Following Hurricane Dorian’s impact in the Bahamas and brush past the US, and with less than 3 months until the January 2020 renewals, it seems like an excellent time to consider the current condition of the US insurance market.

The Council of Insurance Agents & Brokers’ released their Commercial Property/Casualty Market Report Q2 2019 recently, and it revealed some interesting insights.

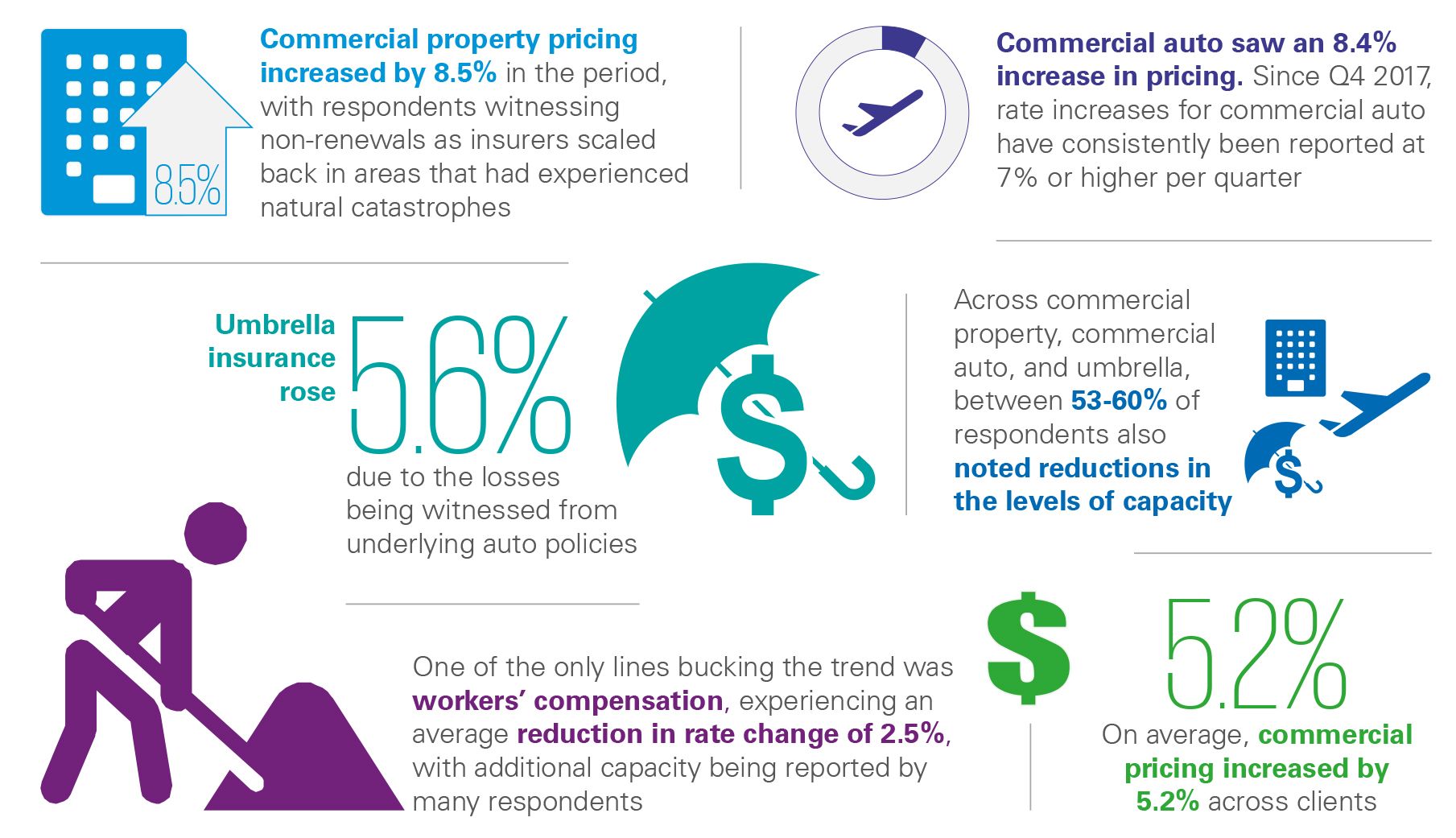

Firstly we will review the trends surrounding pricing in Q2 2019.

Now we have highlighted the rate increases being applied to clients, it is time to investigate which client profiles have been the greatest affected.

Medium accounts (between $25k to $100k in commission and fees) and large accounts (above $100k in commission and fees) saw significant average commercial pricing increases of 6.2% and 5.6% respectively. This highlights a considerable increase in premium spend for those affected.

