21RU-005 Cloud computing arrangement costs – Updated

21RU-005 Cloud computing arrangement costs – Updated

This Reporting Update discusses how an entity which incurs cloud computing arrangement costs, including implementation costs, may account for those costs – i.e. capitalise or expense. Revised May 2021.

In a nutshell

Cloud computing arrangements are ones in which a customer does not have possession of the underlying software. Rather, the customer accesses and uses the software on an as-needed basis – for example, over the internet. Cloud computing arrangements are sometimes referred to Software as a Service (SaaS), infrastructure as a service or hosting arrangements.

To date, IFRS® Standards do not contain explicit guidance on a customer’s accounting for cloud computing arrangements or the costs to implement them.

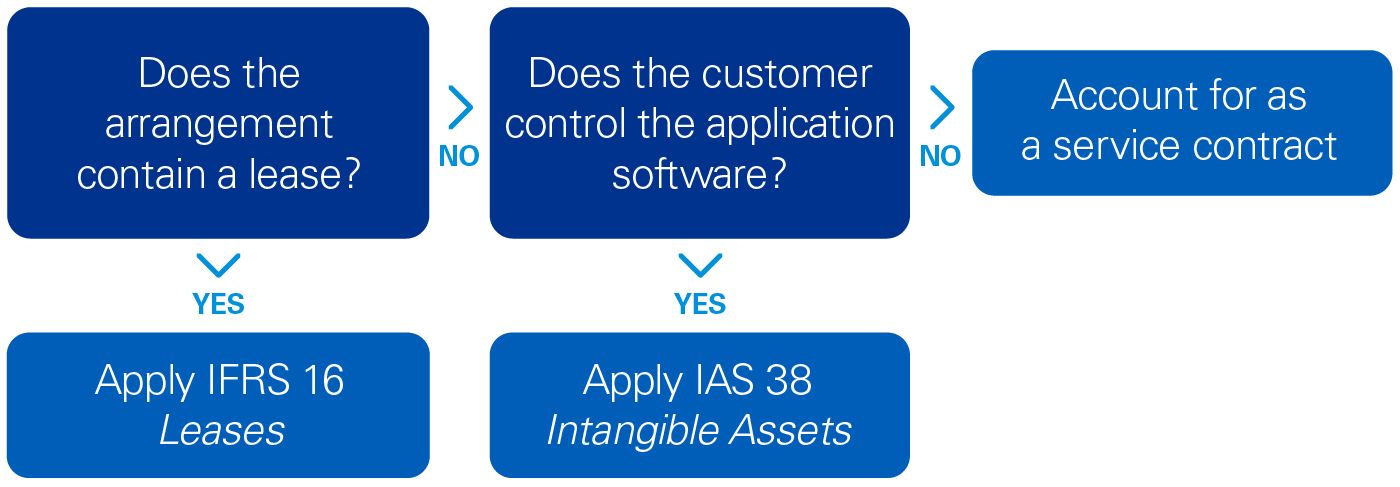

An entity should evaluate whether the rights granted in a cloud computing arrangement are within the scope of IAS 38 Intangible Assets or IFRS 16 Leases. Otherwise, the arrangement is likely to be a service contract.

IFRS® Interpretations Committee (IFRIC) has issued two final agenda decisions on cloud computing arrangements. The March 2019 decision considers whether a customer receives a software asset at the contract commencement date or a service over the contract term. The April 2021 decision builds on the 2019 decision and considers how a customer accounts for configuration or customisation costs where an intangible asset is not recognised. Both are discussed in this publication. |

“Implementation costs related to a cloud computing arrangement that is a service are often significant. When the cloud supplier agrees to customise the software by modifying the existing software code or writing new code, we believe that this customisation service is generally not distinct from the service of receiving access to the software – i.e. the service in the contract is access to the customised software application. Therefore, the expense should be recognised as the customer receives access to the customised software – i.e. over the SaaS contract term. A cloud computing arrangement that is a service contract does not itself include a software intangible asset and the costs of preparing that software for use do not create a separate resource controlled by the entity. Therefore, these costs are not capitalised as part of the cost of a software intangible asset but are expensed as incurred, i.e. when the service is received. In our view, this generally applies to costs incurred for configuring the software – i.e. they are generally considered to be distinct. These costs should be expensed when they are incurred – i.e. when the service is received.” |

This Reporting Update discusses how an entity which incurs cloud computing arrangement costs, including implementation costs, may account for those costs – i.e. capitalise or expense. Refer to the PDF version of the Reporting Update for further details.

KPMG Australia acknowledges the Traditional Custodians of the land on which we operate, live and gather as employees, and recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

©2024 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organisation.

Liability limited by a scheme approved under Professional Standards Legislation.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance.