Each service in our KPMG’s Strategy Practice is built upon KPMG’s 9 Levers of Value Framework, which can be used to decompose, analyze and re-orient your business. The Framework represents the 9 key elements of your organization's financial, business and operating model, and can be implemented to analyze and re-orient your business. It allows you to:

- Study your business in detail, enabling an exhaustive view of the entire enterprise;

- Enhance your CEO's vision by providing a comprehensive structure to organize multiple relevant topics at the same time and understand the trade-offs and interplay between them;

- Finally provide an integrated path to execution which increases your company’s ability to achieve the financial ambition.

What to aim for?

Financial model

Financial outcomes structuring, investment and capital allocation.

Where to play?

Business model

- Markets

- Propositions and brands

- Customers and channels

How to execute and win?

Operating model

- Core business processes

- Technology and operations infrastructure

- Organizational structure, governance and risk controls

- People and culture

- Measures and incentives

Strategic & Performance Transformation

KPMG’s Strategy Practice wants to support you in creating a smarter vision and helping you translate that vision into practice, but also in tackling your key strategic issues and provide insights, ideas, methods and measurable outcomes to support your decision-making, answering three important questions on “what to aim for”, “where to play” and “how to win”.

Whether it is steering a course through industry-disrupting changes or finding ways to operate more efficiently, we help you craft clear, differentiated, winning strategies, including: Growth Strategy, Operating & Cost Strategy, Deal Strategy and Commercial Due Diligence propositions.

Growth & Market Entry Strategy

Helping you to design growth strategies and bring existing or new products to markets via adequate channels.

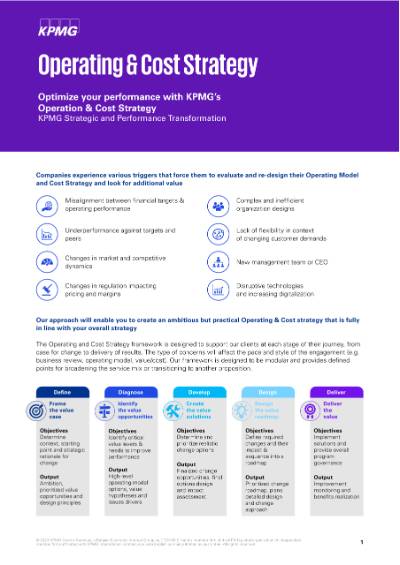

Operating & Cost Strategy

Helping you to identify, prioritize and implement changes to your operating model and perform strategic cost reductions.

Enterprise Wide Strategic Transformation

Helping you transform their strategic, business and operating model in line with your enterprise-wide strategy.

Portfolio Strategy & Strategic Planning

Helping you to make the right investments to achieve financial goals, leverage strengths and achieve future growth.

Integration & Separation

Being successful requires a balance between enhancing value while mitigating risks. Being able to quickly invest or divest while maintaining control of your processes and protecting business as usual is critical. But profit is no longer the only business goal. As companies become more purpose driven, they start rethinking their operations and investments. You can choose to sell non-core business aspects or activities that no longer fit your 'purpose'. This frees up room for investments in activities and other companies that match the new found focus.

KPMG’s Integration & Separation approach helps you throughout the whole integration and separation process, structured around key integration/separation modules, which allows you to pick and choose the relevant modules for your situation.

Integration

Helping clients throughout the end-to-end integration process, structured around key integration modules which allows the client to choose the relevant modules for their situation.

Integrating a new organization into your business is usually a complex process. However, investing in the right acquisition can help you build up your know-how, allows you to refocus on your purpose and ultimately will help you grow. In order to fully capture the value of an acquisition, we can help you align all integration aspects, including all strategic, legal and fiscal matters, data science and change management.

Separation

Helping clients throughout the end-to-end separation process, structured around key separation modules which allows the client to choose the relevant modules for their situation.

Your company may have many reasons to undertake divestitures. You can try to strengthen balance sheets by selling non-core businesses, simplify businesses by selling non-core brands, achieve a new strategic direction by spinning off a division or sell a business unit by regulatory mandate. These complex deals require a detailed approach with clear objectives, and that’s where we can help you.

Commercial Due Diligence

Organizations are experiencing significant disruption caused by innovation, new technologies and evolving customer needs, as well as changing regulations and pressure on capital deployment. As a result, companies are searching for ways to keep up with the changes and drive profitability.

In addition to organic options, CEOs are considering inorganic options to maintain their competitive edge and create shareholder value. While looking for growth, different bottlenecks to assess the strategic fit and commercial attractiveness are encountered:

- New emerging trends impacting your business model;

- Changes in market and competitive dynamics;

- Changes in regulation impacting price and margins;

- Market size and market growth;

- Underperformance against targets and peers;

- Growth potential and key future revenue drivers

Our KPMG Commercial Due Diligence approach will enable buyers to have a clear understanding of the position of the seller to make a well-informed purchasing decision.

Helping clients with market size, trends, target's and competitors’ offer position and differentiation, competitive landscape and dynamics, … associated with a transaction.

Our framework is designed in order to support our clients to create a complete and objective view of the target company’s competitiveness, positioning in the market, industry dynamics, market strengths, commercial performance, potential risks and opportunities, and viability of the business plan in order to support the decision-making process.

Our strategy expertise can be combined with our knowledge of:

We also deliver a comprehensive solution tailored to your journey: