On Thursday, 17 June our webinar on How to improve your EBA compliance with Ivalua took place.

Making smart choices when investing in outsourcing solutions (for innovation, improving customer experience, lowering costs), can generate sustainable added value and help to improve your overall risk and performance scores. The opportunity to review your outsourcing and third party arrangements has presented itself with the latest publications of the updated EBA outsourcing guidelines.

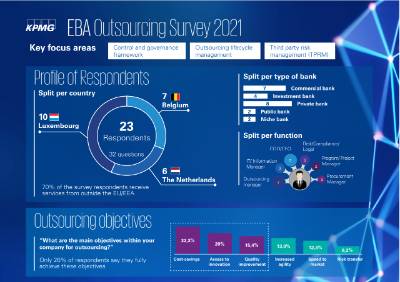

Summary of the KPMG EBA Outsourcing Guidelines Survey 2021

During this webinar our KPMG experts provided meaningful insights, key attention points and real-life client case.

From the beyond compliance angle

- Outsourcing is seen as a quick way to get access to innovation, quality improvement and cost reduction

- Banking institution rely more on Outsourcing for access to new technologies and for key business processes

- The management body remain responsible for outsourced arrangements at all times

- Having and maintaining an up to date Outsourcing register can be a valuable information source for management bodies

- Having enough expertise in-house and resources to monitor/document all outsourcing arrangements should not be taken lightly, appointing a single point of contact/Outsourcing manager directly person reporting to the management body can be helpful

- Setting up regular/frequent reviews of risks and responsibilities, performance and business cases, documenting all these steps along the way, but at least on a yearly basis for critical or important functions is the best protection for any institution

- If for some reason the review of your critical/important Outsourcing arrangements should not be finalised by 31/12/2021, you should inform the competent authority on:

your plan on how to complete the review (critical/important functions) or the possible exit strategy

Outsourcing insights & how KPMG and Ivalua can help

- Applying the EBA outsourcing guidelines, not just for the sake of regulatory compliance, will definitely increase the chances of having fruitful and value adding outsourcing arrangements

- A true partnership requires to explicitly manage perceptions about the services contracted, delivered and expected. Diverging perceptions and expectations could really derail an outsourcing relationship

- Outsourcing Satisfaction is a combination of 3 dimensions : what has been agreed, what is actually being delivered and what is expected to be delivered

- Do not underestimate the complexity of transferring services towards an external party. It needs thorough preparation and a clear division of responsibilities between outsourcer and service provider

- Governance should be at the heart of every phase of the outsourcing lifecycle to make sure value is maximized and risks are mitigated

- Instead of outsourcing labor intensive processes, take into account in your outsource strategy the possibility to automate these processes. From the perspective of the EBA outsourcing guidelines it also means for financial institutions to run a lesser risk on becoming and empty shell, and also the continuity of these processes becomes less dependent on third parties.

- KPMG and Ivalua can offer you the right tools to manage your outsourcing risks throughout the sourcing lifecycle in an auditable and traceable manner. Combining KPMG experience with Ivalua’s market leading Source-to-Pay cloud solutions can actively contribute to accelerated levels of innovation across the procurement function.

If you missed the webinar or would like to revisit it, we invite you to watch the recording and download the slides. If you have any further questions or comments, do not hesitate to reach out to the relevant expert listed below.

Relive the webinar

Relive our webinar with speakers Jos Joos, Georgios Mihailidis and Stephen Cleminson by watching the videos or select your preferred topic by clicking on the corresponding video.