For a century, a single fuel-powertrain combination — the petroleum-powered internal-combustion engine (ICE) — has dominated the global automotive industry. How automotive companies are structured, how they are financed, how they go to market — everything was optimized for producing and selling ICE-based vehicles.

Now, the conventional wisdom says that the battery-electric powertrain will triumph — becoming the dominant force in the automotive business that ICE has been. And automotive companies are making massive bets on this scenario. Yet, we still don’t know when battery-electric vehicles (BEVs) might reach a tipping point and become popular with a wide swath of consumers, generating the sales — and profits — to justify the billion-dollar investment auto makers are making in BEV development. ICE is going to lose dominance, but the future industry may look more like a mosaic — with multiple fuel/powertrain combinations and far more complexity than the conventional wisdom assumes.

Key takeaways

The century-long reign of the ICE powertrain is ending — but no one knows how quickly; analyst estimates of 2030 BEV penetration range from as little as 24 percent to nearly 40 percent.

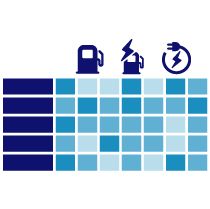

The industry will look more like a mosaic. Contrary to the conventional wisdom and $200 billion- plus of investments, the future won’t just be BEVs. There will be multiple fuel/powertrain combinations—including ICE hybrids, and hydrogen—to meet the needs of the market.

Too many players, too few consumers? Today, many BEV players are aiming at a narrow ($50,000 and up) slice of the U.S. market, representing only 2.4 million units or 17 percent. By 2030, even if BEV penetration reaches 30 percent (including more lower price models) the available market may only be 5.1 million out of a 17 million-unit market.

Massive ICE manufacturing overcapacity. If the 30 percent BEV penetration forecast is even close, by 2030 there could be nearly 40 million units per year of excess ICE manufacturing capacity globally—the equivalent of 200 assembly plants. That does not include the multiplier effect on suppliers and their plants.

Unanswered infrastructure questions. Not only is there uncertainty about building out charging infrastructure (for EVs and hydrogen vehicles), but also about the needed electrical supply. Nearly 4 billion people live in countries with inadequate electrical infrastructure for EVs. Even in wealthy economies, the electric grid is vulnerable and not ready for widespread EV use.

Sweeping structural change. In almost any scenario, the industry can expect massive structural change. New competitors will take share. Value chains will be shattered, and supply chains will be reconfigured; companies will need to adjust their portfolios of businesses.

The stakes could not be higher. The bets—and the uncertainty and complexity—are enormous. New dominant positions will be built, and old empires may fall. A decade from now, there could be a new pecking order in automotive—and one or more of today’s top players may have been acquired or disappeared.

The mosaic can show how to place your bets wisely. To win, companies will need to choose new strategic postures and adopt a dynamic decision-making framework to plan and place their bets. They need the mosaic.

In our paper, Place your billion-dollar bets wisely: Powertrain strategies for the post-ICE automotive industry, we describe why for the next 10 to 20 years, multiple fuel/powertrain combinations (including gasoline/internal combustion) will coexist, and innovation will continue on multiple fronts. So, instead of a monolith built around one dominant fuel/powertrain combination, the industry will look more like a mosaic of a variety of powertrains to meet the need of different market segments. This mosaic can help auto companies evaluate possible scenario drivers — economics, technology evolution, regulation, etc. — so they can place their billion-dollar bets wisely and to revise strategies as factors change over time.