The role tax plays in environmental, social and governance (ESG) related issues continues to expand. What does it mean for my organisation and what are the key current areas of focus?

In this overview we will consider tax governance, transparency, transfer pricing, decarbonisation and environmental taxes.

As ESG develops, so too will the expectation and opportunity for tax functions to engage a broader range of stakeholders in supporting ESG outcomes; building trust and demonstrating commitment to environmental and social responsibility to the board, their shareholders and the communities they operate in.

Governance and tax transparency

Tax as a matter of sustainability – strategy, governance and transparency

Tax has always been at the nexus of law, financing, supply chains and investing. That nexus has required tax to move from being a compliance issue to one of governance and risk management.

And now with the rise of ESG, tax has become a sustainability issue. Investors and financiers are wanting greater comfort that companies are responsible taxpayers. Pension funds have supported several initiatives requiring greater tax transparency of high-profile groups in the US.

Here in Australia, according to a survey[1] by the Responsible Investing Association, consumer investors want to avoid investments in companies that don’t pay a fair amount of tax almost as much as avoiding investing in companies causing environmental damage.

It is no wonder then that according to the KPMG CEO survey[2] 75 percent of CEOs globally say there is a strong link between the public’s trust in their organisation and their approach to tax matters.

Tax teams in response have had to mature their strategy, governance and risk management to support proactively addressing the needs of a broader range of stakeholders and ensuring there is a sensible narrative of the tax technical and tax policy issues in doing so.

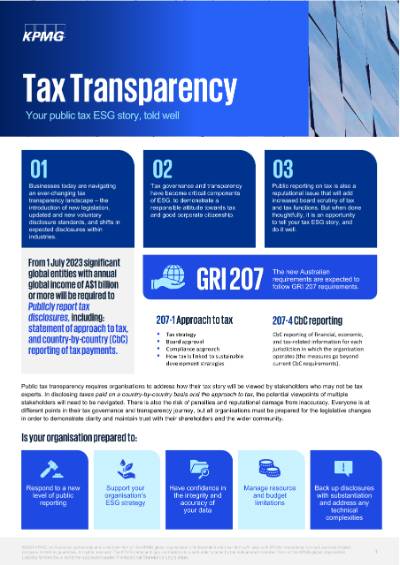

New Australian public tax transparency reporting rules - what's your organisation's tax story?

Following the October 2022 budget announcement, on 6 April 2023 the Australian Government released Exposure Draft legislation to introduce mandatory public country-by-country (CbC) reporting for CbC reporting groups with an annual turnover of AUD 1 billion or more, including a requirement to publish a multinational’s (MNE’s) approach to tax. The new requirements could be effective for income years starting 1 July 2023. They could equally apply to Australian based and foreign headquartered groups. This follows the 16 March 2023 release of draft legislation requiring Australian public companies (listed and unlisted) other than a corporate collective investment vehicle, to disclose information on their subsidiaries including details on their tax residence in their financial reports.

Australia’s developments follow and go beyond the European Union’s efforts to step up tax transparency of large multinationals (MNEs) with EU operations through the introduction of mandatory public CbC reporting. We may see similar policy and regulatory moves to increase CbC reporting of US multinational groups in the future through FASB.

The impact of any new mandatory mechanism could well be significant. Relatively few groups have been publishing tax transparency reports under voluntary mechanisms such as the Tax Transparency Code in Australia or in applying global sustainability reporting standards such as GRI 207.

So what are some of the things multinationals need to consider to sharpen their CbC reporting for publishing in advance of global tax transparency regulatory changes?

- Monitor developments globally, to assess the application to your business; for example, are you already caught by the new EU CbC publication rules?

- Refresh or initiate an approach to inform likely internal stakeholders who will be interested and need to be involved in enhanced tax transparency reporting such as ESG, corporate affairs, risk audit committees in addition to the board.

- Establish the governance model for the sponsorship, creation, validation, review and finalisation of both narrative and CbC and other data content.

- In respect of the data, understand the availability of the data, assess its quality and what story the data is ‘telling’ in terms of opportunities, risks and challenges. Does your data support the narrative of existing reporting to regulators? How can it be used in a BEPS 2.0 project?

- Is your CbC data in line with our tax strategy, tax policy, tax governance and transfer pricing model? What improvements need to be made to tax governance to further support the narrative?

With the new Australian tax transparency rules likely to be applicable from 1 July 2023, these questions are very timely for businesses.

ESG and transfer pricing

ESG-driven changes have considerable implications for transfer pricing that businesses are just starting to wrap their heads around.

The most obvious is perhaps where a new ESG strategy can result in sustainability-driven changes to the value chain and the reorganisation of global supply chains and business models. For example, in addition to rethinking supply chain resilience in light of unprecedented disruptions during a global pandemic, MNEs are redesigning their global supply chains in their decarbonisation journey to meet higher environmental standards.

Tax functions will need to understand what transfer pricing consequences will result from these changes. For example, tax teams should be considering the transfer pricing impacts of:

- New departments and responsibilities (regulatory, research, procurement), supply chains and business restructuring, and (sustainable) financing of projects.

- Book or market value of carbon credits or equivalent in global value chains; or adjustments to products/services such as from carbon offsets attached to products.

- Regulatory impacts, including differing policies in different jurisdictions but connected markets.

- Alignment of contractual terms to ESG-based economic substance adjustments, as well as the potential for risk mitigation through new commercial clauses.

- Relevant commercial pricing or reference points in jurisdictions that may have different degrees of ESG regulation or alternatively, societal awareness/value placed on ESG-related issues.

To be able to effectively assess, implement and monitor the above impacts, it is clear there is a real opportunity to enhance transfer pricing governance including procedures for the implementation of pricing policies.

The impact ESG matters will have on transfer pricing is a good example of where tax teams will need to broaden the stakeholders they are engaging with in order to be fully across the prospective business changes coming down the pipe. That starts with determining who is making ESG decisions within your organisation.

Environmental taxes and decarbonisation

Decarbonisation requires significant business transformation and capital expenditure, which has important tax and legal consequences. Those business changes may, in part, be in response to taxes or emissions trading schemes (ETS) that are used as a policy lever to drive decarbonisation.

As a result, the environmental tax landscape is developing at a rapid pace. A current challenge is having mechanisms in place to be up-to-date with both the local and global environmental taxes affecting their operations.

An example of a significant development in this space is the EU’s Carbon Border Adjustment Mechanism (CBAM). CBAM is part of the EU Green Deal/Fit for 55 package, which is the EU’s plan to reduce greenhouse gas emissions by at least 55 percent by 2030 compared to 1990 levels.

Importantly, the precise impact for Australian businesses will depend in part on domestic developments. For example, how the EU views the ambition of the reformed Australian Safeguard Mechanism relative to EU ETS arrangements, will affect how it considers any implicit or explicit carbon costs paid by Australian firms when calculating CBAM obligations. The reformed Safeguard Mechanism under recent Australian proposals is planned to be effective from 1 July 2023.

Finally, in the US, the Inflation Reduction Act directs nearly US$400 billion in federal funding to clean energy over the next 10 years. This will be achieved through a mix of tax incentives, grants, and loan guarantees including investment tax credits for hydrogen, with a large portion of these incentives available to businesses.

The key question for businesses to consider is how they are tracking the green tax and incentive developments globally in order to understand impact and compliance requirements for green taxes and incentives in key markets, and assess whether they are generating effective tax and carbon price strategies (including offsets markets).

European Parliament adopts rules for carbon border adjustment mechanism

The European Parliament on 18 April 2023 adopted rules for the new carbon border adjustment mechanism (CBAM), which is scheduled to begin its transition phase on 1 October 2023.

During the transition phase, EU importers of goods covered in the scope of the CBAM regulations will be required to submit quarterly reports of the embedded emissions of these goods to the European Commission.

Currently, carbon-intensive sectors such as aluminium, cement, iron and steel, fertilizers, hydrogen and electricity are covered by CBAM.

However, it is expected that CBAM will be extended in the coming years to all products covered by the EU Emissions Trading System (ETS).

We can expect this to have wider implications for Australian exporters.

Working with KPMG

In times of dynamic change it can be difficult for businesses to understand all of the impacts and plan an appropriate response.

KPMG partners with organisations to map out a flexible, agile roadmap that supports both short- and long-term activities. Our ESG and specialist tax advisers keep your tax and finance teams informed of developments, create communication workstreams with stakeholders, and identify areas that can be worked on now as well as piloting activities and applying the lessons over time. We can help your organisation to be on the front foot of ESG issues in the market which can enhance your brand, reputation and corporate citizenship.

2. KPMG 2022 CEO Survey

Get in touch

Are you and your business ready for mandatory public tax transparency reporting?