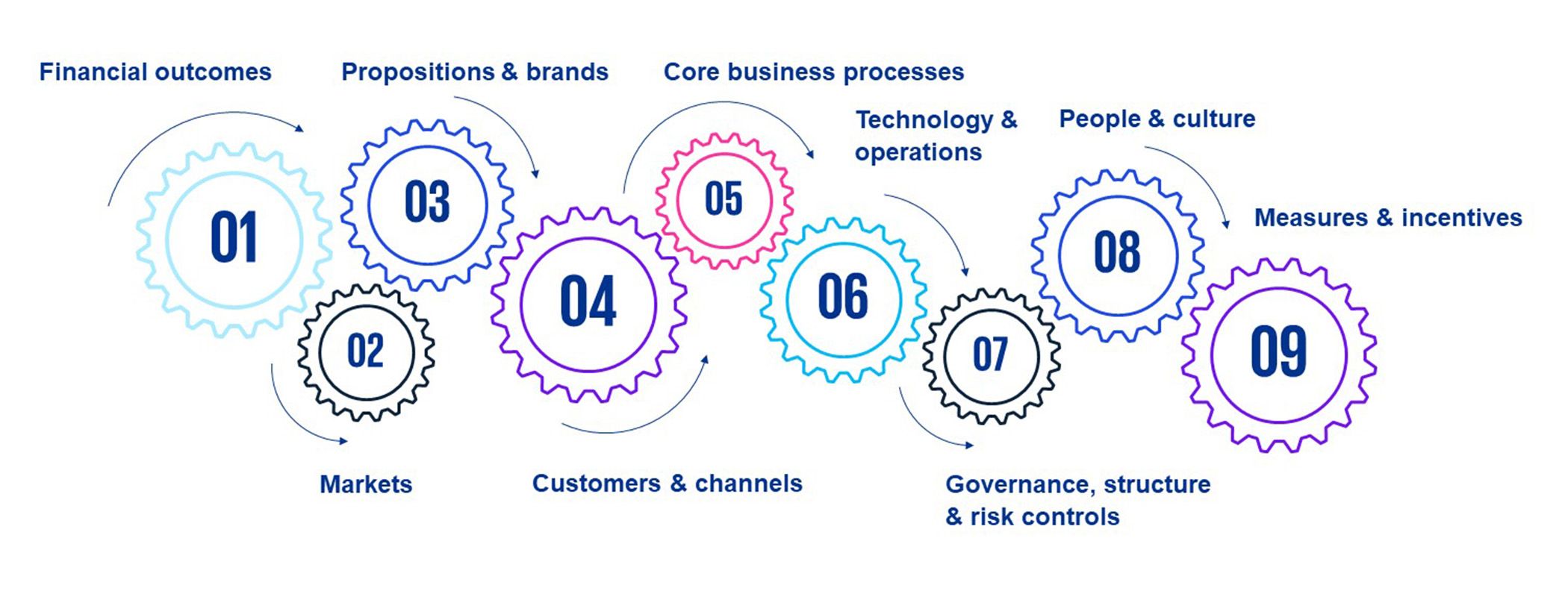

Unabhängige Beurteilung Ihrer Strategie, die Ihnen eine Aussensicht darauf bietet, ob die strategischen Entscheidungen in allen entscheidenden Aspekten des Geschäfts- und Betriebsmodells klar formuliert und aufeinander abgestimmt sind - auf der Grundlage des von KPMG entwickelten Strategierahmens «9 Levers of Value».

Wachstumsstrategie

Hilfestellung bei der Identifizierung von Wachstumschancen, sowohl organisch (z. B. Markteintritt, Preisgestaltung usw.) als auch anorganisch (z. B. Fusionen und Übernahmen, Partnerschaften, Joint Ventures), und Erarbeitung entsprechender Strategien zur Zielerreichung.

Kommerzielle Strategie

Begleitung bei der Optimierung der Vermarktung von Produkten und Dienstleistungen unter Einbezug branchenspezifischer Merkmale, Launch Excellence, Life Cycle Management, Preisgestaltung, Kundenorientierung und anderen Einflussfaktoren.

Betriebsstrategie

Umgestaltung des Betriebsmodells eines Kunden über alle Funktionen hinweg, angefangen beim Front-Office bis hin zum Back-Office, wobei neue Geschäftsmodelle und Technologien sowie Hebel zur Leistungssteigerung in Betracht gezogen werden.

Unternehmensstrategie

Hilfestellung bei der Analyse des Ist-Zustandes, der Zielbestimmung, der Ermittlung von Chancen für nachhaltiges Wachstum und der Ausarbeitung einer Strategie mit entsprechenden Umsetzungsplänen zur Zielerreichung.

Unternehmenstransformation

Begleitung bei der Optimierung von Unternehmensstrukturen, der Verbesserung der Effizienz von Unternehmensfunktionen und der gesamten Wertschöpfungskette, dem Aufbau von Geschäftseinheiten und dem Zugang zu (Wachstums-)Kapital.

Wertschöpfung

Die KPMG-eigene Methode zur Wertbestimmung und -quantifizierung für Transformationen, Restrukturierungen und Transaktionen unserer Kunden. Wir kombinieren Daten, Erkenntnisse und Umsetzungskompetenzen, mit denen wir schnell und sicher Prioritäten setzen und Wertschöpfung erzielen können.

ESG Due Diligence

Überprüfung der entscheidenden Risiken und Chancen eines Zielunternehmens aus ökologischer («E»), sozialer («S») und Governance-Perspektive («G»), um so ein vielschichtiges Bild der Transaktion zu erstellen.

ESG-Strategie

Unterstützung bei der Identifizierung wesentlicher Nachhaltigkeitsbereiche und Formulierung eines Ziels für jeden dieser Bereiche (z.B. Wo stehen wir? Wo möchten wir hin? Wie erreichen wir dieses Ziel?).

Dekarbonisierungsstrategie

Unterstützung von Unternehmen bei der Ermittlung eines Weges zur Dekarbonisierung, von der Bewertung des Ist-Zustandes (aktueller CO2-Fussabdruck von Scope-1-, -2- und -3-Emissionen) über die Darlegung eines wissenschaftlich fundierten Ziels bis hin zu einem Zeitplan für die Erreichung dieses Ziels.

Strategie zur Kreislaufwirtschaft

Hilfestellung für Kunden, den Wert kreislaufwirtschaftlicher Ansätze als wichtigen Hebel für die Verringerung des Kohlenstoffausstosses und die Ressourceneffizienz zu verstehen und zu nutzen.

Unser Ansatz fokussiert auf Wertschöpfung sowie deren Erhalt und Bereitstellung, von der Innovation bis hin zum Ergebnis

Der von der Global Strategy Group entwickelte Strategieansatz «9 Levers of Value» bildet die Schlüsselelemente des Finanz-, Geschäfts- und Betriebsmodells eines Kunden ab, die bei der Entwicklung und Umsetzung einer Strategie berücksichtigt werden müssen - und zwar sowohl auf Unternehmens- als auch auf Geschäftseinheitsebene.

Ungeachtet dessen, ob der Kunde auf internationaler oder nationaler Ebene tätig ist, ein KMU oder ein Grossunternehmen ist, ob es sich um ein privates, öffentliches oder gemeinnütziges Unternehmen handelt – die 9 Levers of Value sind ein überaus vielseitiger und pragmatischer Lösungsansatz für strategische Herausforderungen.

Aktuelle Themen

Branchenkenntnisse

Unsere Lösungen werden komplementiert durch unsere Branchenkenntnisse.

Die globalen Branchenteams von KPMG sind vor Ort präsent und verfügen über die notwendigen Kompetenzen und Netzwerke, um unsere Kunden in den jeweiligen Branchen bei aktuellen Herausforderungen zu unterstützen und künftige zu antizipieren.

In der Schweiz hat das Team der Global Strategy Group für folgende Branchen dedizierte Ressourcen aufgebaut:

Life Sciences

Als ein international führendes Zentrum für Life Sciences verfügt die Schweiz über eine der höchsten Dichten an Biotechnologie-Unternehmen der Welt.

In Anbetracht der Bedeutung dieses Sektors für die Schweizer Wirtschaft und der branchenspezifischen Herausforderungen verfügt die Global Strategy Group in der Schweiz über eine engagierte Gruppe von Life-Science-Fachleuten (u. a. mit Hochschulabschlüssen wie Doktorate in den Molekularwissenschaften und ausgebildete Ärzte), die Start-ups und bedeutende multinationale Life-Science-Unternehmen bei ihren Geschäftsentscheidungen unterstützen.

Konsumgüter & Einzelhandel

Eine globale Pandemie, tiefgreifende Veränderungen im Konsumverhalten, unterbrochene Lieferketten und Wettbewerbsdruck durch neue Akteure sind nur einige der Entwicklungen, die den Konsum- und Einzelhandelssektor immer wieder vor neue Herausforderungen stellen. Unternehmen müssen ihre Vorgehensweise ständig überprüfen, ihre Kompetenzen erweitern und neue Strategien entwickeln, um die Nähe zu den Konsumenten zu bewahren.

Wir begleiten Branchenführer bei der Bewältigung dieser Umwälzungen und entwickeln passgenaue Lösungen, die den Nutzen von Einzelhandelsunternehmen im Alltag der Konsumenten erhöhen.

Luxusbranche

Mehr denn je kommt es darauf an, den Luxusmarkt in seiner Gesamtheit zu verstehen, von der Marke über die ökonomischen Systeme bis hin zu den menschlichen Faktoren.

Es ist zu beobachten, dass die Luxusindustrie einerseits durch Technologie- und Nachhaltigkeitstrends von aussen herausgefordert wird, während andererseits der Wertewandel der Mitarbeitenden die Unternehmen von innen heraus unter Druck setzt. Die Marken müssen ihre Präsenz auf dem Markt und die Mittel und Wege überdenken, mit denen sie ihre Versprechen an die Kunden erfüllen.

Mit unserer fundierten Branchenkenntnis unterstützen wir Luxus- und Modemarken beim Aufbau rentabler und nachhaltiger Unternehmen.

Fertigungsindustrie

Die Fertigungsindustrie in der Schweiz sieht sich mit einer Vielzahl von Herausforderungen konfrontiert – wie etwa dem steigenden Druck zur Dekarbonisierung, zur (Re-)Lokalisierung von Lieferketten und dem generellen Druck auf Preise und Margen.

Gemeinsam mit vielen führenden Industrieunternehmen konnten wir einige dieser Herausforderungen meistern und trotz der schwierigen Rahmenbedingungen ein Umsatz- und Gewinnwachstum erzielen.

> Mehr Informationen zu unseren Services in der Fertigungsindustrie (auf Englisch)

> Mehr Informationen zu unseren Services in der Automobilindustrie

Telekommunikation, Medien und Technologie (TMT)

Der TMT-Sektor boomt, getragen von der ungebrochenen Akzeptanz der Digitalisierung seitens der Konsumenten und Unternehmen gleichermassen.

Wir begleiten sowohl namhafte Kunden in traditionellen TMT-Subsektoren wie Sportrechte und -vermarktung als auch in neueren und sich stark entwickelnden Subsektoren wie z. B. Cybersicherheitsdienstleistungen – zumeist im Hinblick darauf, weiteres Wachstumspotenzial durch kommerzielle Markt- und White-Spot-Analysen zu erschliessen.

> Mehr Informationen zu unseren Services in Telekommunikation (auf Englisch)

> Mehr Informationen zu unseren Services in Medien (auf Englisch)

> Mehr Informationen zu unseren Services in Technologie (auf Englisch)

Ihre Ansprechpartner

Für weitere Informationen und Fragen stehen wir Ihnen gerne zur Verfügung.

Weitere Informationen

Zusätzliche Publikationen & Themen

- True Profitability Model

- Daten, Strategie und Team (PDF, auf Englisch)

- Den Lärm des Metaversums durchdringen (PDF, auf Englisch)

- Entwicklung Direktvertriebs-an-Verbraucher Ökosystems (PDF, auf Englisch)

- Clarity on Mergers & Acquisitions

- Cybersicherheit: Eine Konsolidierungsmöglichkeit mit besonderen Herausforderungen

- Kapitalkostenstudie 2023 (Studie, auf Englisch)