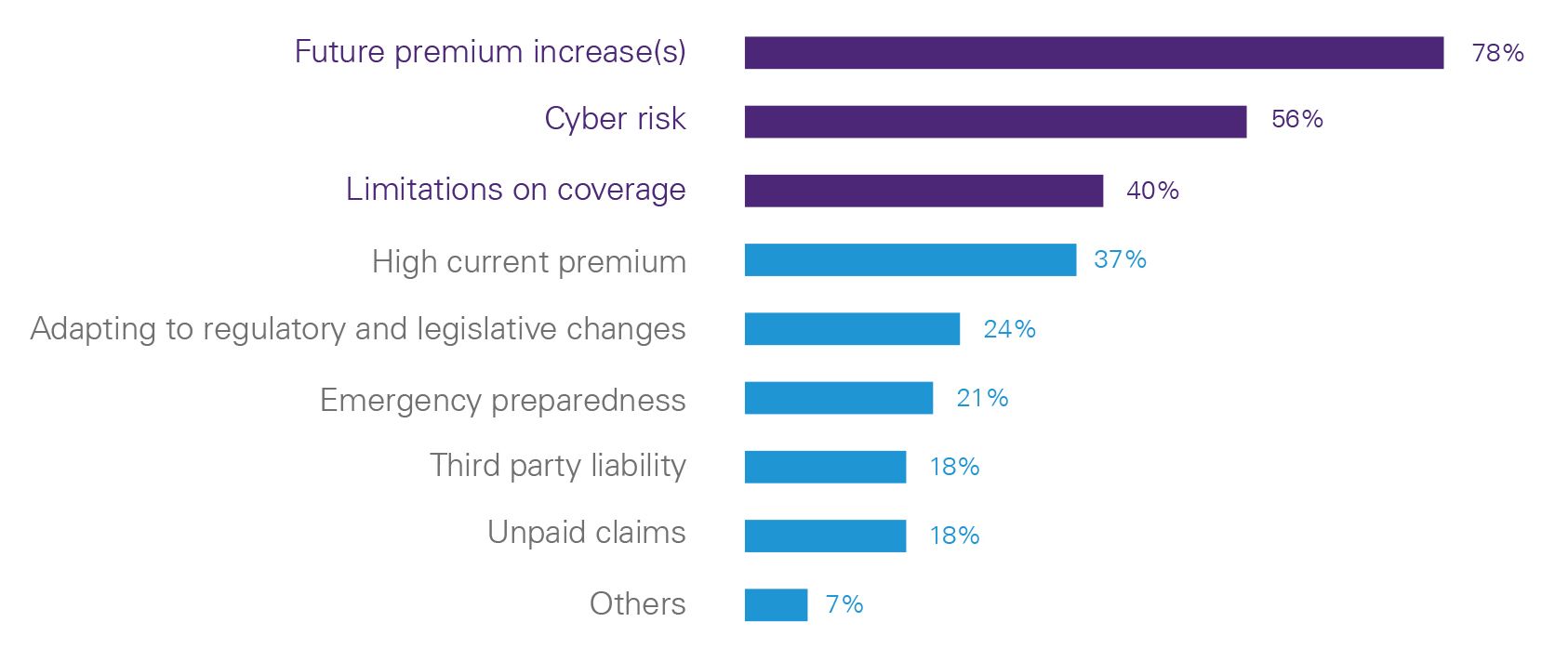

The trends in premium increases unsurprisingly have not gone unnoticed by clients, as illustrated in the graph below:

source: The Council of Insurance Agents & Brokers Commercial Property/Casualty Market Report Q2 2019

So with future premium increases, limitations in coverage, and high current premium concerning clients, what are the solutions?

One viable solution that could tackle these problems is a captive insurance company (“captive”).

A captive is an insurance company that insures, and is controlled by, its owners. A captive is an alternative to self-insurance, whereby the parent company will use its own capital to manage the risk transfer arrangements, outside of the commercial insurance market. A captive can underwrite a wide range of risks and be tailored to the risks faced by the parent company. They come in many shapes and sizes dispelling the myth that they are only for the largest of organizations. Even if your annual commercial insurance premium is only $1m, the benefits of a captive may still be achievable.

Having highlighted the Q2 2019 trends, let’s investigate how a captive can respond to the top concerns for clients:

- A captive gives the client the ability to price risk in line with their own performance, eliminating the impact of losses from others as well as the cost of capital attached with using an insurer to place the risk.

- A client can tailor the insurance program to meet their needs and emerging risks. This resolves the impact of limitations of coverage by the commercial insurance market. This is relevant surrounding the topic of cyber risk, where a client can cover exactly what they need for the organization.

The fact that commercial insurance premium rates are showing trends of increasing should not be the primary driver of a captive. We need to look at the bigger picture towards the long-term, and our ability to use the captive as a strategic risk management tool. One of the most significant benefits of a captive from a risk manager perspective it that it allows the organization to focus on their business and operations, rather than worry about unwelcome surprises at insurance renewal. This leads to additional benefits:

- Being in control of the risk and insurance program also leads to other significant benefits such as control of claims management, better data to improve risk management within the organization, and pricing certainty to build future budgets from. Effectively, a captive can become a central component of the enterprise risk management program of a business.

- As an insurance company, the captive also gains direct access to the reinsurance market. A captive can set their risk appetite and any risk that exceeds this level can be reinsured, at a better rate than the commercial insurance market.

One additional benefit is that any profits the captive generates are held within the captive and not given to the insurer, as is the case with traditional commercial insurance. We see that this incentive helps drive a robust risk management culture at organisations with a captive – why not turn your risk transfer expense into a profit center!

If you are interested in finding out more about a captive and how it can help be an insurance solution for your organization please contact us and we can talk you through the process.

Why KPMG?

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Adam Smith

Partner, Head of Advisory, Sector Lead – Insurance

KPMG in Bermuda

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia